-

Loan demand seems to be returning, but not fast enough for many bankers and their investors. Bankers discuss the various things holding back a return to blow-out quarters of loan growth.

June 10 -

The housing market is unseasonably weak due to consumers' worries about an economic slowdown and a decline in overall household income, according to a Fannie Mae survey.

June 9 -

JPMorgan Chase and Wells Fargo are retaining more high-quality, conforming mortgages that they would normally sell to Fannie Mae or Freddie Mac, raising concerns that the banks are adversely selecting the weakest loans for the government-sponsored enterprises.

May 22

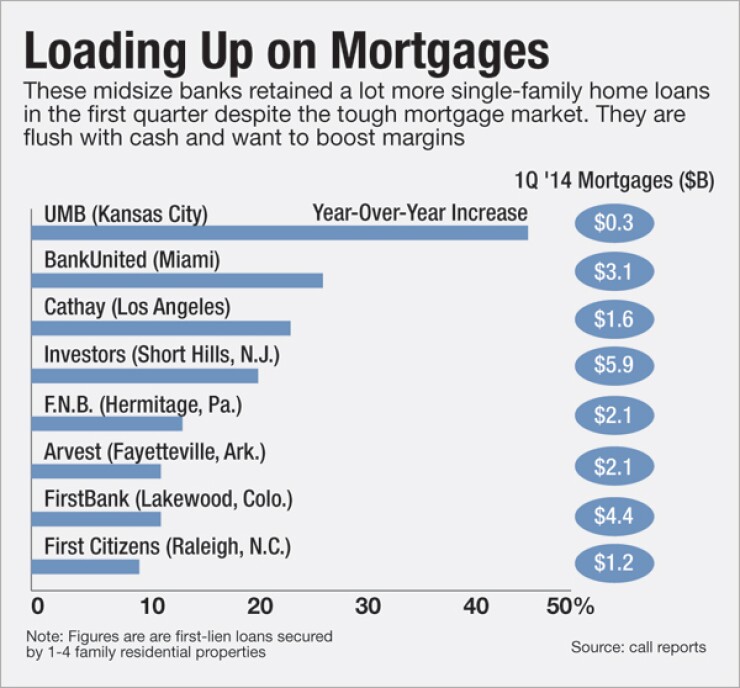

A number of banks have shifted strategy when it comes to the mortgages they originate. Instead of selling the loans to Fannie Mae or Freddie Mac, many have decided to instead hold them as investments.

The decision helps banks juice their overall loan growth at a time when

Most of the banks that are taking the new approach fall in the category of regional banks or larger community banks, typically with assets between $10 billion and $25 billion. They include the $16 billion-asset UMB Financial (UMBF) in Kansas City, Mo., and the $11 billion-asset Cathay General Bancorp (CATY) in Los Angeles.

Motivations vary by bank. But for the most part, today's mortgages are high-quality assets that offer an appealing investment alternative to securities that produce minuscule yields.

"Mortgages are a much more comfortable thing to own," says Chris Marinac, an analyst at FIG Partners.

Many banks in this asset class have also had higher rates of deposit growth than the industry average, he says. So they have lots of cash that needs to be deployed.

"They need to put the money to work," Marinac says. "Otherwise they've got cash sitting in [Federal Reserve} funds at 25 basis points, and that's killing them."

The switch does carry some interest-rate risk, which is why many regionals and community banks have steered clear of retaining mortgages, says David Baker, the president of FirstBank, in Lakewood, Colo.

But the risk is mitigated by the types of mortgages that the $14 billion-asset FirstBank is retaining, Baker says.

"We're not putting 30-year fixed [mortgages] on the books," Baker says.

Instead, FirstBank is largely retaining 5/1 or 7/1 adjustable-rate mortgages, or 15-year fixed mortgages, he says. FirstBank also originates and retains some jumbo mortgages.

"The loss ratios have been very low for us, he says. "We've always had very few foreclosures."

Plus, "we like having mortgages as an asset" because many of them brought new customers to the bank, Baker says.

FirstBank's mortgage holdings rose 12% in the first quarter from a year earlier.

Other banks have different approaches. BankUnited (BKU), a $16 billion-asset company in Miami, is increasing mortgages held for investment, but the majority are loans that it has purchased, not originated, Chief Operating Officer Raj Singh says.

Instead of placing its investments in securities that produce tiny yields, BankUnited decided instead to purchase mortgages as investments. It has the liquidity to pursue that strategy, he says.

"Most banks don't have the tons of cash and liquidity that we have," Singh says.

Most of the mortgages BankUnited has purchased are jumbos, and also include 5/1 and 7/1 ARMs, Singh says.

"These are longer-duration assets, but we manage interest rate risk to neutral as closely as humanly possible," he says.

BankUnited's mortgages held for investment increased by 27% in the first quarter compared with a year earlier.

JPMorgan Chase (JPM) and Wells Fargo (WFC) have been

But JPMorgan and Wells are also retaining more mortgages as a way to avoid the fees assessed when the loans are sold to Fannie or Freddie.

Banks of all shapes and sizes get another primary benefit of retaining more mortgages, in that it helps counter compression of their profit margins, Marinac says.

"One of the ways banks can fight margin pressure is to change the earnings-asset mix, and if you have higher-yielding loans, that helps keep the decline in margins abated," he says.