Glacier Bancorp’s decentralized business model helped it land a strategically important deal in Utah.

The Kalispell, Mont., company

The $12 billion-asset Glacier wasn’t the highest bidder for FNB, according to a

FNB’s directors determined that Glacier’s plan to merge their bank with existing branches to create a new Utah division would save jobs and better serve the community. They also decided that the new division “would be able to operate with a certain level of autonomy,” the filing said.

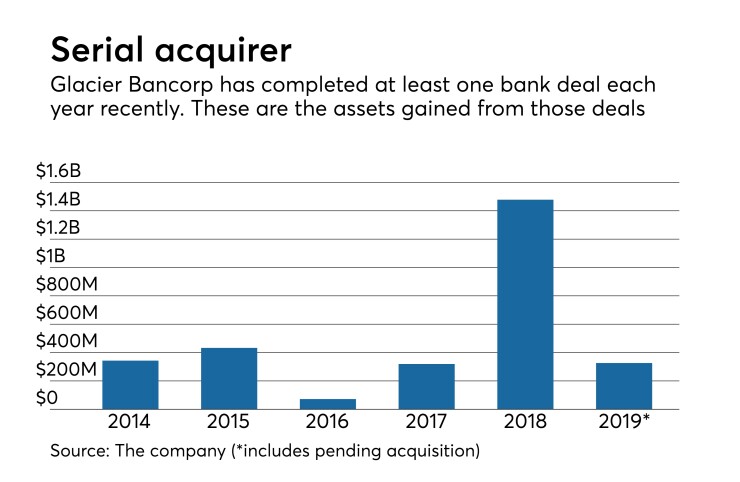

Though it has a single charter, Glacier has 14 bank divisions in seven states. Each division has its own name, management team and advisory board. Glacier has completed nine bank acquisitions in the past five years, including two in 2018.

The deal shows how some sellers value more than money when vetting buyers. It also shows how banks that are willing to cede some oversight can secure deals.

FNB initially flirted with a sale in 2014, hiring an investment bank to review its options. But the board decided at that time to remain independent. FNB’s directors reaffirmed that decision in May 2018.

The situation changed in July 2018, when the CEO of an unnamed bank expressed an interest in buying FNB. It was determined that it was likely the company would make an offer “that would meet or exceed the threshold established” by FNB’s board, the filing said.

At that time, FNB asked its investment bank to contact Glacier and two other banks to gauge their interest. Each company began evaluating FNB. They also met with Kevin Garn, FNB’s chairman, and John Jones, the bank’s president and CEO.

Garn owns about 17% of FNB’s stock, the filing said.

A privately held bank sent FNB a cash-and-stock offer on Sept. 14, though it cautioned that it would be unable to move forward on a deal until early 2019. The filing did not disclose the value of the offer.

By Oct. 28, Glacier had provided an offer that valued FNB at $26.84 a share, and another bank proposed paying $27.32 a share.

Glacier, in addition to offering some autonomy, had superior dividend performance and stock trading liquidity, the filing said. The companies agreed to a 90-day exclusivity period on Oct. 30, and FNB ended discussions with the other banks.

In early January, Glacier informed FNB that it needed to lower the exchange ratio by nearly 3% to account for higher transaction expenses and a higher-than-expected loan-loss reserve. FNB’s board “determined that the reduced offer still constituted a significant premium and unanimously confirmed its desire to proceed,” the filing said.

Directors at FNB and Glacier unanimously approved the merger agreement on Jan. 15. The deal, announced the next day, priced the $326 million-asset FNB at 216.4% of its tangible book value.

“The addition of FNB, along with its long history, strong talent pool, and experienced community banking team helps further establish Glacier in Utah and set the stage for future growth,” Randy Chesler, Glacier's president and CEO, said in a press release announcing the deal.

The transaction should be 0.6% accretive to Glacier's 2020 earnings per share, excluding merger-related costs. It should also be accretive to Glacier’s tangible book value.

Glacier plans to cut 18% of FNB’s annual noninterest expense. It expects to incur $7.4 million in merger-related expenses.

Jones, who will become president and CEO of its Utah division, will receive an annual base salary of $272,000. His employment agreement will be effective until the end of 2020. He will be bound by a noncompete agreement and barred from recruiting Glacier clients and employees for two years after he leaves the company.

Shelly Holt, FNB’s chief operations officer, and Nicolas Bement, its chief financial officer, will have the same roles at Glacier’s Utah division. Jason Robinson, a senior vice president, will serve as the division’s chief lending officer. Though they will have two-year prohibitions on recruiting clients and employees, the executives will not have noncompete agreements.