-

Loans made through the Small Business Lending Fund continued their climb in the first quarter, rising by $433 million compared with the fourth quarter of 2011, the Treasury Department said.

July 9 -

The Small Business Lending Fund provided an exit path for the healthiest institutions in the Troubled Asset Relief Program, but left the latter program full of weak banks with dim repayment prospects, according to a report from the special inspector for Tarp.

April 25 -

Some bankers are withdrawing the applications for the SBLF program after being held back by certain restrictions. Observers question whether the Treasury will deploy most of the funds in time.

August 17 -

QCR Holdings (QCRH) in Moline, Ill., has repaid about a fourth of its money it received from the Treasury Department's Small Business Lending Fund Program as part of its effort to increase its tangible common equity.

July 2

As the one-year anniversary of the Small Business Lending Fund nears, a number of bankers are actually touting the program's effectiveness at increasing loan production.

Overall views are largely positive, though some bankers are less ecstatic about unintended consequences such as reduced loan pricing and narrower yields.

About 84% of the 281 participating banks are

"The blow back in the community was unbelievable when we were in the process of applying" last year, says Ken LaRoe, the chairman and chief executive of First Green Bank in Mount Dora, Fla. But "it's definitely been worth it."

The $193 million-asset bank had one of the SBLF's highest business-loan growth rates since receiving $4.7 million from the program. The bank's qualified loans grew 139% to $72.3 million at March 31 compared to a Treasury baseline that takes into account average loan balances for the four quarters that ended June 30, 2010.

Some bankers are having to increase their competitiveness to make loans encouraged by the program. As a result, some participants have cut rates to make enough loans to get the lower dividend rate through SBLF.

"The cost of [SBLF] capital is less so we're able to provide more lending at a more competitive price," says Robert Sarver, the chairman and chief executive at Western Alliance Bancorp. The Phoenix company grew qualified business loans by 11.2% at March 31.

Sarver did not say how low the bank prices its loans. Some participants agree that they are reeling in more loans, but at rates that are dragging down the yield of their portfolios. And non-SBLF banks are feeling it, too.

"We were hearing some pretty amazing below-market rates being offered" by SBLF banks, says Dan Yates, the chief executive at Regents Bank in San Diego. He says that an unnamed bank with SBLF funds was offering less than a 2% interest rate on a commercial real estate loan.

Yates applied for SBLF but quickly withdrew after he was told he would only receive 80% of the capital the bank received from the Troubled Asset Relief Program. A year later, he says Regents made "a good decision," as loan demand and pricing have weakened since.

Participating clients say SBLF is "helpful" to a degree, "but it's still hard to find good loans," says Kip Weissman, Luse Gorman Pomerenk & Schick in Washington. He was among the program's earliest critics, stating a year ago that some of his healthy clients were unable to participate for various restrictions.

SBLF fell well short of its $30 billion funding objective, issuing only $4 billion.

"It was a nice program and reasonably well-designed but poorly implemented at a key moment for a group of deserving banks," Weissman says. "I think it was solid model for the future. …There's no reason the government couldn't do a program like this again."

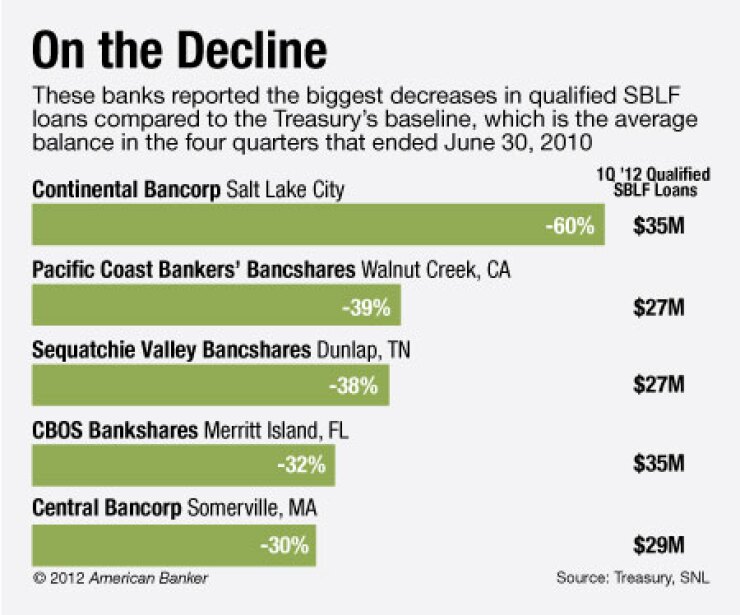

About 40 banks, or 16% of the program's participants, reported declines in qualified business loans at March 31, compared the Treasury's baseline. Even the bankers with the largest growth rates attribute more of their success to improvement in their markets rather than the program's implementation.

"We are a little bit of a success story but in reality, we're in New York City, which is a huge market," says Renos Kourtides, the chief planning officer at Alma Bank in Astoria, N.Y. "We're finding loans here better than if we were in a small community."

Still, Kourtides projects that the SBLF funds will help Alma reach $1.5 billion in assets in 2014, compared to $1.2 billion without the capital. With SBLF counting "as capital, I can raise ten times that amount" in loans, he says. "It's the multiple that counts."

The Treasury did not release first quarter figures until July. Now that it's the third quarter, some bankers say the next report may show a subsiding growth rate until there is more certainly about the economy and November's elections.

"You will probably see a decline or not as fast of a growth rate because there is lot of uncertainty and angst over the election, whether it's founded or not," LaRoe says. "But we're still seeing demand …and we're incredibly pleased at how it [the program] works."

Second quarter updates will not be released until October. But SBLF director, Jason Tepperman, is hopeful participating banks will continue to outperform their peers in small business loan growth.

"The institutions participating in this program have demonstrated a substantially higher level of lending increasing versus a comparison set of similar institutions," Tepperman said. "So I would not necessarily apply the broader lending experience for the industry to the progress of institutions participating in this program."

A number of bankers say they are looking at raising capital to repay their SBLF funds by next year. Banks can hold the funds for the first four and a half years before the dividend rate increases to 9%. Bankers largely agreed that the program was a success to date, though they were cautious in predicting how it would end.

"Whether all participating banks will be able to redeem the preferred shares or buy it back remains to be seen," Kourtides says. "Prudent management will have to plan it out."