Foreclosure Starts Rose This Spring ...

Related:

... And Repossessions Followed

New York's Lawsky Derides Backlog

Related:

Zombie Properties Won't Die

Related:

Liquidations on Rise in Florida

Related:

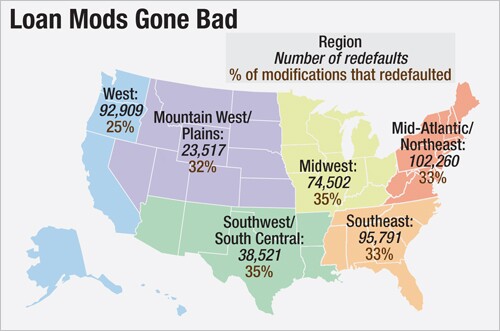

It's Not Over Yet: Loan Mods Gone Bad

Related: