In their deals with the government, SunTrust Banks Inc. and Regions Financial Corp. got more than cheap deposits. They gained investor confidence.

Since the Federal Deposit Insurance Corp. sold deposits and certain assets of failed banks to the companies, both stocks have spiked.

The implication: For all their credit woes, and for any speculation that they might need more capital, both SunTrust and Regions must be relatively healthy if regulators are doing business with them.

With 117 banks and thrifts on the FDIC's "problem" list as of June 30, analysts say, regulators are bound to shut down more institutions and turn to companies they deem relatively strong to take over deposits and prevent customer losses.

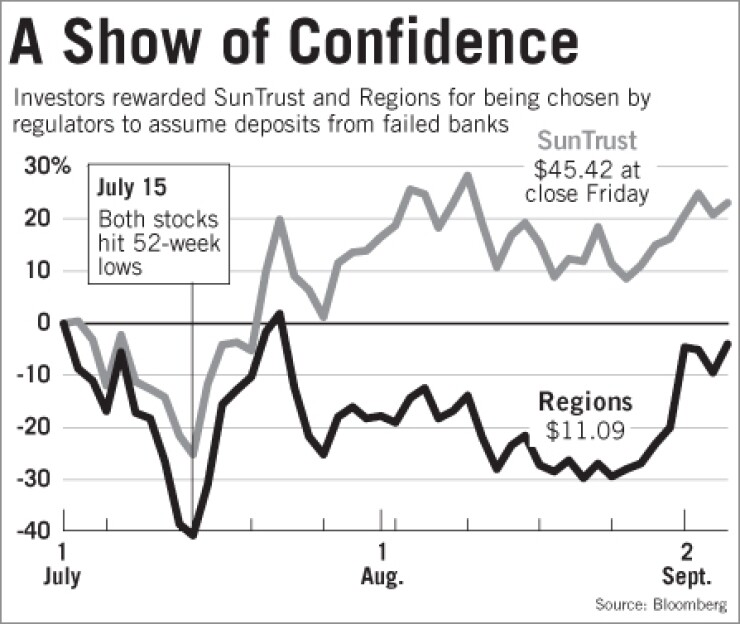

That regulatory show of confidence has helped shares of both SunTrust and Regions gain 50% since their 52-week lows, both set July 15.

Analysts and investment strategists say those gains have been generated in a particularly volatile market for bank stocks and are at least partly the result of good fundamentals. However, they also say that as regulators shop for new homes for failed banks' assets, investors will get a new way to spot companies poised to ride out the credit storm.

"The thinking is simple — if regulators have enough faith in them, investors should, too," Jack A. Ablin, the chief investment officer at Bank of Montreal's Harris Private Bank, said in an interview last week.

Regions' shares jumped nearly 20% on Sept. 2, after investors read as a show of strength its decision to work with regulators to take over the deposits and operations of five branches of the $1.1 billion-asset Integrity Bank of Alpharetta, Ga.

The $144 billion-asset Regions slashed its dividend in July, when it conceded it might need to raise more capital this year to offset home equity losses. Its second-quarter earnings fell 54.5% from a year earlier, to $206.4 million, or 30 cents a share, 12 cents below the average estimate of analysts.

The discussion of capital issues had raised questions among analysts about Regions' near-term stability, but after the FDIC picked the company to help with the Integrity closure, several analysts said that if regulators, who get an inside view of bankers' finances, were confident working with Regions, it must not be in any serious danger.

"If the regulators don't have reason to be worried, that at the very least is a good sign," Jefferson Harralson, an analyst at KBW Inc.'s Keefe, Bruyette & Woods Inc., said in an interview last week.

C. Dowd Ritter, Regions' chairman, president, and chief executive officer, said at a conference last week that the FDIC "did come to us," and that his company responded. "We think, unfortunately, there will be more of this, and banks our size have a responsibility to do this and bail out depositors."

Mr. Ablin cautioned that gauging trends from bank stock trading remains a dicey endeavor, since the economic tumult that has roiled the markets all year continues to deliver setbacks, cutting rallies short.

But over the past several weeks some companies have made and sustained gains. SunTrust's shares rose 10% on Aug. 1, when the Florida Office of Financial Regulation and the FDIC closed the $259 million-asset First Priority Bank in Bradenton and approved SunTrust's assumption of the insured deposits.

When SunTrust hit its 52-week low in mid-July, investors were bracing for a weak second-quarter report July 22. The $177 billion-asset Atlanta company's second-quarter earnings fell 21% from a year earlier, to $535 million. And the results were propped up by a $345 million gain from selling 10 million shares of Coca-Cola Co. stock and $18.4 million after taxes from selling the investment management services unit First Mercantile Corp. (SunTrust also said it had arranged to sell another 30 million shares of Coke stock this quarter to bolster capital levels.)

But a month after it absorbed First Priority's deposits, investors have kept SunTrust's shares well above their July lows.

Joseph K. Morford, an analyst at Royal Bank of Canada's RBC Capital Markets, said in an interview last week that, in general, the FDIC is offering an "implied endorsement" when it picks a company to take over a failed bank's assets.

"They sure aren't going to turn around and turn over deposits to another seriously troubled bank," Mr. Morford said. "So in effect, yes, regulators are saying this is not a seriously troubled bank."

But he and other analysts said that investors should not put too much weight in a perceived FDIC endorsement.

In Regions' case, "it is not as if the fundamentals of the company have changed," William Schwartz, an analyst at DBRS Ltd., said in an interview last week. Though it is struggling with credit troubles, it has remained profitable this year and has not shown any concrete evidence of being in serious danger, he said.

"Investors are looking for positive news, grasping on to it wherever they can find it," Mr. Schwartz said. "But we don't look at this one thing [working with the FDIC] with a whole lot of seriousness."

Moreover, a nod from regulators has not been the only big driver of bank stocks since mid-July. Falling oil prices have boosted interest in financials at various times in the past month.

Also, most notably, a wide swath of bank stocks surged July 16, rallying around Wells Fargo & Co.'s better-than-expected earnings report that day. The KBW Bank Index shot up 17%, the biggest one-day gain in its 16-year history. But the record jump accounted for less than half the gains for SunTrust and Regions since mid-July.

On Friday, despite the Labor Department's report that the jobless rate spiked in August, to 6.1% from 5.7%, the KBW Bank Index rose 4.8%.

And large regional banking companies are not the only ones that seem to get a lift from working with regulators.

The $5.3 billion-asset Iberiabank Corp. of Lafayette, La., bought the holdings of the $1.9 billion-asset ANB Bancshares Inc. of Bentonville, Ark., when it failed in May. Iberiabank bought nine branches and about $200 million of deposits for a deposit premium of 1.01%. Its shares are up nearly 50% since hitting a 52-week low in January.

"I think it is safe to say that some investors do interpret the FDIC's comfort in working with a given bank as endorsement," Mr. Schwartz said. "For those banks, that's been a positive."