-

Smaller banks are beginning to see more revenue from service charges as they experiment with new fees and products.

February 5 -

To avoid a monthly fee, bank customers must maintain an average balance of $723 in their non-interest checking accounts, up 23% from 2011 and the highest balance in 15 years, according to a survey.

September 24

Checking-account holders are generally ignorant of how much it costs banks to service their accounts, and most say they would likely switch banks in response to a $5 monthly fee increase, according to a new survey of U.S. customers.

The findings, compiled in a report by the Deloitte Center for Financial Services, suggest that banks face an uphill fight as they seek to recoup fee revenue lost as a result of new regulations.

The survey finds that 75% of customers believe it costs their bank less than $11 per month to service their checking accounts - when the actual figure is more than $20. Moreover, when customers are asked whether a $5 monthly fee increase would cause them to switch banks, 58% say they probably would or definitely would.

While the report notes that customers may be less likely to switch banks than they claim, due to the costs and hassles involved, it also argues that defection is a significant threat.

One problem is that depositors don't really understand what banks are providing them, says Jim Eckenrode, executive director of the Deloitte Center for Financial Services.

"And so when you charge them zero for a long period of time, they sort of develop this idea that if you're not charging me for it, it must not be worth much," he adds.

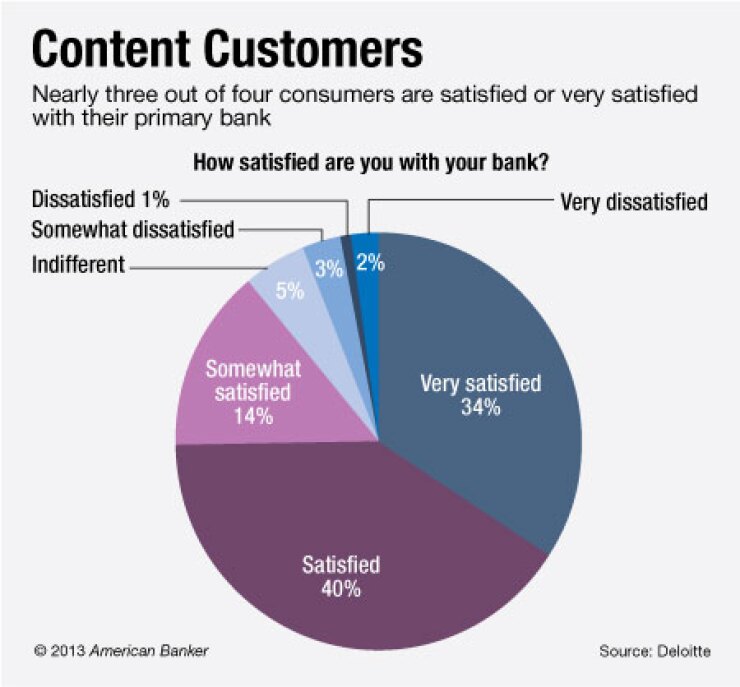

The report, which is based on a survey of more than 4,200 checking account customers, does contain some findings that will cheer bankers. For example, it states that 74% of customers are either satisfied or very satisfied with their primary bank.

But the report's main message is that the days of free checking are on the wane, and that banks need to become savvier about how to compete in the new environment.

As regulators have made it harder for banks to earn money from overdraft fees and debit card swipe fees, and interest margins have narrowed, more customers are paying for their checking accounts. Only 39% of interest-free checking accounts are available for free, down from 76% in 2009, according to a

The Deloitte report argues that banks should avoid raising their prices broadly, and indeed,

Instead, banks should target specific offers at specific customers, based on not only demographic characteristics but also certain psychological traits related to their attitudes about banks and their willingness to pay for services, the report argues.

"It isn't one-size-fits-all anymore," Eckenrode says. For example, the survey's respondents were split over the kind of pricing model they would prefer in exchange for reduced fees. The options included a digital banking plan, a $5,000 minimum balance, and a two-year contract.

Banks are already trying various pricing schemes, but they are not experimenting as scientifically as they should, according to Eckenrode. He points to the credit-card industry, which sends multiple offers to specific groups of customers and then gauges response rates in order to better target their marketing efforts, as a model that retail banks should follow.

The study's authors also conclude that banks should strive for transparency in their pricing.

According to the survey, 48% of checking account customers say that if they had to choose between different prices models, they would prefer to pay a flat fee of 25 cents to 75 cents per transaction. That compares to 21% who would prefer to pay a flat monthly fee of $15 to $30.