-

While banks almost universally offer mobile services, such as smartphone apps or mobile-friendly websites, their customers have been slow to use them, according to an American Banker/SourceMedia Research white paper.

October 29 -

Citigroup has issued a fintech challenge that asks developers to propose banking technologies that interact with the Internet of things and consumers' wearable devices.

September 25

This article is from the annual

Only a handful of banks and credit unions aren't offering mobile banking now. Yet, investment remains a high priority as we move into 2015. Where are today's investment dollars being spent, and what are the investment priorities that we see now?

U.S. banks are juggling many investment priorities, and there's no overwhelming imperative in the next two years. That said, 28% of institutions have declared mobile banking one of their top three priorities.

However, these institutions are planning for short-term projects and then will move on to the next thing: BAI's research into long-term plans finds mobile banking doesn't even make the list.

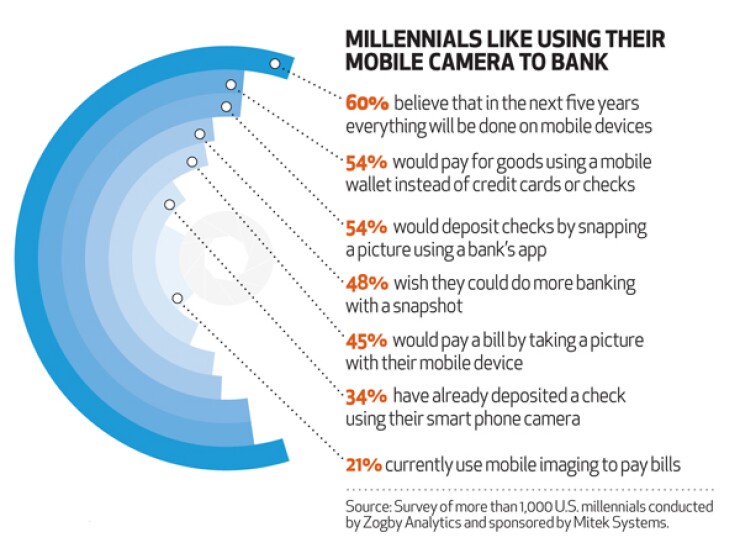

The kinds of near-term enhancements banks are making to their mobile offerings include using the camera for bill-pay and account opening, replacing first generation platforms with those built using responsive design, or decoupling mobile banking enrollment from online banking.

NOT JUST A SMALLER ONLINE BANKING SITE: With this current wave of investment, we will see a greater divergence between mobile and online banking solutions. More of the unique capabilities of mobile devices, such as their built-in picture-taking ability, will be leveraged for banking services. The camera can be used to take a selfie and create a biometric user authentication using retina scanning. The camera is also being used to take pictures of government-issued credentials that can then be compared to databases to verify their authenticity. Both of these capabilities improve user experience and increase the fraud controls banks can access as they roll out more mobile offerings. The camera, geolocation services, and mobile operator subscriber databases are all being leveraged to improve banking services and increase the security of mobile banking. For example, First Bank in Colorado, U.S. Bank, BBVA Compass and City Bank Texas have rolled out mobile photo bill pay. Using the camera, consumers take a photo of the bill and extract biller information automatically to set up the payment information.

RESPONSIVE DESIGN: Another big area of investment in 2015 will be in responsive web design. The first generation of mobile was designed for specific devices and specific screen sizes. Apps were developed for each operating system, and mobile web sites were developed for different screen sizes. This is an expensive approach to maintain and requires new coding as devices evolve. The modern approach is responsive web design, where the code is developed in a way that screens will render according to the device accessing the site. This way, institutions can bring enhancements to market quickly, reduce their coding expense, and support more devices out of the box.

LOCATION-BASED SERVICES: Consumers carry their phones with them, and institutions are experimenting with ways to use that knowledge to offer services and improve customer experience. Using Apple's iBeacons in branches, banks can know which customers have entered the branch and pair that with information about immediately previous digital or phone banking activity to predict the customer's needs. By knowing that a customer has been looking at mortgage rates online, for instance, or has partially completed an application for an IRA, branch staff can make sure the first person the customer interacts with is the person who can answer their questions.

Outside of the branch there are opportunities as well. When customers are in specific locations, for example a car dealership, institutions can present appropriate offers and increase cross-selling effectiveness. Geolocation services can also improve fraud detection and reduce false positives when purchases occur outside of normal locations.

MEETING CUSTOMERS AND PROSPECTS WHERE THEY ARE: Mobile will enable branch staff as well. Employees can attend local fairs or student orientation days. With a tablet they can provide product information, enroll new prospects immediately, and get them set up and trained on online banking. Even in the branch, many banks and credit unions are replacing desktop computers with mobile devices. This creates a more personal experience between staff and customers and is a way of promoting a more progressive bank brand.

THE FUTURE OF MONEY: One of the hard-to-predict mobile trends is with the future of mobile wallets. So far, cards have been hard to dislodge and they remain an effective and simple method at the point of sale. But with Apple's entrance, with MCX coming to market, and with the highly effective packaging of mobile banking and prepaid cards, there will be more consumer adoption of mobile wallets in 2015 and 2016. As consumers replace cards with phones, we'll be able to see what that means for banking, and what future investment will be spurred to ride the next mobile wave.