-

PNC Financial Services will not need to issue additional shares of common stock to complete its $3.45 billion acquisition of RBC Bank USA, the Federal Reserve Board said.

November 29 -

U.S. banks may get to spend some excess cash on loans or lines of business that European banks will seek to dump. Still, a cloud hangs over the outlook for bank M&A next year.

November 16 -

The Spanish bank will raise $1 billion and plow some of the money back into its fast-growing Santander Consumer arm.

October 21 -

At its second hearing on the deal, Capital One said its merger with ING's online bank unit was the safest option for the system.

September 27

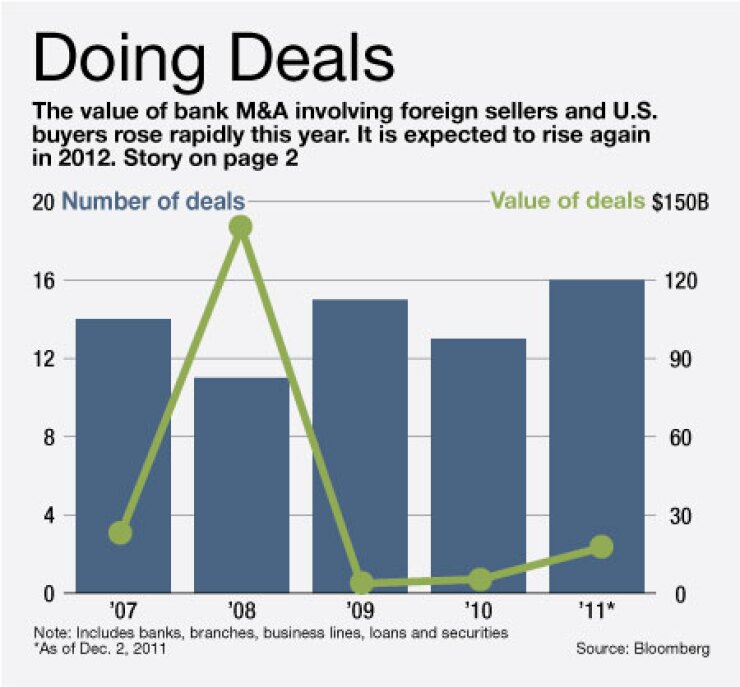

Most of the past year's large stateside bank deals involved overseas conglomerates getting rid of unwanted assets, a trend that experts say should continue through the new year.

Banco Santander SA of Spain, BNP Paribas SA of France and other big banks from debt-plagued Europe need to slim down on risk and beef up on capital. The healthiest big U.S. banks have plenty of cash and capital, but are wary of building branches or buying other publicly traded companies. That makes foreign bank sales of branches, loans, businesses and other assets one of the few games in town for wannabe buyers.

Buying a "book of business" is easier than buying an entire bank, says Wayne Busch, a managing director in Accenture's North American banking practice.

The returns also are more predictable, industry observers say. Mortgages may be still risky, but credit card portfolios, auto loans and business loans have stabilized, Busch said.

Foreign sales of these types of assets will not completely satiate revenue-starved banks' merger ambitions, Busch said. But they will provide an opportunity for some cash-flush banks to put money to work as they cut costs and fight for new customers — priorities that trump traditional acquisitions at the moment.

"I don't think that we're likely to see any blockbuster deals — or major retreats from the market," Busch said. "All the banks are looking for [these types of] opportunities. I just don't believe this is No. 1 on their strategic list right now."

So far this year, there have been 16 deals worth nearly $18 billion involving a U.S. bank buying a foreign-owned banking asset, according to data from Bloomberg News. In all of 2010 there were 13 such transactions, worth nearly $6 billion.

This year's tepid bank mergers and acquisitions market was dominated by cross-boarder transactions: Capital One Financial Corp. agreed to pay $9 billion for ING Group NV's U.S. online bank in June, and it agreed to buy HSBC Holdings PLC's U.S. credit cards business for $2.6 billion in August.

PNC Financial Services Group Inc. in June agreed to pay $3.45 billion for Royal Bank of Canada's RBC Bank in Raleigh, N.C.

Experts expect similar spinoffs to continue because there is a growing appetite for financial assets among a broad swath of investors. That has been enticing foreigners to put up for sale decent-quality loans and securities or business lines that do not require a lot of capital to operate, and thus can be sold for a gain.

"We expect cross-border [deal activity] to continue going forward," Eric Heaton, a managing director and head of Deutsche Bank AG's financial institutions group in the Americas, said at a banking conference in New York in mid-November.

Deutsche Bank in late November said it might sell large parts of its asset management arm because the business was suffering from regulatory changes, increased costs and competition.

Experts do not see many more large deals akin to RBC Bank or ING Direct on the horizon because most foreign banks with major stateside banking assets are deeply reluctant to let them go on the cheap. ING Group only sold its U.S. online bank under orders from regulators.

Banks are the cheapest they have been in years right now. That makes Europeans active in the U.S. such as BNP Paribas and Banco Santander especially reluctant to auction off their entire U.S. franchises.

But most are looking at their operations to determine what business lines or loan portfolios they can do without. Santander in October raised $1 billion after selling a minority stake in its U.S. auto finance arm to a handful of private-equity firms. BNP in August agreed to sell the U.S. investment manager FundQuest Inc. for about $24 million.

Other foreign-owned banks have large and diverse holdings in the U.S. that they need to pare down: Royal Bank of Scotland Group PLC's Citizens Financial Group Inc. of Providence, R.I. — in the middle of a five-year plan to turn around its stateside operations — just announced plans to close an undisclosed number of its 1,500 branches.

The $131 billion-asset company in recent years has sold off branches in upstate New York and Indiana. Citizens is among the more-diversified U.S. banks, which would give it lots of options were it to decide to streamline in the U.S. as U.K. rival HSBC has. Citizens' operations include auto finance, investment services, business capital, asset finance and credit card businesses.