Firm advising GSE investors updates plan to end conservatorships

(Full story

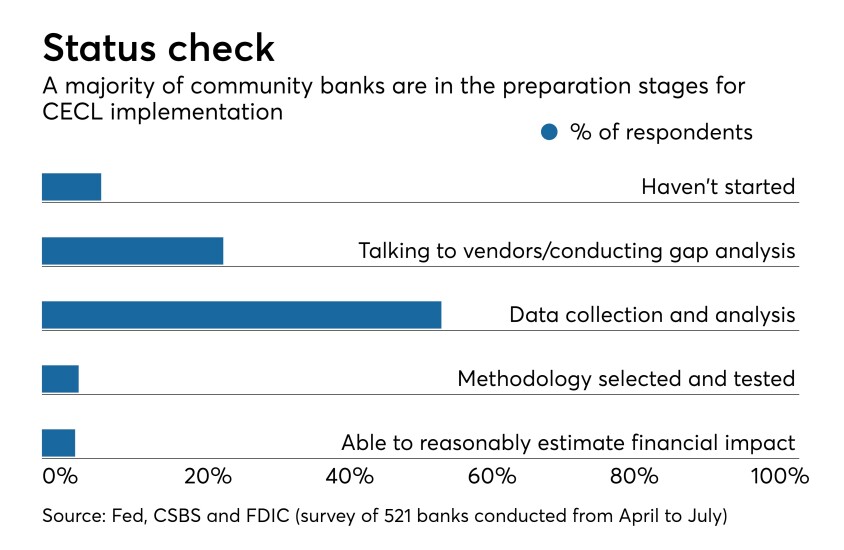

Proposed eleventh-hour change to CECL has bankers scrambling

(Full story

Wells Fargo layoffs begin with 1,000 mortgage, tech jobs

(Full story

Payday lender's emails tell a different story on Choke Point

(Full story

Security risk in cardless ATMs? The customer

(Full story

CFPB walks tightrope in effort to define 'abusive' practices

(Full story

HarborOne in Mass. hires former Santander exec to run retail banking

(Full story

Blockchain slashes approval time on syndicated loans, BBVA says

(Full story

'I lost my home because of a computer glitch': Wells Fargo victims seek answers

(Full story

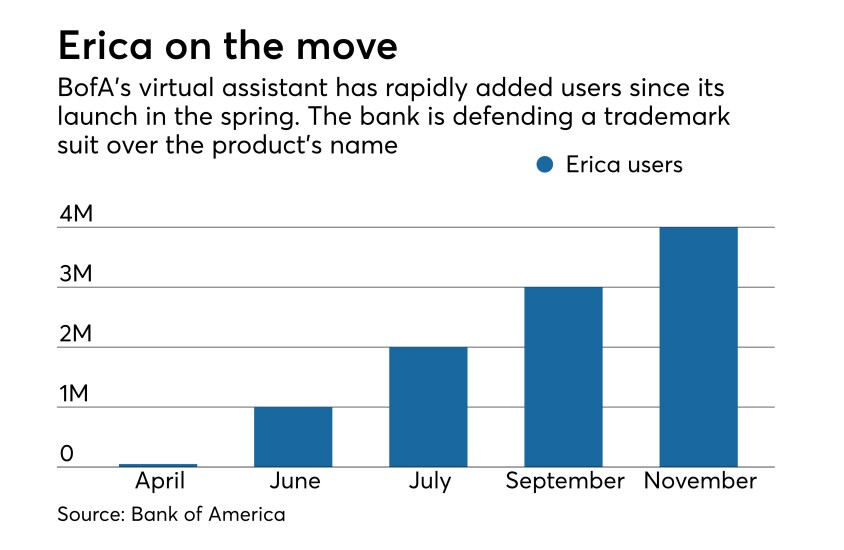

BofA faces lawsuit over use of the name Erica

(Full story