-

Homeowners who faced wrongful foreclosure actions due to big banks' mortgage servicing failures are entitled to cash payments of as little as $1,000 to up to $125,000, according to new federal guidelines. But consumer advocates say that disparity is too wide.

June 21 -

Edward DeMarco, the acting director of the Federal Housing Finance Agency, on Tuesday defied both the Obama administration and widespread expectations that he would cave to a torrent of political pressure and allow Fannie Mae and Freddie Mac to offer principal reductions to troubled borrowers.

July 31 -

The Treasury Department said Thursday that it did not pay any incentives for foreclosure prevention efforts to Bank of America Corp. and JPMorgan Chase & Co. in the second quarter, as the two banks still need "substantial improvement" in their mortgage servicing operations. But Wells Fargo & Co. did make the cut.

September 1

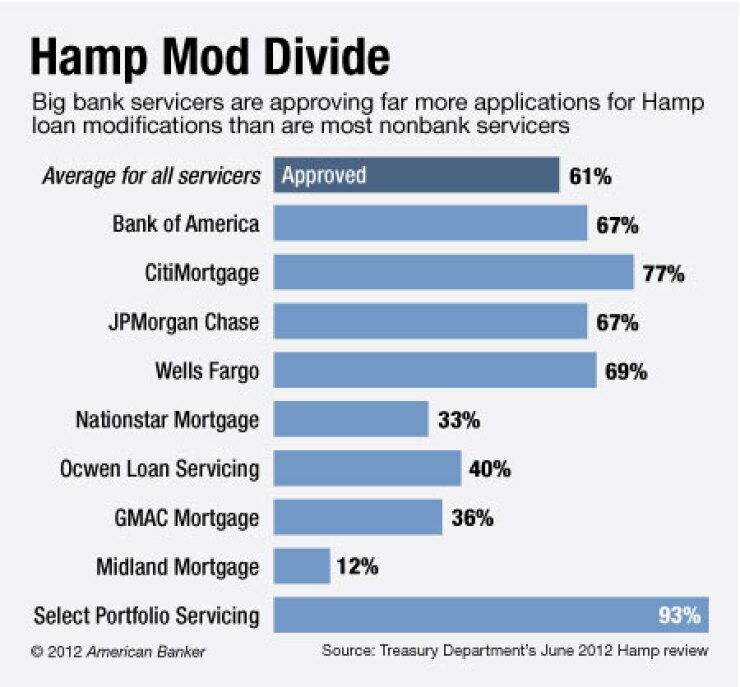

The Home Affordable Modification Program has long since left the spotlight. But data shows that after initially dragging their feet, the largest mortgage servicers have modified nearly 70% of loans to eligible borrowers largely because they are receiving major incentives from the government.

A review of the Treasury Department's Hamp data also shows that while major banks have granted far more modifications than they've denied, many nonbank mortgage servicers and a few smaller banks have rejected the overwhelming majority of applicants. The distinctions can't be simply explained by portfolio quality: Bank of America (BAC) approved more than two-thirds of Hamp applicants despite its responsibility for Countrywide's portfolio.

"There definitely has been a shift in banks' commitment to using Hamp," says John Taylor, president and CEO of the National Community Reinvestment Coalition, and a longtime bank critic. "These are the kinds of numbers we had hoped to see from the beginning."

The top five mortgage servicers — Ally Financial, Bank of America, Citigroup (NYSE:C), JPMorgan Chase (JPM), Wells Fargo (WFC) — control 66% of mortgage servicing so the sheer volume of loans they are modifying is much larger.

Citi had the highest cumulative approval rating for Hamp mods at 77% at the end of June, followed by Wells at 69% and B of A and JPMorgan Chase at 67%. Ally had the lowest among the largest banks at 36%.

The Treasury only recently breaking out the data by individual servicers in March so it is unclear what individual banks' approval rates were before then.

But consumer advocates say the approval numbers are definitely up and they attribute the increase to rich incentives the government has given to servicers, particularly the top five banks, to resolve delinquent loans held on their own balance sheets. In January the Treasury reduced some requirements and tripled cash payments to servicers that agree to modify loans. The five largest banks that signed a national mortgage settlement with state and federal regulators earlier this year also receive added credits for reducing principal balances in the first year of that agreement.

"We are seeing a lot of modifications because the incentives have increased significantly," says Faith Schwartz, the executive director of Hope Now, the private-sector alliance of mortgage servicers, investors and nonprofit housing counselors.

The differences in approval rates are material: If just Nationstar Mortgage and Ocwen Loan Servicing (OCN) had granted Hamp mods at the rate of their peers, nearly 100,000 more borrowers would have received modifications, the data shows. Among nonbank servicers Nationstar has the lowest cumulative approval rate for Hamp mods at 33%, while Carrington Holding, which purchased the assets of the now-defunct subprime lender New Century Financial, approved 36% of processed applications and Ocwen approved 40%.

To be fair to the nonbank servicers, there is a case to be made that the quality of loans in their portfolios made it harder to say yes. Nationstar and Ocwen have acquired large number of mortgages over the period measured, some of which may have been poor candidates for a turnaround. Both Ocwen and Nationstar have said they seek keep borrowers in their homes whenever possible.

Paul Koches, an executive vice president and general counsel at Ocwen, in West Palm Beach, Fla., says when loans transferred from prior servicers are taken out of the equation, Ocwen has a much higher approval rate.

Though servicers initially process all applications through Hamp, if a borrower doesn't qualify, they may still get some alternative. Carrington has approved 60% of all loan mod applications though only half are through the Hamp program, says Executive Vice President Rick Sharga.

However, the frequency with which Bank of America approved modifications suggests that big banks have made granting approvals a priority. The stark contrast between servicers reveals a sometimes neglected fact during the last three years of debate over modifications. The government provided a blueprint — and massive incentives in the form of direct payments and credits -- to the largest banks, while many nonbank entities that weren't in the public eye simply did not take the bait.

Sharga says many nonbank servicers hold loans that simply did not qualify for a Hamp mod. Loans held in private-label securities often have investor restrictions.

"What you had during the real estate boom were underqualified or unqualified buyers getting into ill-advised loans on a lot of properties that were overvalued," Sharga says. "Those loans were difficult to modify using Hamp or any other product because the borrower just had too much debt."

Still, while roughly 60,000 to 70,000 loans are getting modified every month, fewer than one-third have been completed using Hamp guidelines, Hope Now's Schwartz says. The majority are proprietary modifications created by each individual servicer.

The biggest banks caught plenty of flak when Hamp was first introduced in March 2010 to lower the mortgage payments of struggling borrowers by reducing the interest rate, extending loan terms and more recently, writing down principal. The Treasury even

In its most recent assessment of servicers in the first quarter, the Treasury determined that six -- Bank of America, CitiMortgage, GMAC Mortgage, JPMorgan Chase, Ocwen and Homeward Residential — still needed moderate improvement in complying with the program. (Homeward is the former American Home Mortgage now largely owned by the private equity firm Wilbur Ross & Company.)

Dave Stephens, the president and chief operating officer of the mortgage hedging company UCM Inc. and a servicing industry veteran, says many nonbank servicers are simply being realistic in denying modifications.

"Maybe it's because they're nonbanks they have more ability to go ahead and cut to the chase, evict people, actually run it like a business," Stephens says.

But he suggested that the success of modifications ultimately depends on individual servicers' redefault rates, something not captured in the Treasury statistics. There's no data for individual servicers on redefault rates, but according to the Office of the Comptroller of the Currency's most recent mortgage metrics report — using data from yearend 2011 — Hamp-modified mortgages were found to have significantly outperformed other modifications.

Servicers that have embraced Hamp also likely will have fewer issues to deal with when the Consumer Financial Protection Bureau releases its proposed rules for mortgage servicing later this month, because they have already met many of the government's requirements.

"History will probably be kinder to Hamp than current events," says Sharga. "For servicing shops structured around Hamp processes, the new requirements will not be nearly as disruptive."