-

Despite companies' strong performance in the Federal Reserve capital simulations mandated by the Dodd-Frank Act, stress tests for the largest banks have really only just begun.

March 7 -

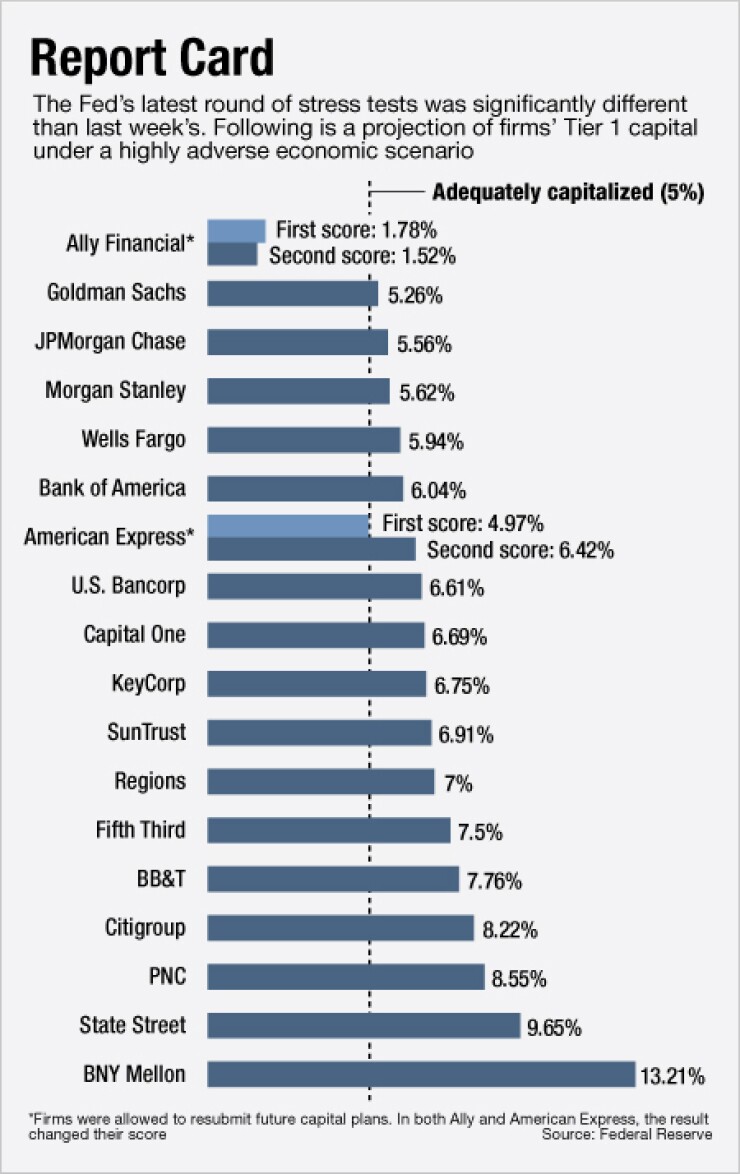

The biggest financial companies received their first official report cards of Dodd-Frank stress tests on Thursday, with Bank of New York leading the pack while Ally Financial fell far behind.

March 7 -

The Federal Reserve Board on Thursday gave the 19 largest financial institutions the economic variables that will be used to assess a firm's capital strength and resiliency to withstand an economic crisis.

November 15 -

Federal Reserve Board Gov. Daniel Tarullo is set to meet Wednesday in New York with the top executives of several large banks, including JPM Chase's Jamie Dimon. The meeting will focus on the central bank's recent stress tests, among other things.

May 1 -

Certain large banks emerged as stalwarts among their competitors following severe tests by the Federal Reserve Board. Others, such as Citigroup Inc. and Ally Financial, fared less well.

March 13

WASHINGTON — The Federal Reserve Board said Thursday it would approve the capital plans of 16 of the 18 largest banks, rejecting proposals put forward by Ally Financial and BB&T.

In its third round of stress tests, the central bank also asked JPMorgan Chase and Goldman Sachs to take a second look at their capital plans, citing weaknesses, but it gave them conditional approvals to move forward.

The Fed released the stress test results of the 18 largest banks from its yearly comprehensive capital analysis review, or CCAR, which is meant to test the strength of a firm's capital against "severely adverse" economic conditions.

Only one firm's capital was projected to fall below 5% -- the minimum to be considered "adequately capitalized" — in an adverse economic scenario while four banks hovered between that floor and 6% of Tier 1 capital, the threshold for "well-capitalized."

Ally Financial received the lowest score, projected to hold just 1.52% of Tier 1 capital under severe stress. Goldman Sachs was projected to hold just 5.26% in such a scenario, while JPMorgan held 5.56%. Morgan Stanley and Wells Fargo held 5.62% and 5.94%, respectively.

(The full results of the test can be found in the graphic at upper right.)

Although BB&T was well above the Fed's capital minimum, its capital plan was rejected on "qualitative grounds," the central bank said. On a conference call with reporters, a senior Fed official declined to go into specific details about supervisor's objections. Ally's plan was also rejected because it fell below the 5% regulatory capital minimum.

In a statement, BB&T said the Fed's objections to its capital plan were unrelated to the firm's "capital strength, earnings power or financial condition." The bank said it intends on resubmitting its capital plan as soon as possible and expects its new plan to address the Fed's objections.

In a statement, Ally said it "continues to disagree" with the Fed's review of the bank's capital strength under a stress. The bank said it would like further insight into the central bank's assumptions and modeled results like loss rates on Ally's commercial and industrial loans, particularly dealer floorplan lending.

Ally was the only bank to effectively fail both of the Fed's stress tests. Last week's tests, mandated by Dodd-Frank, were different mainly because they did not include banks' planned capital distributions. Ally received the lowest capital projection on those tests as well, and was predicted to hold just 1.5% in Tier 1 capital under an adverse economic scenario.

JPMorgan and Goldman, meanwhile, were asked by the Fed to submit new capital plans by the end of the third quarter "to address weaknesses in their capital planning processes." Their plans, at least for now, have not been rejected, and the firms are allowed to proceed with their capital distributions to shareholders.

JPMorgan's chief executive Jamie Dimon said the firm "is fully committed to meeting all of the Fed's requirements." The Fed, he said, plans to increase the bank's dividend back to its highest level in the second quarter and to continue its equity buyback program.

The senior Fed official explained on the call that there were certain deficiencies in both JPMorgan's and Goldman's capital planning process that were significant enough that supervisors felt the two institutions needed to start immediately to fix the problem. In the past, the Fed has allowed banks to have more time to bolster their planning processes until the next round of stress testing.

Without getting into specifics, the Fed official said the deficiencies in either of the firm's capital plan did not strike at the heart of the stress test results, but it was enough to make supervisors wary about the reliability of the firm's planning process given what their projected losses of revenue would be under stress.

It marked the first time in the three years that the Fed has been conducting its stress testing that it has approved a bank's capital plan on a conditional basis.

Among the firms whose capital plans were approved by the Fed included: Citigroup Inc., Morgan Stanley, and Bank of America Corp.

Citigroup Inc., which failed the tests last year, improved its capital ratio to 8.22% in the latest round. The firm plans to issue $1.2 billion common stock in a buyback program through the first quarter of 2014 and keep its current common stock dividend of $0.01 per share per quarter.

"Over the past several years, we have rebuilt Citi's capital base and strengthened our balance sheet as well as shed assets and businesses not core to our strategy," said Michael Corbat, Citi's chief executive, in a statement.

Bank of New York Mellon Corp., State Street Corp., and PNC Financial Services Group Inc., each had the highest capital ratios at 13.2%, 9.65% and 8.55%, respectively.

Since the start of the government stress test in 2009, U.S. banks have greatly improved the amount of capital they hold. Cumulatively, firms have increased the amount of Tier 1 common equity to $792 billion in the fourth quarter of 2012 from $393 billion at the end of 2008.

Banks' stronger capital positions are largely due to the substantially lower capital distribution firms have made since the crisis.

Unlike previous rounds, banks were permitted to make adjustments to their initial capital plans submitted in January to the Fed in order to surpass the minimum regulatory capital thresholds.

Only Ally and American Express Co. requested a downward revision in their capital plans. In the case of Ally, the change did not help it, instead lowering its projected Tier 1 common equity ratio from 1.78% to 1.52%. In contrast, American Express' change helped to lift its capital ratio to 6.42% from 4.97%.