-

Bigger banks have shifted their efforts to deposit growth in advance of proposed liquidity rules. As a result, community banks are seeing more opportunities to lend, particularly in commercial lines that were once the domain of larger lenders.

April 24 -

With rock-bottom interest rates expected to begin rising soon, regulators and industry representatives are increasingly concerned about institutions' ability to weather a boomerang effect on their funding costs.

January 5

The community banking model is supposed to be simple: take deposits, make loans. There is, however, a growing number of banks that are largely omitting the lending part of the model.

As loan yields get tighter and key mortgage rules remain unclear, more community banks are reducing their lending and investing more in securities portfolios. These loan-averse lenders are following a conservative strategy that a subset of banks have been using for years, a strategy where lending plays a minimal role.

Some of those banks, including Bank of Utica (BKUT) in upstate New York and Union County Savings Bank in Elizabeth, N.J., have been consistently profitable despite having very low loan-to-deposit ratios. Each has had just one year of losses in over two decades, a successful run that came by following a model of investing deposits rather than lending them out.

Such banks have their critics. Regulators often discourage such practices, while community advocates argue that small banks are supposed to serve their communities primarily by making loans. Other critics deride banks with low loan-to-deposit ratios as little more than federally insured investment funds.

They're "subsidized hedge funds," says bank consultant Michael Iannaccone of MDI Investments, adding that the strategy is an unfortunate, if sensible, reaction to the burdens placed on banks after the last recession.

"The strategy makes sense as a response to the financial crisis and regulatory burden," Iannaccone says. "But the only way that an economy gets better is if the community banks in those markets lend."

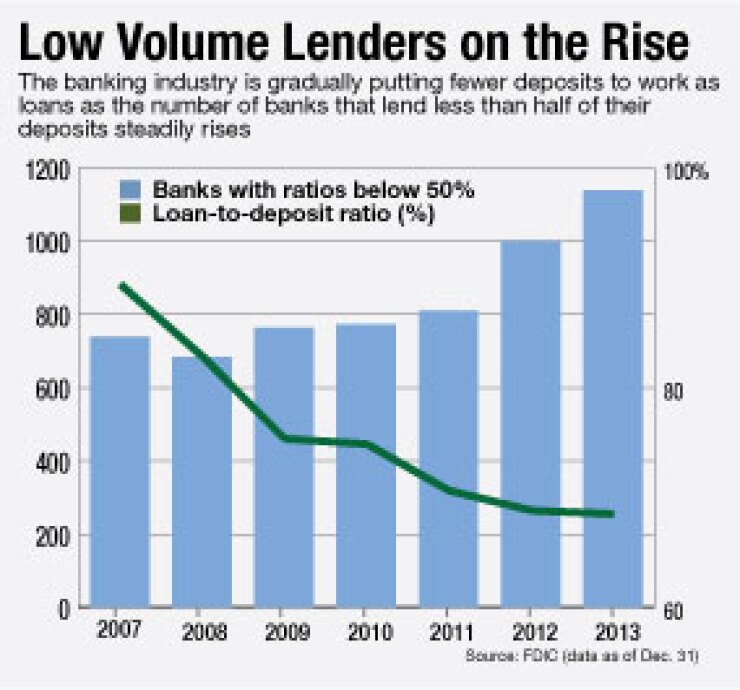

Banks of all sizes have tightened standards and expanded their securities portfolios since the recession. The average loan-to-deposit ratio for institutions insured by the Federal Deposit Insurance Corp. has fallen from 89.43% at the end of 2007 to 68.2% at March 31 of this year. The number of banks that lend out less than half their deposits has grown 53% over the same period, to 1,134.

There are also more than 100 banks that reinvest less than 20% of their deposits in loans. Some belong to insurers or asset managers. A few are smaller banks that one would expect to lend.

Defenders argue that most traditional community banks would prefer to lend rather than shift to securities, but have been boxed in by increased regulation and the weak economy.

"They've more or less been forced to do this by overregulation," says James Kendrick, vice president of accounting and capital policy at the Independent Community Bankers of America. "Examiners are very cautious when looking at loan patterns of community banks, and loan demand has been weak. They want to be lending [and] growing, but they've been hit so hard."

Executives at many smaller banks with low loan-to-deposit ratios declined to publicly discuss their strategies, though several said they would prefer to reinvest deposits in their communities but couldn't find safe loans to make. For these banks, holding securities is preferable to stockpiling cash, but is not a long-term strategy for generating good yields.

Other community banks preferred securities over loans well before the crisis. The most successful of these banks usually have very low overhead, since they require few lenders or underwriters, and consistent returns.

The $969 million-asset Bank of Utica is one of the most successful; its stock has nearly doubled since it began trading in 2009. With one branch and 38 employees, it had a 28.26% efficiency ratio last year, compared to a 70.52% average for all community banks, according to the FDIC.

Bank of Utica has one of the industry's lowest loan-to-deposit ratios, at 6.34%. The family run bank earned $2.2 million in the first quarter and $15.1 million last year, almost entirely by investing in low-risk, short-term securities. Its $900 million securities portfolio accounted for 91% of its interest income in the first quarter.

Union County Savings has found consistent success with a similar strategy. The $1.7 billion-asset bank has a $1.2 billion securities portfolio, just $103 million in loans and a 7.1% loan-to-deposit ratio. It earned $2.3 million last quarter and $9.1 million in 2013, with a 38.11% efficiency ratio.

Other banks have large securities portfolios designed to keep their balance sheets flexible. Roselle Savings Bank in New Jersey has $410 million in assets, $300 million in securities, and a 21.1% loan-to-deposit ratio.

"The bank isn't doing it primarily to make money, but it is a way of keeping a nice even flow of income while managing our risk," says Andriette Mathews, Roselle Savings' chief financial officer. "The logic of the strategy is that having a concentration in securities gives us the flexibility to model our balance sheet as we need it to respond to shifts in the economy."

Roselle Savings has been profitable since 2009, earning $1.1 million in 2013 and $302,000 in the first quarter. Securities accounted for 71% of its interest income.

While securities-focused banks have performed well since the financial crisis, the road is becoming rockier, industry experts say. Yields have been pinched by low interest rates, and an eventual rise in rates may make portfolios skewed toward longer-term securities riskier.

Complying with the Community Reinvestment Act is another concern for banks with low loan-to-deposit ratios, lawyers say. Banks can buy CRA-compliant securities, but some, including Union County, have had issues. Bank of Utica and Roselle Savings passed their latest CRA exams.

Regulators have also been paying close attention to the interest rate risk in securities portfolios.

"It is becoming more challenging for these banks," says Chet Fenimore, a lawyer at Fenimore, Kay, Harrison & Ford. "Regulators are focused on interest rate risk, and in those models there's a lot more interest rate risk than if you had a model that involved more lending. It's true for all banks, but there are heightened concerns for banks that have low loan-to-deposit ratios."

Banks can't be forced to lend, but the FDIC has in some cases taken steps to force banks to abandon investment-heavy strategies. The agency did not respond to questions about its policies toward such banks.

Frontier State Bank in Oklahoma City overhauled its business model due to FDIC pressure. The agency successfully argued that the bank's strategy of investing heavily in collateralized-mortgage obligations using short-term funding exposed it to too much risk. Frontier State has shifted strategy and has a 92% loan-to-deposit ratio, up from roughly 30% before the FDIC intervened in 2008.

It took

"Legally, the FDIC won the case, but from a financial perspective the bank won," Brown says. "They kept doing what they were doing for five years and by the time the FDIC won the bank had moved on."

Regulators generally frown on extreme strategies like Frontier State's, Brown adds. "I think the regulators don't like any strategy that is viewed as aggressive, be that a 130% loan-to-deposit ratio or a bond bank that is highly leveraged," he says.