-

During testimony on Capitol Hill, the Treasury secretary faces criticism from members of both parties over a slow-moving, smaller-than-expected initiative to boost lending to small businesses.

October 18 -

The Treasury Department said this week it will distribute $4.3 billion from the Small Business Lending Fund, about a third of the funds that banks were seeking from the program and only 14% of the total available.

September 7 -

Some bankers are withdrawing the applications for the SBLF program after being held back by certain restrictions. Observers question whether the Treasury will deploy most of the funds in time.

August 17

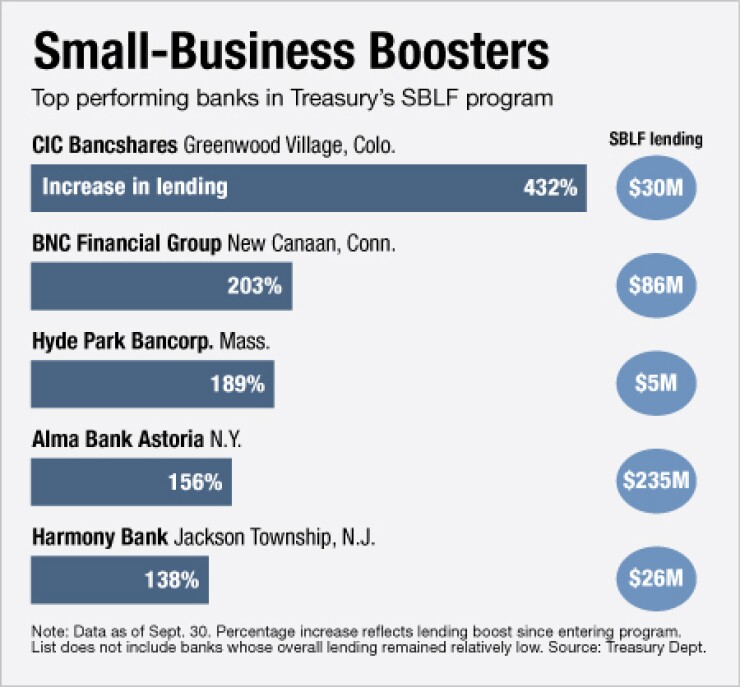

WASHINGTON — After months of criticism, the Treasury Department is hailing the success of its Small Business Lending Fund, providing data that shows banks have significantly boosted such lending as a result of the program.

In a quarterly report sent to Capitol Hill this week, Treasury found that 78% of the institutions participating in the program have increased small business lending from the levels reported prior to the program's start. A majority of those have increased it by at least 10%, the threshold banks must maintain to pay the lowest dividend on the borrowed funds.

"These loans are helping small businesses to grow, create jobs and support families in communities all across the nation," Don Graves, Treasury's deputy assistant secretary for small business, community development and housing policy, wrote in a blog post on the Treasury website.

Observers agreed the program had an impact.

"It clearly had the desired effect in the short term, no question about it," said Kip Weissman, a partner with Luse Gorman Pomerenk & Schick. "Every single one of our clients on this list needed the capital to grow."

Even some banks said they were pleasantly surprised by the success of the program.

The $244.3 million-asset Seneca-Cayuga Bancorp Inc. in Seneca Falls, N.Y., used its $5 million capital injection to push further into the small business lending market. The company increased its lending 73.4% as of Sept. 30, to $23.1 million from $12.9 million.

That $10.1 million has gone to new and expanding wineries in the Finger Lakes region as well as a number of used car dealerships, as well as other small businesses.

Menzo Case, the bank's president and chief executive, said he was initially skeptical of participating in a government program.

"We're a savings bank and we've had a portfolio of all residential mortgages," Case said. "We had that for quite a while and we're diversifying our portfolio, so this just came at the right time. And we plan to continue with a robust small business lending program, and this just got us the engine to start — it just got us the fuel."

Congress created the program in September 2010 as part of the Small Business Jobs Act, but it took Treasury more than nine months to get the program off the ground. Lawmakers complained that the agency was taking too long to distribute much-needed capital to banks, and later, that it only distributed a fraction of the $30 billion allocated by Congress.

Yet Treasury officials maintained that many of the country's 8,000 banks either weren't eligible to participate, or didn't want or need to because they have enough capital to lend.

However small the program's scope, it would have an important effect in the communities where banks received funds, they claimed.

"What this program tries to do is reach a subset of the banking system that can't raise capital on their own, but are still viable institutions," Secretary Tim Geithner told members of the House Small Business Committee in June. "That's not going to be the bulk of banks, but it's go to be a meaningful fraction of banks."

According to the SBLF report issued to Congress on Monday, banks that did receive funds have managed to increase lending by $3.5 billion over their baseline, or their average small business lending, over the four quarters that ended June 30, 2010. That represents a nearly 10% aggregate increase in small business lending from the baseline of $35.8 billion.

Treasury said banks have projected a $9.3 billion increase in small business lending from the baseline over the next two years. "So this represents a pretty good amount of progress toward that goal," said Jason Tepperman, the program's director, in an interview.

It's difficult to tell from the report how much of the increase occurred as a result of moderate improvements in the economy versus the program, but Treasury officials said the average bank under $10 billion of assets — the only ones that were eligible for SBLF money — has not reported such substantial lending increases.

"It's hard to distill what institutions would have done without this capital, or without the prospect of receiving the capital," Tepperman said. "The average bank under $10 billion has not significantly increased its business lending over the comparable baseline, but banks participating in SBLF have."

Industry observers said they were optimistic about the report, which provides the first snapshot of lending levels since the funds were distributed during the third quarter.

Under the program, banks that boost small business lending pay a lower dividend to the Treasury Department — as low as 1% for banks that boost small business lending by 10% or more.

The report found that 60% of participating banks met that threshold.

Paul Merski, the executive vice president and chief economist of the Independent Community Bankers of America, said the trade group was pleased with the data.

"The upside there is they're going to free up more of their resources because the dividend payment goes down then, so that actually frees up more of their earnings to recycle back into small business lending," Merski said. "So the program is actually working as intended."

Merski said the early positive results lead him to believe, however, that the program would have been even more successful if more banks had participated.

Weissman said most of the banks fall into two categories — traditional commercial lenders who anticipated these increases, but still needed the capital, and lenders who used the capital as a way to enter the small business lending market for the first time. The data may be skewed somewhat by these latter banks, which reported some of the largest percentage increases in small business lending, primarily because their balances started at zero.

Still, Treasury said it was still a positive since those companies weren't making any small business loans prior to the program's creation and now are helping smaller firms.

But Chip MacDonald, a partner with the law firm Jones Day in Atlanta, noted that small business lending growth overall has occurred over six quarters, since June 30, 2010, and is not as impressive as it may seem.

"Fast growth also may attract regulatory attention due to concerns about credit quality in light of fast growth," he said.

Weissman said it was also unclear if banks will have an incentive to maintain the levels of growth over the next several years. They only need to achieve and maintain a 10% increase to keep their 1% dividend rate.