-

Utah-based Ally Bank has expanded its use of Fiserv's Popmoney person-to-person payments service. It now lets consumers send and receive funds from within the bank's mobile banking app.

November 26 -

The San Antonio bank and insurance outfit is taking another look at its current support for Windows 7 and possible future Windows 8 app.

March 7 -

Banks like Huntington Bancshares and Mercantile Bank of Michigan have no immediate plans to upgrade to Windows 8 internally, which is a typical stance of businesses toward enterprise upgrades.

October 30 -

Microsoft's new operating system and tablet officially launches today. ING Direct in Canada already has a tablet and desktop banking app for Windows 8; Bank of America and USAA are developing them.

October 26

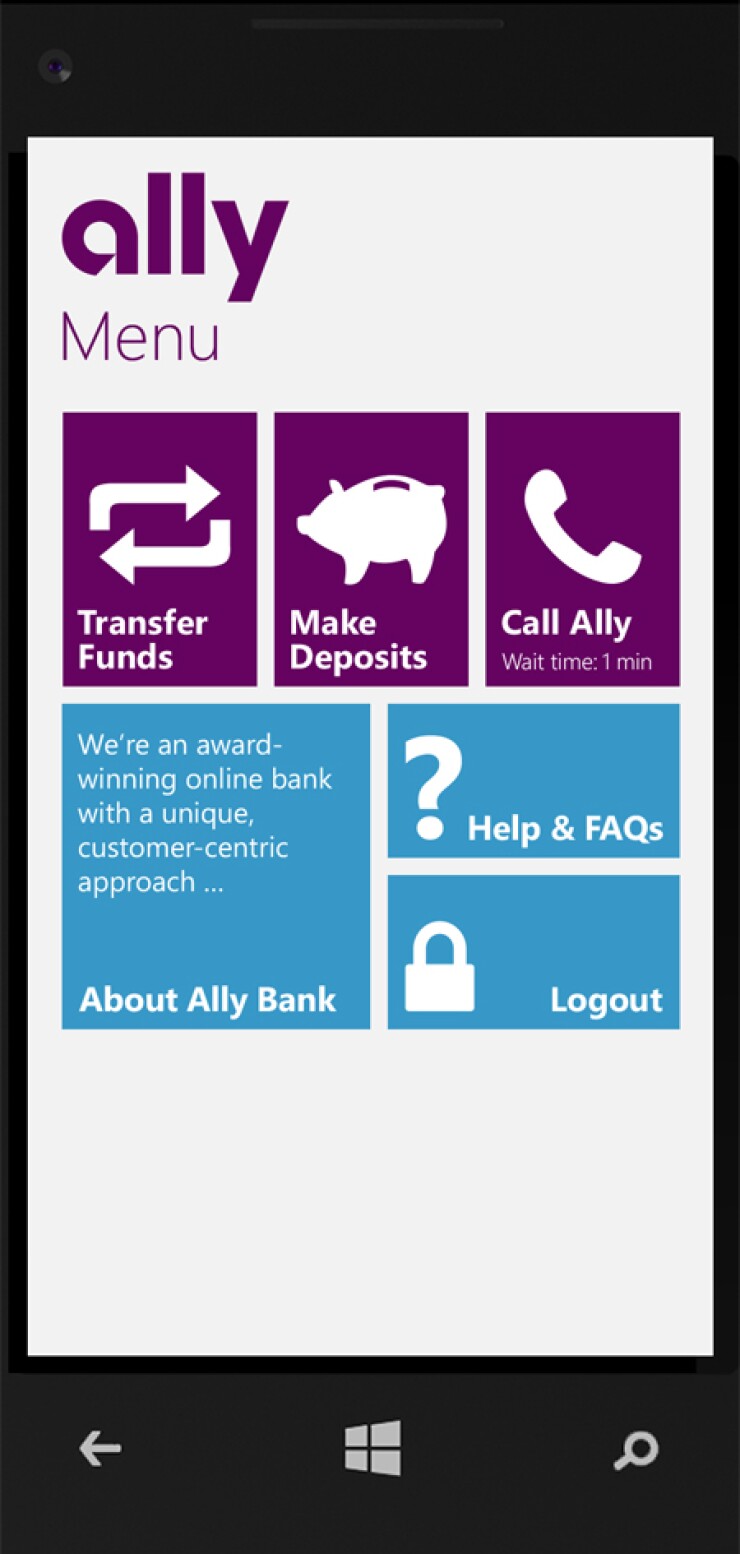

Ally Bank, a mobile banking late bloomer, has created an app for an operating system many financial institutions have yet to embrace: Windows Phone 8.

The direct bank's new app lets customers conduct basic banking activities such as viewing account data, depositing checks, and setting up recurring electronic transfers through the mobile app. Then, in an upgrade expected to be launched later this year, the bank said its app will also offer bill payments and person-to-person payments.

Why put a Windows Phone 8 app out now? "A lot of digital product [development] and strategy is based on what we hear from customers," says Carrie Sumlin, brand and digital deposits executive at Ally Bank. "A Windows Phone 8 request was in the top three. People were saying, 'We want this.'" Customer requests came in through multiple channels, including an app store.

Ally Bank opted to roll out its Windows Phone 8 app in two phases in a bid to quicken the time to market. "We would rather have a shorter development cycle," says Sumlin.

The direct bank first launched apps for iOS and Android devices in 2012. "At that point, we were late to market," she says.

Last year, the bank updated those apps. It also determined its next mobile investment move would be to develop for Windows Phone 8.

Wells Fargo, Bank of America and Chase are among the big banks with apps in Microsoft's Windows Phone store. And most recently,

Most banks continue to wait to create apps for Microsoft's young smartphone operating system, for one reason, because it has yet to capture a large audience in America. The most

Ally Bank, meanwhile, declined to disclose the costs of creating this new app. However, Sumlin says its Windows Phone 8 development "went significantly faster" than its earlier app projects. "We are gaining efficiencies as we continue to build out [mobile]," she says.

The Windows Phone 8 app, however, represents a departure from Ally Bank's earlier design philosophy. In the past, the bank has tried to create the best-looking app without distinguishing the design for varied operating systems, recalls Sumlin. For the Windows Phone 8 app, the bank had a visual designer study the platform's nuances, and in turn, customize the navigation including how the pages scroll for the Windows operating system.

And so far, the extra effort toward user experience seems to be paying off.

"We are pleased with the feedback," Sumlin says.

From the 58 reviews posted as of February 10, the bank had earned

Mobile user ratings are not a new pressure for Ally Bank. The bank also lets people rate products through its website in addition to soliciting direct user feedback all of which matters. "We don't weigh the app store rating more or less than we weigh the voice of the customer that doesn't get rated," she says.

Ally Bank, like some banks across the country, has noticed a positive trend in digital banking: mobile customers are adding to digital interactions rather than cannibalizing online banking usage.

Still, the bank has yet to experience a shift among its customers toward wanting to

Ally Bank is monitoring the adoption of the Windows 8 tablet, meanwhile, to see when to support the device.