-

I myself am a HMDA wonk, but one with a rather love-hate relationship to the numbers. I love what they reveal, but hate the headaches that come from wrestling with data.

February 20 -

Banks are looking at a regulatory plan to dramatically expand the data collected on mortgages as a potential ally in their battle to ease separate rules that they say will curb access to credit.

February 7 -

The Consumer Financial Protection Bureau penalized two nonbank mortgage lenders on Wednesday for incorrectly reporting data to regulators in a move certain to draw significant attention from the rest of the industry.

October 9

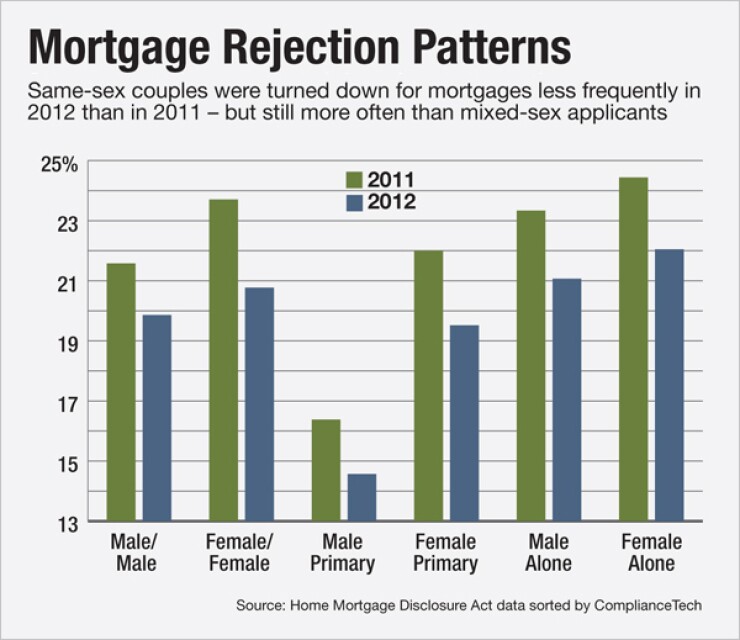

Among Home Mortgage Disclosure Act wonks (there are more of us than you think), all eyes were on a recent kerfuffle between Fannie Mae and the Mortgage Bankers Association over loan denials to African-Americans. But what caught the eye of this HMDA geek was another set of figures much less frequently looked at than denials to minorities: denials to same sex-couples.

These were down in all categories in 2012, for male and female same-sex borrowers, but still higher than denials for mixed-sex couples having a male as the primary applicant.

Higher-priced lending to same-sex couples also dropped in all categories but one in 2012 compared to 2011.

Looking at analyses done by the Federal Reserve and by ComplianceTech, which has a HMDA analysis program called LendingPatterns, denial rates for same-sex couples applying for mortgages in 2012 were lower than denials for one-person applicants of either gender. (Having two incomes versus one might explain this.)

Compared to mixed-gender applicants, though, same-sex couples did not do as well, although two-male couples were denied at about the same rate as mixed-gender couples where a woman was the primary applicant.

The Fed report shows denials increased for most categories between 2011 and 2012, while the ComplianceTech report, which includes all conforming and jumbo loans, showed all categories with a smaller percentage of denials.

Definitively extrapolating trends for gay and lesbian loan denials from HMDA data is impossible, since lenders do not survey for sexual orientation for their annual HMDA reports. Same-sex couples are not necessarily gay or lesbian; two male relatives could buy a home, for instance, or two women business partners looking for an investment could get a loan. LGBT (lesbian, gay, bisexual and transgender) applicants certainly can obtain home loans and be counted in the single-borrower categories as well.

But the figures are intriguing.

Denials of same-sex couple applicants were down in 2012 versus the year before in conventional (Fannie Mae, Freddie Mac and jumbo) home purchase and refinancing, and in nonconventional (FHA-, VA- and USDA-guaranteed) purchase and refinancing as well, according to the Fed. In some cases, especially on refis, they were down significantly.

For conventional refis, the denial rate dropped from 24.5% to 21.7% for male same-sex couples and from 24% to 20% for female couples.

On the nonconventional side, the drops were even greater. Male couples were denied in 31% of refi apps in 2011, but just 22% in 2012. Female couples saw denial rates drop from 33.3% to 21.7%.

For conventional purchase mortgages, denials were down for both male and female couples, though not as much as on the nonconventional side. Two-male couples saw 17.2% denials in 2012, 150 basis points better than in 2011. Two-female couples dropped to 16.2%, from 18.5% in 2011.

There is, no doubt, prejudice against LGBT applicants. But there's not a lot of data to show how much.

"We've never studied it. It has never come up for any of our clients," says Michael Taliefero, managing director of ComplianceTech, a fair lending software vendor and consultant in Arlington Va., that specializes in HMDA analysis and supplied me with several custom tables of HMDA data for this column.

Lisa Rice, vice president of the National Fair Housing Alliance, notes that sexual orientation is not a protected class under the Fair Housing Act or the Equal Credit Opportunity Act. (Some states and municipalities have banned LGBT discrimination on their own.)

"We're trying to get the law expanded," she says, to ban discrimination on the basis of sexual orientation or against veterans. "It's been a very long campaign for us to get it done."

LGBT discrimination cases can be brought on the basis of gender, she says. The Department of Housing and Urban Development has stipulated by rule there can be no discrimination on the basis of sexual orientation in HUD-funded facilities or for government-insured mortgages.

HUD has charged and settled its first case under its Equal Access rule, alleging LGBT mortgage discrimination at Bank of America. The bank agreed to pay $7,500.

The agency last year released its first study on same-sex housing discrimination, in the rental market rather than the mortgage side. It found that "same-sex couples experience unequal treatment more often than heterosexual couples when responding to Internet ads for rental units, and findings show that gay male couples experience more discrimination than lesbian couples." Discrimination was shown in every metropolitan area it studied.

Rice wonders if the drop in denials to same-sex applicants has any correlation to the increasing number of states that have approved marriage equality.

"People may feel more comfortable applying for a mortgage now" in those states, she says, generating a larger number of qualified candidates.

Same-sex couples make up only a small percentage of total borrowers, and that can skew percentage changes. According to ComplianceTech, there were about 92,000 mortgages made to male couples in 2012, and 82,000 to female couples, out of a total of 9.8 million loans. That's a little less than 2% of all mortgages.

There were about 320,000 applications made by same-sex couples that year, according to ComplianceTech. More than 62% of male and female couples' apps were funded. That is better than the male-alone or female-alone categories, and it matches the mixed-couple "female primary" category. Both same-sex categories are considerably below the mixed-couple "male primary" category, which saw more than 69% of loans originated.

Denials are not the only way mortgages are not funded. There is also what ComplianceTech calls the fallout category, meaning applications withdrawn or incomplete. Male couples had a 17.5% fallout rate in 2012, while female couples had 17%. Again, these were better than fallout percentages for single borrower applications, and about the same as female primary, but considerably higher than the male primary category.

For incidences of higher-priced lending (defined as 150 basis points above the average), the only category where same-sex couples did worse in 2012 was in female-couple nonconventional home purchase lending. That category saw an eight basis point increase to 3.33%. All other categories fell for women, and all categories fell for men.

ComplianceTech did a sort for the total universe (including jumbo loans) of male versus female denials (applications with at least one male versus one or more females and no male) and the difference is significant: Females were denied at a rate of 22% for 2012 while males were denied at 17.5%.

Does that indicate discrimination? And what about that figure of less than 2% of mortgages going to same-sex couplesis that simply reflective of their percentage in the population?

My colleague Victoria Finkle has done an excellent job of sorting out the debate over access to credit by minorities as revealed (or not revealed) by HMDA data. That is an important discussion. Gender questions, whether they involve same sex couples or not, could use a thorough airing out as well, and I welcome any reflections on this in the comments box below.

Mark Fogarty, Editor at Large at National Mortgage News, writes analysis and commentary based on his 30 years covering the mortgage industry.