Truist unveils logo that emphasizes high-touch, high-tech focus

(Full story

Wells Fargo loses another patent lawsuit to USAA

(Full story

'Extraordinarily inefficient': Scharf's blunt assessment of Wells Fargo

(Full story

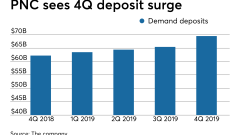

PNC learns the downside of paying cash bonuses to new customers

(Full story

10 fintech forecasts for the '20s

(Full story

Inside Union Bank's development of a new core system

(Full story

Visa's $5 billion Plaid deal takes a possible rival off the table

(Full story

Can California's mini-CFPB pick up slack left by federal agency?

(Full story

What the Visa-Plaid merger means for banks, fintechs

(Full story

Regulators aren't only ones at odds over CRA reform

(Full story