To the list of things dividing large and small banks, add the Troubled Asset Relief Program.

While larger banks have returned the capital they accepted from the government program or are desperate to do so, some smaller banks still see Tarp as what it was meant to be — a source of cheap capital to fund new lending.

"We are aware of the stigma largely because the program evolved as a so-called bailout of the large regional and money-center banks. But as it is trickling down to community banks, it is really serving the purpose for which it was intended," said Tom Lumpkin, the chairman of Biscayne Bank in Coconut Grove, Fla., and its parent company Biscayne Bancshares Inc., which received $6.4 million from the Treasury Department on June 19.

The Treasury recently tweaked Tarp to let banks with assets of less than $500 million get capital injections equal to 5% of their risk-weighted assets. That's up from 3% when the program was unveiled last October.

Paradoxically, this new program is being funded by repayments from larger institutions that no longer want to participate in the program. To date, 30 companies have returned $70 billion.

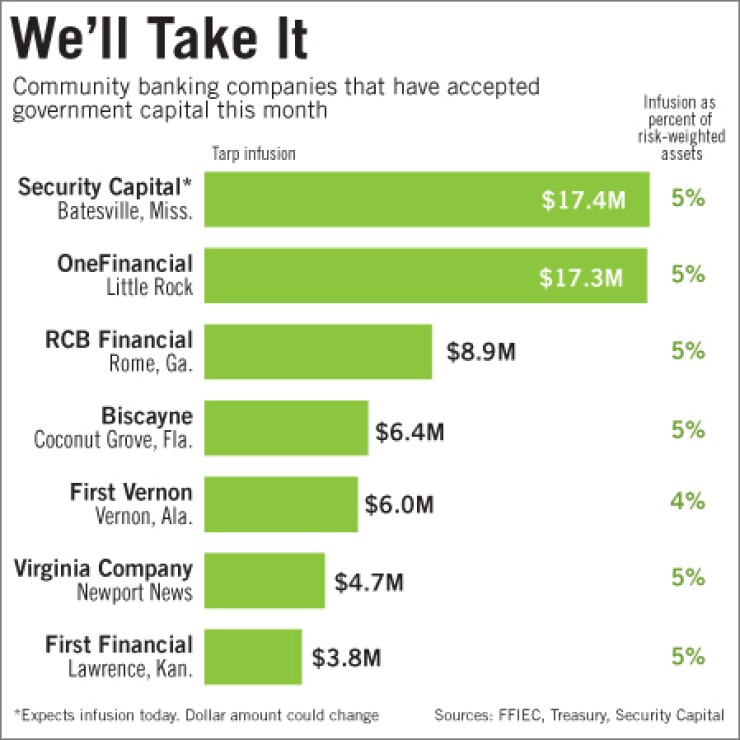

So far at least seven banks have decided to go for the bigger capital slice, but more are expected to do so, particularly those that had already decided to participate at the 3% level.

But Rob Klingler, an associate in the Atlanta office of the law firm Bryan Cave LLP, said the offer is attracting banks that were not going to participate.

"For banks this size the difference between 3% and 5% is the difference between too small to bother with the headaches to something that is worthwhile and we can do something with it," he said.

Still, Klingler said even some smaller banks are turned off by Tarp's negative associations. "It's so unpopular right now that if banks have an alternative then they will go there," he said.

Some banks, like Virginia Company Bank in Newport News, don't have an alternative.

The Tarp funds are a lifeline for the three-and-a-half-year-old bank; the $4.7 million it got from the Treasury is a ticket to remain independent and continue lending, said Mark Hanna, president and chief executive officer of the $108 million-asset bank.

Hanna said it was always in the bank's plan to raise capital at this point, but with bank stock prices so low, turning to the private sector would have caused a big dilution to existing shareholders.

"The dilutive effects of selling shares at 65% of book value had a terrible consequence for shareholders who invested with us. There wasn't much positive for them," he said.

The bank's other main option was a sale, Hanna said.

As Virginia Company weighed its options, Tarp became the clear choice.

"If Tarp monies weren't there … we would have had to look at strategic alternatives with other organizations," Hanna said. "But all told, this capital will allow us to grow for a little over three years, three to four years, assuming the capital markets don't return to their historic levels."

The Treasury reopened the application process last month and gave smaller banks until Nov. 21 to submit a request. Those that have already won preliminary approval for the 3% may seek expedited approval to receive up to 5%.

And as an additional benefit to participants, the added 2% is less expensive than the first 3% because no additional warrants are required to be issued.

Several bankers said that made taking the additional money even more attractive, especially considering the capital markets for small banks haven't thawed.

Eddie Wilson, the CEO of River City Bank in Rome, Ga., said the RCB Financial Corp. unit has plenty of capital — at March 31 its total risk-based capital ratio was 13.5%. Still the bank decided to go for the 5% investment, or $8.9 million, because it offered additional insurance against the slowing economy.

Also, a handful of banks in Georgia have already failed this year and more are expected to close, so River City sees opportunities to pick up both bankers and customer relationships. Adding capital now for that anticipated growth makes sense, Wilson said.

But for River City, which is 37 months old, raising capital now would be difficult and expensive. It's a sea change from 2006, when the bank raised $17.6 million in 31 days.

"It was unbelievable," Wilson said. "Fast-forward to last spring. We wanted to raise $6 million and we started last February or March. In eight months we raised $5.1 million. You can see the difference in raising capital in 2006 and 2008. The market for selling stock is much different now."

Lumpkin of Biscayne Bank said taking the extra funds was an easy call. "We had already made the decision to apply for the 3%, so all the gnashing of teeth and the pulling of hair that was going to go on had already gone on," he said.

"We already put together a template of pro formas showing the bank's performance based on the 3% capital raise," Lumpkin said. "We had been through the documentation and discussed it at the board level, and we understood … the implications of becoming partners with the government. So the only question when it came to the additional 2% was, 'Can we put this money to equally good use?' And the feeling was we could."

It is not clear how much Tarp demand has been spurred by the expanded program for small banks. The Treasury only releases information after a Tarp application has been approved and has not specified how many small banks are seeking more funds. But 633 banks have received $200 billion under the program overall.

The Government Accountability Office said in a June 17 report that the Treasury had received more than 1,300 applications from federal regulators as of June 12, and that fewer than 100 were still awaiting a decision. The GAO also said bank regulators are reviewing another 220 applications that have not yet been forwarded to the Treasury.

Of the banking agencies, only the Office of Thrift Supervision details the Tarp application process. Of the roughly 800 companies it oversees, the OTS said 302 have applied for capital injections. Forty-nine have gotten the money and 140 have withdrawn their applications. Another 71 are in some state of review while 42 have yet to be considered.