-

As operating costs rise, a growing number of community banks are following the lead of larger rivals by shuttering branches, though analysts hope the pace of closures will accelerate.

January 30 -

Executives at KeyCorp and Fifth Third Bancorp said they are noticing increased consumer confidence, which would translate into more lending opportunities this year.

January 23 -

Executives at a number of midsize institutions were excited about the prospects of booking more commercial loans in 2014.

January 17

Community banks, coming off a decent quarter in terms of loan growth, should expect marginal improvement in the year ahead.

Aided by increased activity in commercial real estate and more fixed-rate loans, community banks have become more competitive, industry experts say. Still, this additional lending may not lead to big bottom-line gains as banks continue to struggle with low interest rates

"Yields are still below where they were before," says Jeff Davis, a managing director of Mercer Capital's financial institutions group. "There's still an adjustment going on with this lower-yield environment. Banks are swimming harder to stay in place."

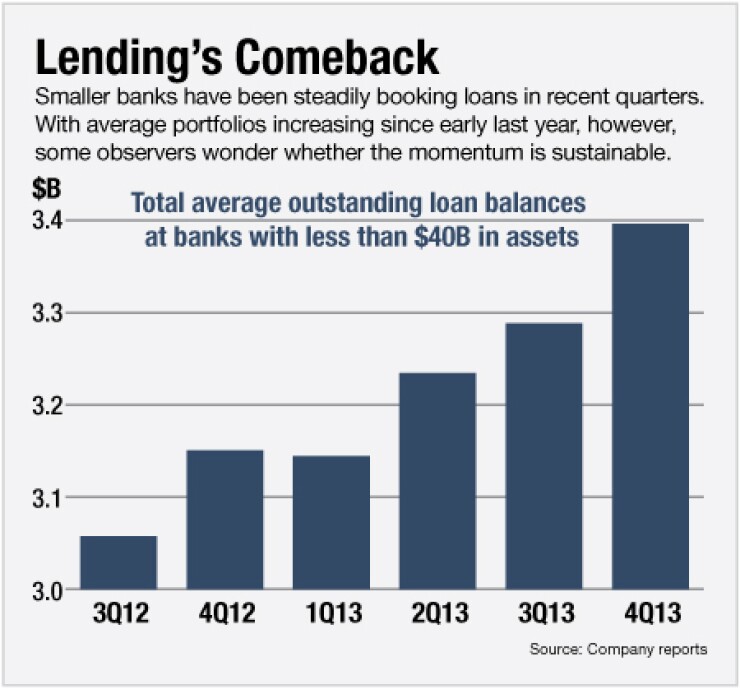

At Dec. 31, total loans at banks with $40 billion or less in assets rose by 3% from the third quarter and 8% from a year earlier, according to preliminary analysis by American Banker.

Loans at small banks should continue to increase, more or less, by 5%, industry experts say. An improving economy should help, and banks are healthier, which should help them lend more, says Jim Adkins, a managing member of Artisan Advisors.

"It's been a slow road but the economic conditions in the U.S. will be better," Adkins says. "Banks have a lot of capital and are under pressure to put it to work."

Banks typically see a yearend lending spike that tapers off in the following year, says Gary Tenner, an analyst at D.A. Davidson. This year, however, it seems as though bankers are slightly more optimistic about their pipelines. "The commentary has been a little more positive in January," he adds.

Zions Bancorp. (ZION) has experienced stability in its loan book so far this year, Doyle Arnold, the Salt Lake City company's vice chairman and chief financial officer, said during a quarterly conference call. Total loans rose by nearly 4% from a year earlier, to $39 billion.

"What's interesting is that the growth in the quarter was not just in the last three or four weeks" like in years past, Arnold said. "It occurred, rather, throughout the quarter with still some noticeable increase in the last few weeks but not nearly as severe. At the same time, we haven't seen the runoff of the spike up in the first quarter so far."

Still, banks are feeling more pressure from investors to make more loans, industry experts say. This has led to longer-term loans, sometimes with five- to 10-year durations, at fixed rates, Davis says. It also means banks are giving up more on terms or structure, Adkins adds.

Such terms could hurt banks' bottom lines. Fourth-quarter net interest income rose just 2% from the third quarter and 4% from a year earlier, based on American Banker analysis. The net interest margin was relatively stable, averaging 3.70% at the 275 banks including in the data.

Smaller banks are looking at new lending areas,

"There's sort of a natural transition since the peak of the economic cycle to where we are now," Tenner says. "There will be a natural loosening of credit standards the further you get from a recession. You've got more banks willing to compete on price."

Still, executives should be wary of interest rate risk, industry experts say. As rates rise, bankers may regret booking some longer-term fixed-rate loans.

Executives at East West Bancorp (EWBC) want to control for interest rate risk while diversifying the Pasadena, Calif., company's balance sheet, Chairman and Chief Executive Dominic Ng said during the company's quarterly conference call. Last year the company benefited from "broad-based" growth in its commercial-and-industrial, commercial real estate and residential loan portfolios, Ng said.

In 2013, total loans at East West increased by 20% from a year earlier, to $18.1 billion. The company has changed its product mix in home mortgages, and management is being careful to avoid longer-term fixed-rate commercial real estate loans, Ng said.

"With our loan growth, with our earnings, with our very efficient operation, we don't think that we need to take the next potential ticking time bomb, which is interest rate risk," Ng said.

Paul Davis Contributed to this story.