-

Citigroup Inc., the third-biggest U.S. bank, reported a surprise profit of $468 million for the third quarter, helped by a $582 million tax benefit and bond- trading revenue that beat analysts' estimates.

October 15 -

Former FDIC chairman Sheila Bair, who vocally criticized the Citigroup bailouts in her new book, said Friday that she sees few growth prospects for the bank.

October 11 -

Citigroup (NYSE: C) has reached another milestone in its long, painstaking recovery from the financial crisis, but its executives still see a slog ahead.

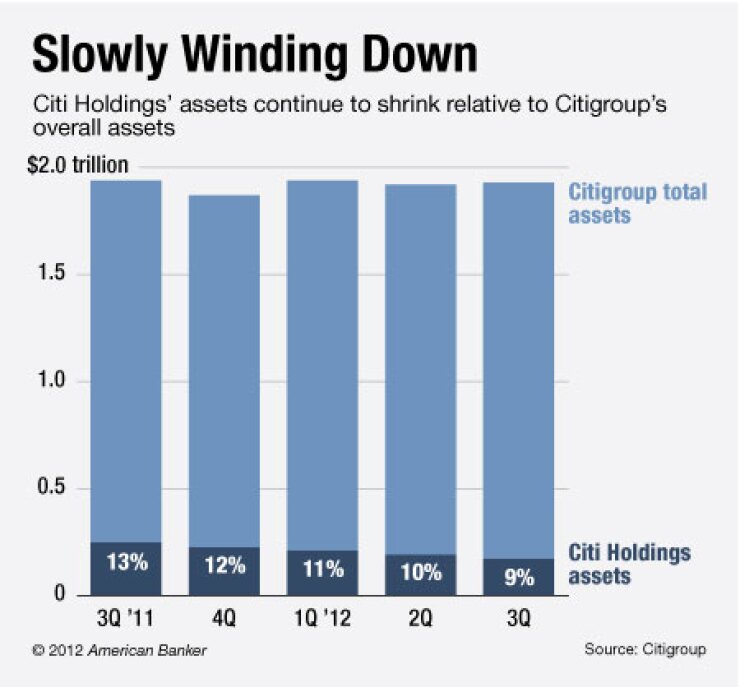

The third-largest bank said Monday that it has reduced its portfolio of unwanted assets to 9% of its overall assets, or $171 billion — down from $662 billion, or about 36% of its assets, in early 2009. That's when Chief Executive Vikram Pandit, trying to pull the bank from the brink of failure, created a "Citi Holdings" unit for businesses he planned to sell or wind down.

Since then, Citigroup has sold off student lending and insurance operations, and is in the

The split was less noticeable in some ways on Monday; Pandit said in the bank's third-quarter

But while the Holdings unit has shrunk dramatically in the past three-and-a-half years, it will remain a drag on profits until it is wound down for good. In a conference call with analysts Monday, Citi executives said that they expect the unit to survive for the foreseeable future.

"There could become a point in time when it would shrink to such an extent that we wouldn't put it out as a separate segment. I don't see that timeframe in the near-term horizon," chief financial officer John Gerspach said.

In a later conference call with investors, Gerspach warned that more shrinkage of Citi Holdings would occur "likely at a slower pace than the third quarter."

Citigroup's slow-but-steady wind-down of the Holdings unit recently drew criticism from Sheila Bair, the former Federal Deposit Insurance Corp. chairman and author of the bailout-centric memoir "Bull By the Horns."

Citigroup is "better off but they're still just nursing a bad balance sheet … and that's what a sick bank does, they nurse their balance sheet and slowly get back to health,"

(Her book is apparently not a must-read among Citi executives. Asked during the call with reporters if he had read it, Gerspach said, "That's not something I'm considering right now.")

Despite its smaller size, the Holdings unit can still have a large impact on the overall bank. Citigroup's third-quarter results were clouded by a pre-tax charge of $4.7 billion resulting from the sale of a 14% stake in the Morgan Stanley Smith Barney venture. Citi Holdings lost $3.6 billion in the quarter, tripling its loss of a year earlier, due to the charge and other charges tied to the changing value of its debt. But excluding those charges, Citi Holdings' third-quarter loss shrank to $679 million.

The bank's

In heavy trading, Citi's shares were up 4.3% midday Monday, to $36.23.

The bank benefited from improving capital markets conditions, which helped boost its bond trading revenue 63% from a year earlier, to $3.7 billion for the quarter. Like

Citigroup expects "strong mortgage refinancing activity" to continue into at least the beginning of 2013, Gerspach said during a conference call with investors. Earlier, he told reporters that the bank is not trying to compete for a bigger share of the mortgage refinancing market.

"We did not staff up perhaps as quickly as we otherwise could have, but we've got the business moving now," he said.

Days after JPMorgan Chase (JPM) CEO Jamie Dimon declared that "the housing market has

"I don't use phrases like, 'turned the corner.' I have difficulty seeing corners sometimes," Gerspach told reporters. "We're all seeing elements of what I'd call stability, but there are still some rather significant challenges to be faced.

"In the past we've seen some of these periodic improvements only to see them come crashing down, [so it's] still a question in my mind whether we've still got a strong enough economy to support the housing market."