-

Analysts will also pay close attention to what bankers says about cost cutting and fallout from the fiscal cliff compromise.

January 11 -

Rusty Cloutier, the Lafayette, La., company's CEO, says MidSouth can double in size over the next five years without making another large acquisition.

September 27

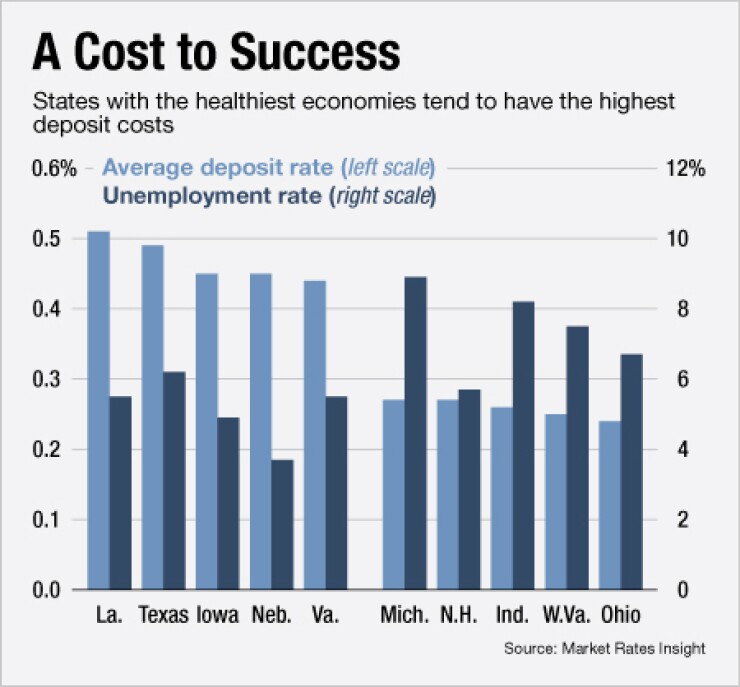

Banks in some states are paying deposit rates that are much higher than the national average, but bankers in those states shouldn't agonize too much about paying up for the funds.

Louisiana, Texas and Virginia are among the states with the highest deposits rates, but they also have relatively healthy economies, says Dan Geller, executive vice president at Market Rates Insight, a firm that provides pricing data and analysis to financial firms.

Banks that are operating in those states should focus on lending "because it's a sign there is an increase in economic activity," Geller says. Those banks must also monitor and stay competitive with deposit pricing "to make sure they are attracting the right amount of liquidity."

In the

Louisiana had the highest average deposit rate in December, at 0.51%, compared to just 0.24% in Ohio, Geller says.

Economic health seems to have a major influence on deposit pricing. Average unemployment was 5.2% in December in the five states — Louisiana, Texas, Iowa, Nebraska and Virginia — with the highest deposit pricing. States with the lowest deposit rates — Ohio, West Virginia, Indiana, Michigan and New Hampshire — had an average unemployment rate of 7.4%.

"There's a link between the highest interest rates paid on deposits and state unemployment," Geller says. "These rates are clearly a reflection of economic activity."

Generally, lower unemployment indicates "higher economic activity" and greater demand for loans, he says. High loan demand often spurs more-competitive pricing for deposits.

Louisiana and Texas, for instance, have enjoyed a surge in economic activity, mainly because of the energy sector.

"We're definitely seeing a lot of growth in" Louisiana and Texas, says Rusty Cloutier, president and chief executive of MidSouth Bancorp (MSL) in Lafayette, La. "We have some areas where unemployment is below 4%."

The $1.9 billion-asset MidSouth has 57 branches in Louisiana and Texas. Oil and chemical companies want to spend $50 billion in the next 18 months in an area stretching from Baton Rouge, La., to Houston, Cloutier says.

MidSouth's deposit rates are less competitive than some of its competitors, Cloutier says. The company has $400 million that it wants to lend after completing five

MidSouth must make $500 million in new loans, or 50% more than what it already has on its books, before it would pay up for deposits. "We're seeing fairly good loan growth and demand," Cloutier says. "But there's a real pressure" on banks to keep deposit rates low.

Regardless, some banks in MidSouth's markets are offering "great deals," such as 1.25% on two-year CDs, Cloutier says.

Ohio has been unable to generate the same kind of economic activity as Louisiana or Texas, says Kevin Jacques, a finance professor at Baldwin Wallace University in Berea, Ohio. The state has growth potential, especially in the energy sector, if the practice of fracking gains popularity, he says.

"This really links finance with the real economy," Jacques says. "You have some parts of the country that are experiencing more rapid economic growth, and in those scenarios there's the need for funding."

To be sure, there are outliers in Geller's data. For instance, New Hampshire has a relatively low unemployment rate, at 5.7%, but the state's 0.27% average deposit rate is among the lowest in the nation.

Other factors, such as the types of industries in a state, the number of small businesses and the level of household income, play a role with deposit rates, industry experts say. The number of banks operating in a state and the degree of competition are also important, says Robert Strong, a finance professor at the University of Maine.

The five states with the highest deposit rates also have roughly 32,000 individuals per bank, which includes customers and their families, Strong says. That compares to 49,000 at the states with the lowest deposit rates.

"Some banks don't have to offer as high as rates because customers don't have as many choices," Strong says. "While employment is a factor, I suspect another one is the choices consumers have available."

Rates on deposits have mostly leveled off in recent months, though pricing for long-term CDs has continued to decline slightly, Geller says.

Deposit rates should remain low through this year because there is more than enough liquidity in the banking system, industry experts say. The future of deposit rates will depend on how the Federal Reserve Board handles interest rates.