With its credit quality increasingly troubled, Midwest Banc Holdings Inc. was already among the relatively small group of banks to defer dividend payments on the government's preferred shares.

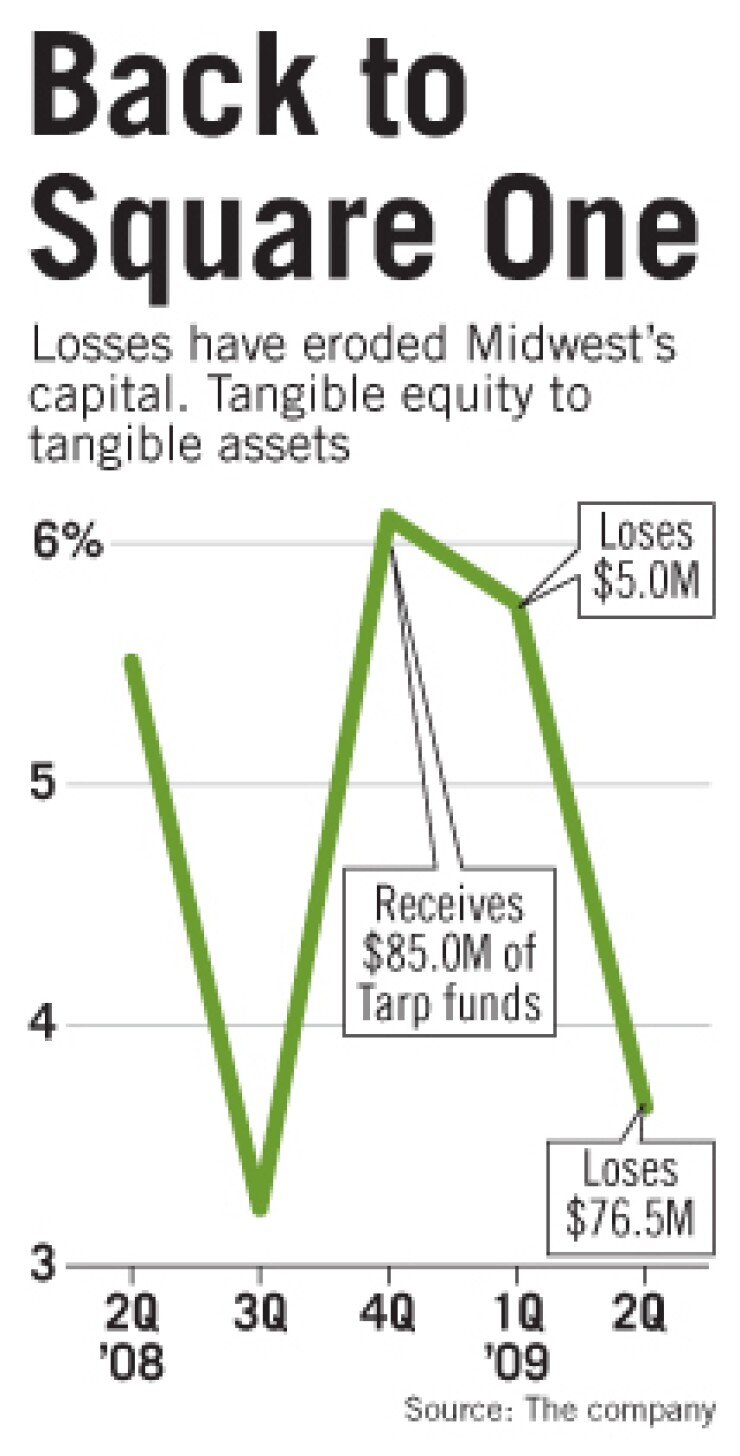

Now the $3.6 billion-asset company is going back to the till, asking the Treasury for even more capital. This time it's seeking to bolster a tangible common equity ratio that has dwindled to what analysts peg as a dangerously low 0.12%, after a $76.5 million loss in the second quarter.

It's going to be a tough sell, experts say.

Midwest, of Melrose Park, Ill., announced Tuesday that it has applied to participate in the Treasury's Capital Assistance Program. If approved, the government's investment in the struggling company would increase by 62%, to $138 million.

Roberto R. Herencia, who became Midwest's president and chief executive in May, said that the CAP application is part of a larger strategy to restructure and restore the company's common equity. Its common equity was badly damaged when it wrote off its preferred shares in the government-sponsored enterprises Fannie Mae and Freddie Mac last year. Instead of safeguarding the balance sheet against credit losses, the money Midwest received through the Troubled Asset Relief Program went toward plugging the GSE hole.

"When you look at our asset-quality ratios, we are middle of the road compared to our peers. We just don't have enough cushion," Herencia said in an interview on Wednesday. "So that really points to a capital structure problem. … If the investment losses had not been there, and the Tarp came in and did what it was supposed to do, this would be a very different story. The cushion that was supposed to be there wasn't."

In addition to its losses on its Fannie and Freddie investments, the company has sustained rising credit losses. In the second quarter the provision for loan losses was $20 million, 4.5 times the size of the year-earlier provision and 53% bigger than the first quarter's. Nonperforming assets were $125.6 million, or 3.52% of total assets. On the upside, while nonperforming assets increased threefold from a year earlier, they are at least growing at a slower pace than in previous quarters, Eileen Rooney, an analyst with KBW Inc.'s Keefe, Bruyette & Woods Inc., said in a research note.

The company's tangible common equity may be razor thin, but its Midwest Bank and Trust Co. did stay well capitalized at the end of the quarter, with a total risk-based capital ratio of 10.5%. Rooney estimated Midwest needs to raise $200 million in common equity.

Gary Townsend, the CEO of Hill-Townsend Capital LLC in Chevy Chase, Md., said regulators could in fact order Midwest to increase its common equity. "Just because you are in line with your regulatory capital ratios doesn't mean that they can't come back and say, 'We don't like how you are operating' and order you to raise common equity," he said.

A $57.9 million valuation allowance on Midwest's deferred tax assets drove the $76.5 million loss. It posted a profit of $2.4 million for last year's second quarter.

Though the valuation allowance is a nonrecurring charge, Michael Iannaccone, the president of MDI Investments in Chicago, said it is a blow to Midwest's shot at CAP because it is tantamount to accountants questioning the company's viability. "You write off your deferred tax asset because your accountants likely don't view you as a bank that is going to be around in the next two or three years. For the Treasury, that would be like throwing good money after bad."

Herencia sees it differently. Though he concedes that the valuation allowance underlines accountants' pessimistic view of a company's ability to turn a profit, he said that he does not think it signifies Midwest is a goner and that it should not prevent his company from getting CAP funds.

"If anything, we are adding more transparency to our balance sheet," Herencia said.

Townsend said it might be harder for Midwest to get CAP than it was to get Tarp, simply because the government has been tightening its spigot. "My sense is that winning approval for any of the programs is becoming increasingly difficult as the recovery progresses," he said. "The needier you are, the tougher it will be to get assistance."

CAP is one piece of a capital plan to increase common equity, Herencia said. The other pieces include an offer to exchange convertible preferred shares to common equity, which would result in a $43 million boost to the latter. The company is also considering private and public offerings. (After the seizure of Fannie and Freddie last year, Midwest unsuccessfully tried to raise $125 million through a public offering.)

Raising private capital with or without CAP could put Midwest in a difficult spot, Iannaccone said. Getting denied CAP funds would spook investors, he said, but receiving CAP would present problems for private capital, too. "If I was an investor and the government owns most of the equity, why would I want to be there?" Iannaccone asked.

The company is also trying to raise its capital ratios by shrinking the balance sheet and controlling expenses. "We have set an aggressive recovery path during my first 75 days at Midwest," Herencia said in a press release.

He succeeded Jay Fritz, who took the helm in January after James Giancola resigned. That is not the only shake-up lately at Midwest.

Its release of second-quarter results included an announcement that three of its 11 board members had abruptly resigned. During the conference call, Herencia thanked the board members for their service but declined to say why they had resigned.