-

Secure Vault Payments, which lets consumers spend at online merchants without disclosing their bank account details, is expanding into more financial institutions through a deal with the vendor Jwaala.

August 17

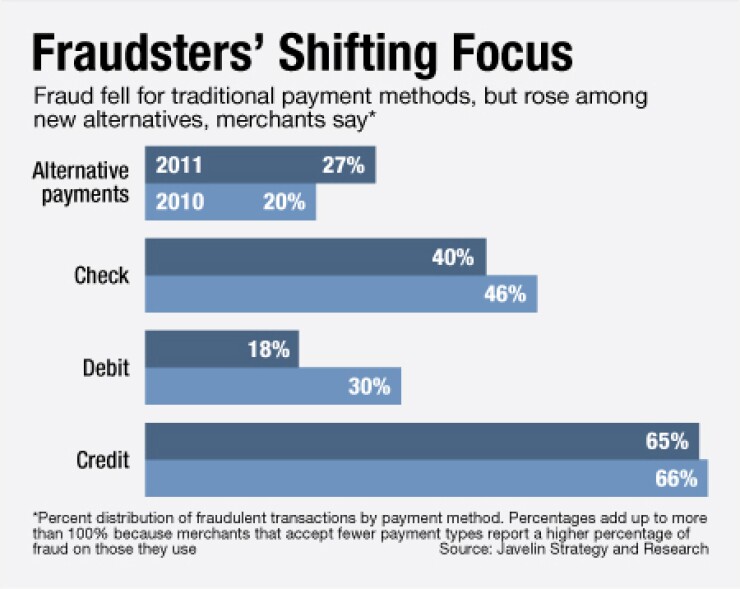

Fraudsters are increasingly using alternative payment methods to make bogus transactions, in many cases moving away from debit cards and checks, merchants report.

Alternative payment methods, such as eBay Inc.'s PayPal, are often pitched as a safer option for online payments than cards and checks, since they allow consumers to make purchases without exposing their bank account details to the seller. But merchants that use alternative systems report that fraudsters are increasingly turning their attention to them.

Merchants that accept alternative payments reported in July that 27% of fraud takes place with those products, up from 20% a year earlier, according to data from Javelin Strategy & Research. Credit, debit and check transactions all showed declines in fraud occurrences among merchants that accept them.

The sharpest decline was for debit. Merchants that accept debit cards reported that just 18% of fraud took place with debit this year, compared to 30% a year ago. Check fraud dropped to 40% from 46% last year. Credit slipped to 65% from 66%.

Small merchants that use alternatives are particularly vulnerable, attributing 31% of fraud to alternative payments. Midsize merchants reported just 12% of fraud involved alternatives and large merchants reported 15%. Javelin's data was published Tuesday in the LexisNexis 2011 True Cost of Fraud Study.

Small merchants may be more vulnerable to alternative-payment fraud because they are more likely to accept alternatives. The report mentions PayPal as a catalyst for merchants' acceptance of alternative payments in general.

"It is key to note that emerging channels … are primary areas of growth for businesses – and also the most nebulous areas where security and prevention methods are still growing," the report said.

Small merchants are vulnerable because they "are less equipped to battle the more sophisticated methods of fraud associated with newer payment methods, and fraudsters are taking advantage of it," it said.

PayPal says its anti-fraud systems are designed to address the concerns of small businesses.

"Many small merchants choose to work with PayPal because of our high level of security," a PayPal representative said by email. "Most of the time, PayPal detects and prevents fraud before it ever even reaches our customers."

Another alternative payment provider says it has not seen an increase in fraud over the past year.

"We haven't really seen any large changes or any new patterns," says Marwan Forzley, president and chief executive of ModaSolutions Corp., the provider of the alternative payment system eBillme. Moda, of Rye Brook, N.Y., allows consumers to pay merchants through a bank's online bill pay system, so users have to authenticate themselves through the bank's own website before any money is spent.