-

SCBT Financial Corp. in Columbia, S.C., announced Tuesday morning that it is buying the $546 million-asset Peoples Bancorporation Inc. in Easley, S.C., for $28 million in stock.

December 20 -

At least three serial consolidators are positioning themselves for more deals should the right opportunity arise. SCBT and Iberiabank filed shelf registrations this month, while Wintrust raised $127 million.

March 26

The recent sale of a Georgia banking company illustrates that sometimes the whole really is worth more than the sum of the parts.

SCBT Financial (SCBT) on Wednesday announced an agreement to buy Savannah Bancorp (SAVB) in a stock exchange valued at $67.1 million. It is one of the biggest traditional bank acquisitions in Georgia since the onset of the housing crisis.

The deal gives SCBT an entry point into Savannah. It also provides the $4.4 billion-asset SCBT with a strong investment advisory and mortgage business, two areas where the Columbia, S.C., company would like to grow.

Savannah Bancorp is struggling with an

Timing was on the seller's side, deal makers say. By holding out, Savannah Bancorp found itself at a convergence of two industry trends. Buyers are more comfortable with loan portfolios and all banks are trying to boost fee income.

"I think [the ancillary businesses] are clearly the reason why Savannah had residual value and didn't have a worse fate," says Christopher Marinac, an analyst at FIG Partners in Atlanta, which worked with the company to explore strategic options. "Fee income is going to be important to banks next year, and I think a lot of them have no clue how they are going to grow it."

SCBT's executives devoted a large amount of time during a Wednesday conference call to discuss Minis, which was formed in 1932 and

Minis "brings in some infrastructure that we would have had to build," Robert R. Hill Jr., SCBT's president and chief executive, said during the call. "This is a meaningful part of this transaction."

In the second quarter, Savannah Bancorp reported roughly $1.4 million in income from its trust business, while SCBT made $1.6 million in the same area.

Hill said in an interview after the conference call that his company would be able to cut expenses because Minis is a registered investment advisor, a service that SCBT now outsources. "We will be able to make that business even more profitable," he said.

Executives also highlighted Savannah Bancorp's mortgage business. The company doesn't underwrite loans, but serves as a broker to other banks. During the conference call, SCBT's executives said Savannah Bancorp is among the five biggest originators in its market and that SCBT would funnel that business into its mortgage line.

From a core-banking perspective, the deal gives SCBT 11 branches around Savannah and Hilton Head, S.C. During the call, Hill said those coastal areas are expected to have higher population and household income growth in the next five years, compared to SCBT's current markets and the country overall.

"We were interested in buying the whole company, not just the pieces," Hill said in the interview, though he said a whole-bank deal would have been less likely a year or two earlier, given the credit environment.

"A couple of things have changed. Obviously, at this point banks have charged off more and worked through some of the problems," he said. "And sellers' expectations have come more in line."

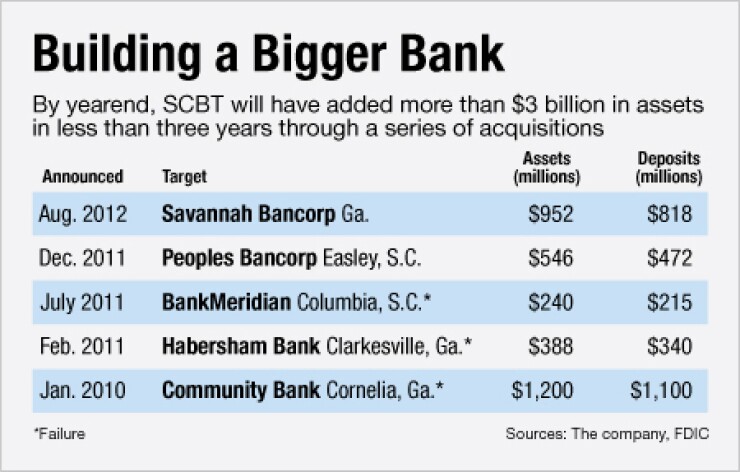

SCBT is buying Savannah Bancorp at 84% of tangible book value. The deal, which is expected to close in the fourth quarter, is SCBT's fifth acquisition since 2010 and its second whole-bank deal.

Though credit is improving, SCBT is taking a credit mark of 11.5%. When combined with the losses that Savannah Bancorp has taken since the fourth quarter of 2007, SCBT is expecting a cumulative loss rate of 19.1% on the seller's balance sheet.

William Wallace, an analyst at Raymond James, says the expected cumulative loss rate for most banks in the region is about 12%. "It is a very conservative mark than we've seen elsewhere, but Savannah is a coastal market so they needed to be conservative," he says.

Hill said that Savannah has fared better than Atlanta, but the mark shows that SCBT is being cautious as it handles a deal in a state that has not had much traditional bank consolidation in recent years. "The credit losses are an unknown and this is one of the first whole-bank deals in the Georgia market in a very long time," he said.

SCBT is a respected acquirer in the region and perhaps the deal could lead to further acquisitions in Georgia and its neighboring states, industry observers say.

"It is an attractive deal for SCBT and Savannah, but it is a pretty meaningful deal for the Southeast," says Kenneth James, an analyst with Sterne Agee. "This is a macro positive for the region, because there just haven't been a lot of deals."

Marinac says the deal is particularly important to Georgia. "It sends a signal that there are more than just failures in the state of Georgia," he says.