-

The OCC's third risk report cited put cybersecurity as the second biggest worry for bankers, right after struggles to maintain revenue.

June 18 -

For years, banks have been seeking to turn a profit on mobile apps. In the latest twist, Regions Bank is rolling out programs that charge fees based on convenience.

June 17 -

Banks are increasing their research and monitoring of third parties as regulators take a closer look at outsourcing.

April 4

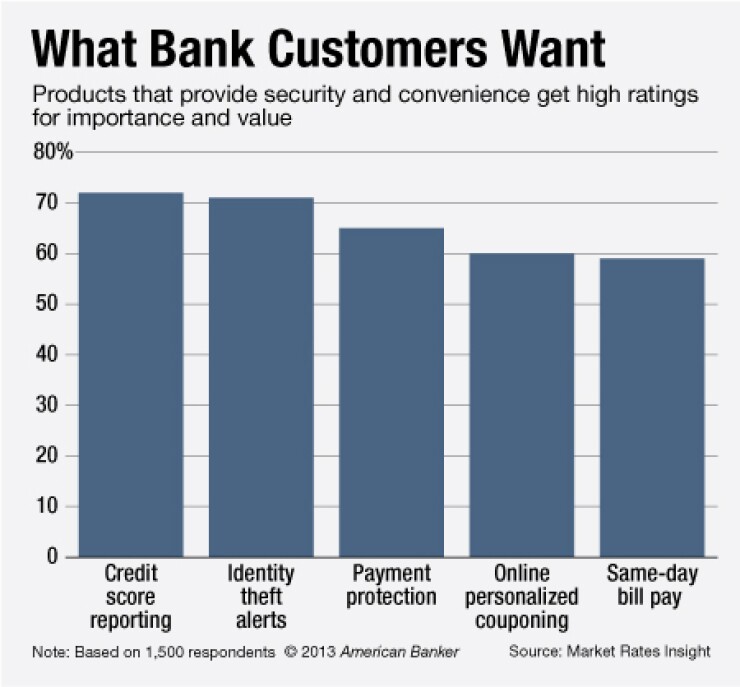

Community banks are leaving money on the table due to an inability or an unwillingness to offer a number of coveted financial products.

Numerous bank customers are clamoring for products such as

"There's definitely an opportunity gap," says Dan Geller, executive vice president of Market Rates Insight. "Banks need to look for ancillary revenue streams and fee income is one way to do it."

Less than 10% of community bank customers use emerging financial services such as prepaid reloadable cards or low balance alerts, though 52% of people surveyed by Market Rates Insight expressed an interest in them. Those customers are also interested in payment protection, where an issuing bank provides protection on credit card payments in instances where a customer is unable to pay due to unforeseen events.

About 75% of community bank customers surveyed by Market Rates Insight were keen on products dealing with

"Cybercrime is one of the fastest-growing crimes in terms of the monetary damage it causes people," Geller says. "It's on people's minds. Community bank customers desire these services and are willing to pay for it."

Providing extra services is another way that a small bank can differentiate from competitors, says Lynn David, president of Community Bank Consulting Services. Still, adding new products could be challenging since most community banks are notoriously slow to embrace change, he says.

"It takes a lot of soul searching before a service gets added," David says. "Many banks don't want to be the beta site. They want something that is totally proven and working for other bankers they know."

It can also become costly to add new technology, says C.R. "Rusty" Cloutier, president and chief executive of MidSouth Bancorp in Lafayette, La. The $1.8 billion-asset company is planning a call center to largely handle evening issues tied to mobile bill payments and online banking. "A smaller bank just cant afford that," Cloutier says.

"I'm not sure I could have afforded that when we were at $1 billion" in assets, Cloutier adds. High-tech products "raise the cost of business but customers want those services and they dont want you to charge them anything for them."

Customers also tend to avoid products if there is a lengthy sign-up process, and services such as identity theft alerts often require participants to provide detailed data, says Trent Fleming at Trent Fleming Consulting. Some banks actually offer free anti-virus software for customers to download but few actually do because of the work required, he says.

"I think customers talk a good game, but I don't see the adoption of some products being high enough to drive the value there," Fleming says. "Customers just want to flip a switch and get something for it."

Small banks must exercise caution when offering identity theft alerts and other products that require outside vendors, David says. A bank has "no control over the customer service of the vendor, and it can end up being a negative reflection on the bank" if the vendor is unresponsive to customer concerns, he says.

Market Rates Insight's study also found that customers are willing to pay more for bundled services, compared to products marketed individually. Still, there were diminishing returns when too many products were bundled together, Geller says.

The best success rate involves bundling two or three products for $8 to $12 a month. Charging a higher rate can backfire because it prompts customers to think about the costs more analytically, Geller says.

When bundling services, community bankers must make sure the fee actually covers the cost of the transactions, industry experts say. Bankers should also consider how products are marketed to consumers, which is an area that larger banks have mastered, Fleming says.

Bankers should also package products in a way that is in line with their bank's strategic plan, David says. For instance, banks that want more electronic banking customers should consider bundling that service with a free-checking account, he says.

Community banks should offer three levels of accounts one that is free if certain criteria are met, another that is interest bearing but requires a minimum balance, and a premium account with a fee that offers several bundled services, Fleming says.

"Bankers have realized they can't give everything away," Fleming says. "It's encouraging that bankers are beginning to entertain the idea of passing along fees to customers."