Yes, there is still some optimism left in the banking industry.

Despite ongoing challenges, ranging from low interest rates and regulation, executives at banks with $1 billion to $20 billion in assets are confident that they can boost revenue this year, according to a recently released survey from KPMG.

Doing so won't be easy, though. A rising number of bankers believe that smaller institutions will struggle to survive, making it increasingly important to build scale. More consolidation is also on the horizon, along with pressure to avoid pitfalls in areas such as credit.

-

The age-old fight over whether earnings forecasts are essential for investors or bad for the economy has new legs, and banks are square in the middle of it.

August 4 -

It's liable to be an uphill climb as banks try to boost revenue and hold profit steady over the rest of the year. Here's why.

July 15

"Most of our clients will focus more on the quality of growth, and what it does for their earnings, rather than just growth for the sake of growth," said John Depman, national leader for regional and community banking at KPMG. "It is positive that people are expecting growth."

Roughly 40% of executives polled said they expect revenue at their institutions to increase by up to 5% this year. Another 29% forecast growth ranging from 6% to 10%.

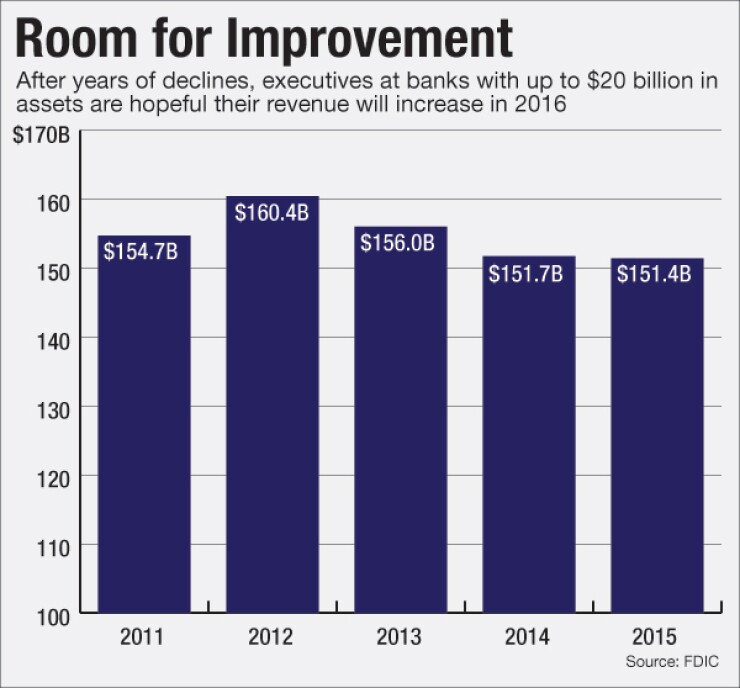

Any increase in revenue would be a major accomplishment for smaller institutions.

Banks with $1 billion to $10 billion in assets reported flat revenue last year, according to data from the Federal Deposit Insurance Corp. At the same time, annual revenue was off nearly 6% from 2012 as banks dealt with low rates and regulations that cut into fee income.

A number of bankers were hopeful during recent conference calls to discuss quarterly results.

"We remain optimistic about some of the things we're seeing going on in the market," Gerard Host, the president and CEO of Trustmark in Jackson, Miss., said during the company's conference call. "We will continue to control our expenses in this challenging rate environment and we are very hopeful … about the future."

Like Host, 52% of the participants in the KPMG survey said they are focused on reducing costs. Another 59% said they are primarily focused on finding way to grow organically, particularly in areas such as wealth management and credit cards. Wealth management is "a huge growth opportunity that banks are recognizing," said Ken Siegman, senior director at West Monroe Partners. "At a macro level … there's this big transfer of wealth in place between generations. The baby boomers are getting to retirement age and … they've accumulated more wealth than any other generation."

Lending operations will remain under pressure, participants told KPMG. That view was shared repeated during recent quarterly calls. "The low interest rate environment continues to put pressure on both loan retention and loan yields," Chris Myers, president and CEO of CBV Financial in Ontario, Calif., said during its call with analysts. "Price competition remained challenging, and it intensified during the second quarter."

Those types of pressures will force more banks to consider mergers, the KPMG study found.

Half of the survey's respondents said an institution must have $1 billion in assets to stay independent. Another 41% said they believed that $5 billion in assets is necessary to go it alone – versus 33% a year earlier.

Nearly 45% of the survey's participants said they were "likely" or "somewhat likely" to sell their institutions in the next year, marking a noticeable increase from 21% in the 2015 survey. In comparison, 40% of respondents would expect to be buyers, down from 49% a year earlier.

Bank consolidation has slowed down considerably this year, due in part to market uncertainty and regulatory roadblocks for some regional banks. Industry observers, however, are confident that deals will rebound once some of those issues have been addressed.

"The pressure hasn't been relieved really for all of us," Mark Hardwick, chief financial officer and chief operating officer at First Merchants, said during the Muncie, Ind., company's latest earnings call when asked about acquisition opportunities.

"The margin is challenging," Hardwick added. "The regulatory environment is challenging. … Just core growth is challenging. So I think you're going to see those that are winners in those transactions and those that have to look in other directions. So we're trying to stay as close as possible to all of our potential partners."

"All those things make it pretty hard to raise capital and … will force the boards of a lot of banks to consider either buying or selling, Siegman said. "You can't organically grow fast enough."