No. 1: High Unemployment

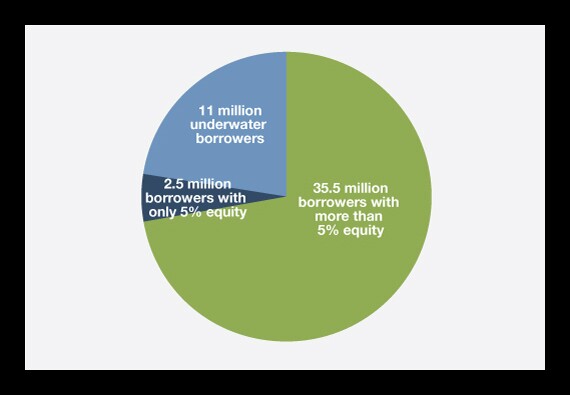

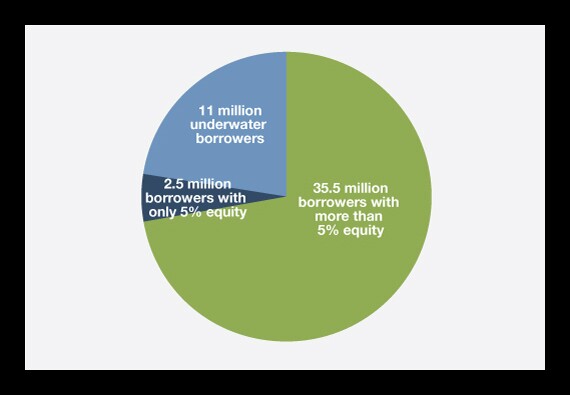

No. 2: Underwater Borrowers

No. 3: Shadow Inventory

No. 4: Stagnant Incomes

The Office of the Attorney General in New York says the bank violated the state's Exempt Income Protection Act, illegally transferring customers' money to debt collectors.

The Providence, Rhode Island, company is having discussions with private wealth management teams elsewhere as it seeks to expand its fledgling private bank. In just three months, private banking deposits doubled to $2.4 billion.

After the Minneapolis-based company reported stubbornly high commercial deposit costs, it reduced its full-year forecast for net interest income by $200 million-$500 million.

The CFPB has dissolved the Office of Supervision, Enforcement and Fair Lending and eliminated the job of associate director in a move that impacts how it designates nonbanks for supervision.

Rising deposit costs have plagued banks in general, and the Tennessee bank had to pay up to bolster liquidity after its failed merger with TD. But First Horizon retained customers in the first quarter while not paying them the special rates they got last year.

U.S. customers who have previously used Sweden-based Klarna's buy now/pay later financing — and paid off their loans in full — will be prequalified for interest-bearing loans through a new version of the Klarna Visa card rolling out later this year.