Banks have struggled for years to get their customers to accept paperless account statements. But even among those who have succeeded in such efforts, paper use has risen.

The surge in paper use stems from changes in the regulatory environment and a boost in marketing efforts following years of pull-back that started with the 2008 financial crisis, bankers say.

"Paper is a key resource that a bank uses, and it has been very important to us for the last couple of years from an environmental stewardship and cost perspective to focus on paper reduction," says Lisa O'Brien, senior vice president and director of environmental affairs for U.S. Bancorp. "But there are other factors, like regulatory challenges that require more customer communications, and which make statement lengths longer."

U.S. Bank has an e-statement penetration rate for deposit account customers between 35% and 40%, compared to an average around 24% for banks of its size, O'Brien says. Fewer than half of its statements are sent by mail today.

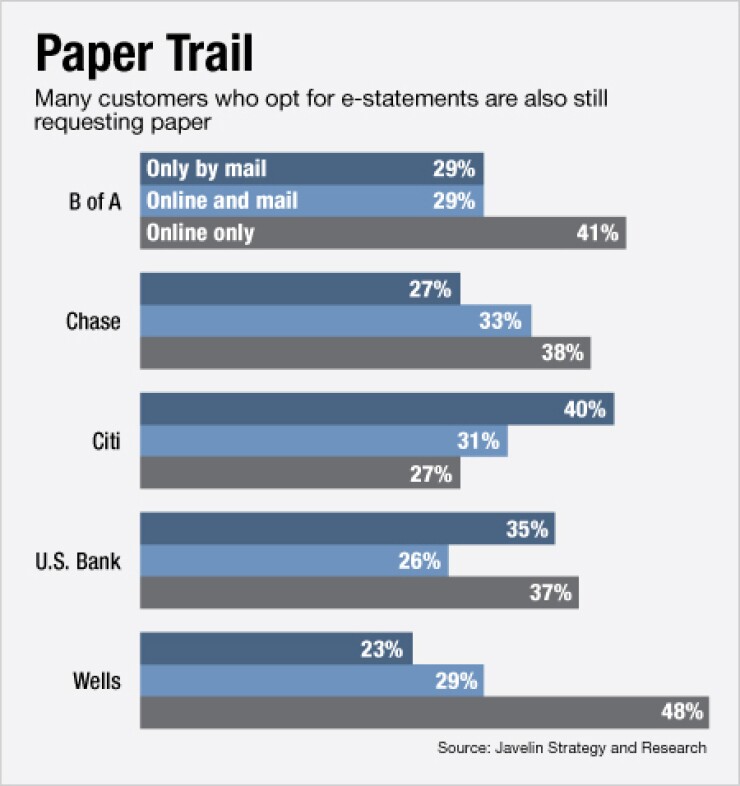

Many customers are so-called double-dippers — they consent to getting electronic statements, but don't ever switch off paper.

"Banks have successfully done the hard work of getting a lot of people to get electronic statements, but they have not been able to get that same group to let go of paper," says James Van Dyke, founder and principal of Javelin Strategy and Research.

About a third of JPMorgan Chase & Co.'s customers fall into this category, Van Dyke says, the highest percentage of the top U.S. banks.

JPMorgan Chase said in an April 2011 report that its paper consumption increased 55% last year, to more than 114,000 tons, even though the bank eliminated 203 million paper statements for retail and credit card customers.

"Paper use remains a material impact of our banking operations despite advances in moving many processes and products from paper to electronic form," its report said. "The main driver for the rise is Chase Card Services' significant increase of direct mail marketing in 2010. This was a function of the economic recovery and also was a departure from the uncharacteristically low volumes of 2009."

The suppression of paper statements alone can earn banks about 50 cents per customer per month, Van Dyke says.

Deutsche Bank reported a 7% increase of paper over the same period, to 4,000 tons, despite its goal of reducing paper use by 15% by the end of 2011. And HSBC Holdings PLC reported a doubling of paper consumption in the U.S., driven by increased correspondence with consumers necessitated by new regulatory demands, the bank said in its 2010 report. It did not say how much paper it used.

(Neither Deutsche Bank nor HSBC responded by deadline to requests for an interview from American Banker.)

Banks and other businesses send nearly 50 billion pieces of mail to customers annually, according to the United States Postal Service, yet various estimates place total paperless adoption at 15% or less.

Paper consumption for some of the top 10 global banks has risen between 50% and 100%, according to the New York environmental consultancy Green Research.

"A big reason why customers are concerned about giving up paper has been the amount of history they have had access to online," says Ravi Acharya, JPMorgan Chase's senior vice president of online and mobile products and payments. Adoption increased dramatically about five years ago when JPMorgan Chase increased the number of statements it offers online to a seven-year history, up from a six-month history, Acharya says.

Banks can encourage their customers to turn off paper through better education and rewards offers, says PayItGreen, a consortium of 50 financial institutions devoted to reducing paper consumption managed by Nacha, the electronic payments association. Banks can also require customers to opt out of using e-statements, rather than require them to opt in.

"Almost 50% of consumers would be comfortable having a bank shut off paper once they are enrolled, but the opt out option is not something universally out there as policy," says Samantha Carrier, senior director of advanced payment solutions for PayItGreen.

O'Brien says that U.S. Bank tries to make it as simple as possible for its customers to turn off paper. When they sign up for online banking, they are guided to a screen that says the bank will convert their statements to electronic versions, unless the customer wishes to opt out.

It also includes messages on paper statements about the environmental impact of paper. A section of U.S. Bank's website explains ways customers can reduce paper consumption.

Customers are also likely to respond well to incentives to shut off paper, Van Dyke says. Nearly 40% of consumers polled in a March survey say they would shut off paper if given better rates, discounted fees and other offers.

A Citigroup Inc. spokesman says incentives have varying levels of success with the different segments of its market. Citi, which has a 25% penetration rate for electronic statements with its credit card customers and which suppressed more than 20 million statements for these accounts in May, says it offers to plant trees for customers that care about the environment. For those that don't, it offers rewards from its Thank You program.

"We tailor the marketing to the market," the spokesman says. "Different tactics resonate with different consumers."

Wells Fargo & Co. says it is attempting to use electronic methods of communication to meet regulators' requirements for customer contact.

"In this regulatory environment, banks are communicating to their customers more than ever, however we are doing so in a more environmentally-conscious and sustainable way," says Mary Wenzel, director of Wells Fargo Environmental Affairs, in an email.