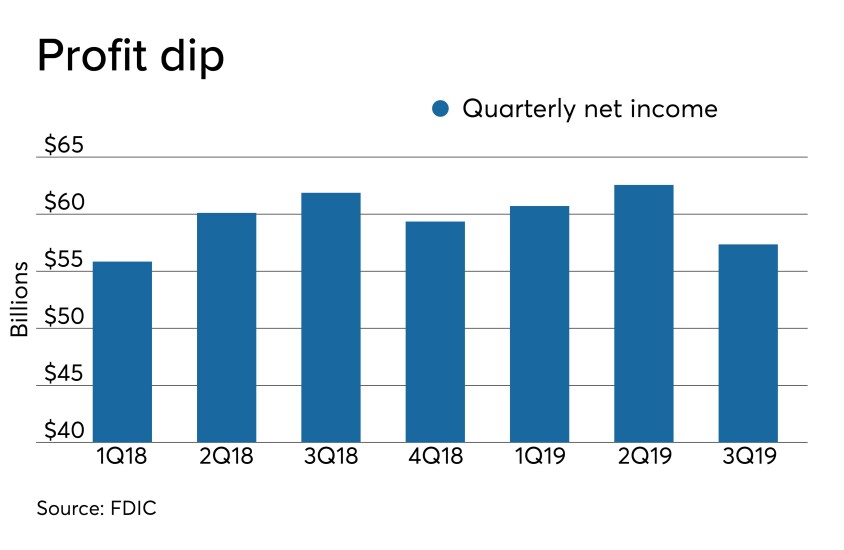

WASHINGTON — The banking industry earned just over $57 billion in the third quarter, as 62% of institutions had higher net income than a year earlier and operating revenue rose 2.2%.

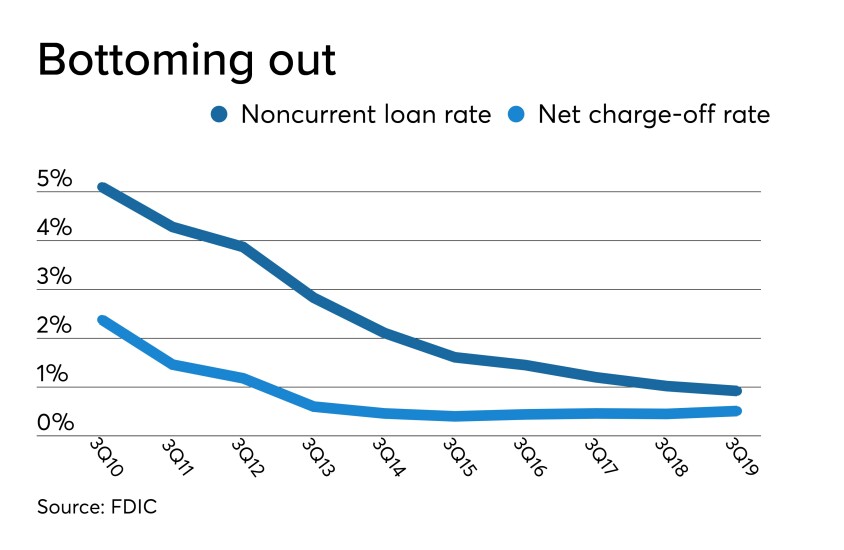

The Federal Deposit Insurance Corp.’s Quarterly Banking Profile portrayed a healthy sector, with a growing loan book and a declining rate of noncurrent loans.

Yet net income was down from the previous quarter for the time since late 2018, and was also slightly down from a year earlier. Total industry profits were held back by what the FDIC called “nonrecurring events” at three large banks, leading to securities losses and litigation costs and helping to boost noninterest expenses.

Meanwhile, the credit-quality picture is hazy as the net charge-off rate increased slightly and the dollar increase in net charge-offs was the highest since 2010.

Here are takeaways from the FDIC’s third-quarter report.