Lagging stock prices are keeping some potential bank acquirers on the sidelines.

While bank stocks generally performed well last year — the KBW Nasdaq Bank Index rose by nearly 10% — not all lenders participated in the upswing. That has complicated the merger math for many of those banks, forcing them to look at other ways to bolster earnings or deploy excess capital.

As much as a fifth of U.S. banks trade at lower multiples to peers and, as a result, could struggle to make a deal happen, said Gordon McGuire, an analyst at Stephens.

Howard Bancorp in Baltimore, First Western Financial in Denver and Synovus Financial in Columbus, Ga., are among the banks that are focusing internally while their stock valuations make it trickier to pursue deals. The key for those banks is to keep discussions going in hopes that their prices will recover in time to make something work.

"There aren't any present plans today to do anything like an acquisition given where the currency is," Mary Ann Scully, Howard's CEO, said during the $2.4 billion-asset company's quarterly earnings call. Though Howard continues to "entertain discussions ... it's not something that we have any immediate plans for until the currency improves."

Low valuations for aspiring buyers hampered some activity in 2019, said Joey Warmenhoven, CEO of the investment bank JWTT.

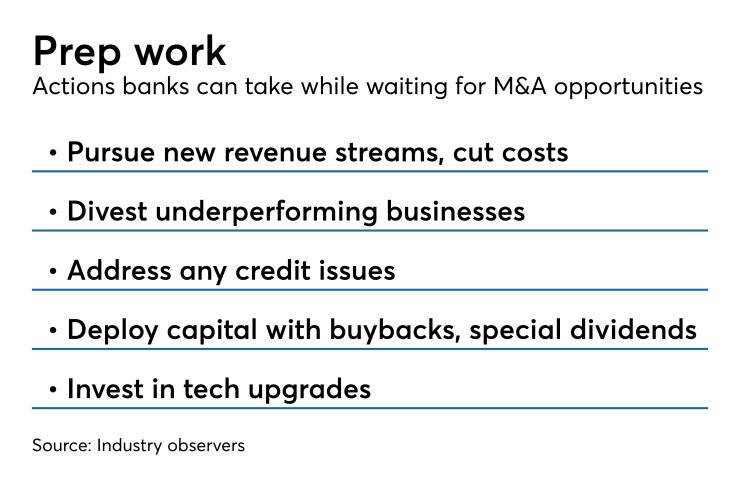

"Most deals are stock deals and, with lower valuations, the acquirers are less likely to use their currency to buy other banks," he said, adding that, in some cases, it makes more sense for a bank to repurchase stock or pay out special dividends.

First Western, for instance, spent $716,000 to buy back more than 43,000 shares of its stock during the fourth quarter.

The $1.3 billion-asset company has looked at a few acquisitions since its 2018 initial public offering, but a languishing stock price has made it hard to finalize anything, said Chairman and CEO Scott Wylie. The company trades at about 120% of its tangible book value at a time when the average bank hovers closer to 160%.

"As our stock price normalizes and catches up to where peers are, and people understand our earnings story going forward, I think our stock will be rewarded and we'll have the currency we need to ... do those transactions in a way that makes sense," Wylie said.

First Western may be idling as a buyer, but McGuire doesn't see the company as a seller, either. First Western should enlarge its loan portfolio by about 15% over the next two years, while growing earnings per share by about 20% compounded over the foreseeable future.

"I don't view the lack of inorganic strategy to be a big headwind for them," McGuire said.

Another option for eager, yet frustrated, buyers is to work more cash into their deals.

The $2 billion-asset CapStar Financial Holdings in Nashville, Tenn., recently

CapStar is "able to find smaller, well-priced deals in more rural markets that still help them to advance the bank forward, but do so at a price with a palatable TBV earn-back," said Stephen Scouten, an analyst at Piper Sandler.

Another option is to pursue organic growth and improve efficiency like the $48.3 billion-asset Synovus. The company is aggressively hiring revenue producers. It is also in the early stages of an initiative to identify ways to boost revenue and trim costs.

The company's "currency has come back some but not enough to position us to participate in a transaction right now," Kessel Stelling, its chairman and CEO, said during its quarterly call.

"I think we would have to certainly look at something, but I wouldn't anticipate that being a 2020 event," Stelling added. "I think, short-term, the answer is a heads-down internal focus [and] keep building on the reputation I think we've established."

First Western, like Synovus, aims to take advantage of disruption caused by recent bank mergers in its local markets.

"We're seeing really nice organic growth," Wylie said. "When the time is right we'll pull the trigger on some of the acquisition opportunities."

Another factor could be the imbalance of buyers and sellers. Industry observers said that sellers outnumber buyers, which could eventually rightsize pricing expectations and help banks that are having difficulties making their numbers work.

"While a pullback in the stock prices of [potential] buyers may limit what they're willing to pay, the seller incentive is becoming more of an imperative," said Michael Jamesson, a principal at Jamesson Associates, a consulting firm in Scottsville, N.Y.