Since the Pentagon first wrote rules nearly a decade ago designed to protect active-duty service members from high-cost credit, most U.S. banks and credit unions have been blissfully out of the loop. But that is about to change.

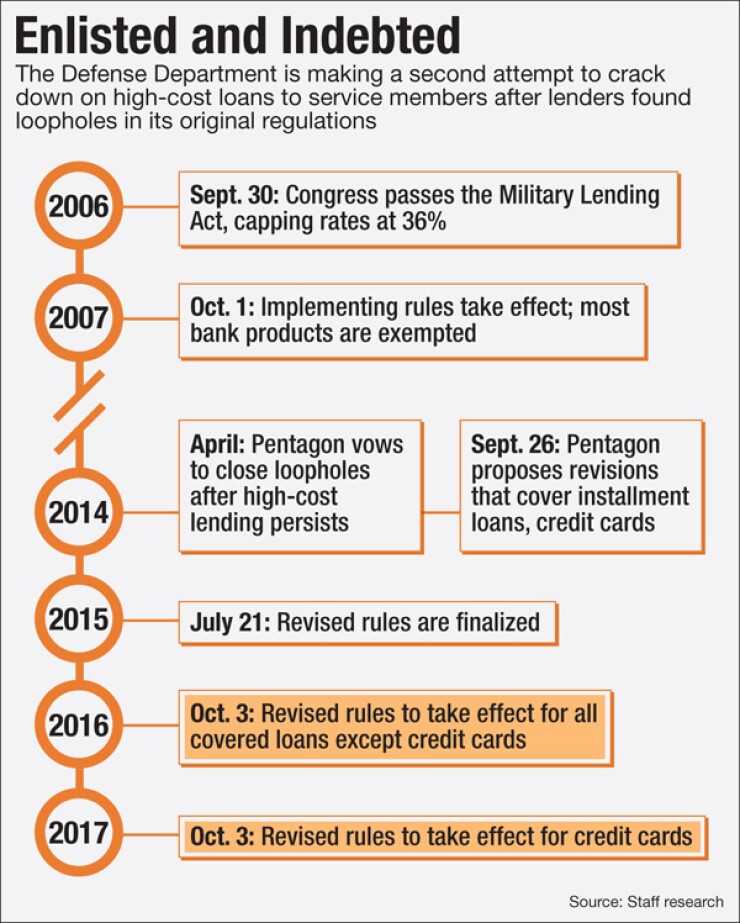

The Military Lending Act, enacted by Congress in 2006, initially applied only to a narrow range of payday loans, auto title loans and tax refund anticipation loans — the kind of consumer credit that few mainstream financial institutions were offering in the first place.

However, new rules from the Obama administration last year broadened the law's scope substantially. Loans covered by the tightened regulations include credit cards, installment loans, private student loans and overdraft lines of credit — products that are staples at many banks and credit unions.

With a phase-in of the new rules scheduled to start on Oct. 3, thousands of financial institutions are now scrambling to get ready. Below are key questions and answers regarding how to comply with the act.

Which borrowers are covered by the Military Lending Act?

The law covers active-duty members of the U.S. military — they number well over 1 million — as well as their spouses and other dependents. This part of the rule is not changing.

What specific protections are these borrowers entitled to?

For loans that are covered by the rules, lenders may not charge an annualized interest rate above 36%. The interest rate must be calculated using a formula known as the military annual percentage rate, which includes more fees than a standard annual percentage rate does.

Consequently, loans with standard APRs below 36% may have military APRs above 36%, in which case those products cannot be offered to active-duty service members. Again, this part of the rule is not changing.

Which new loan categories will become subject to the interest rate cap in October?

The additions will be made in two waves. The first wave, which hits on Oct. 3, includes installment loans, auto title loans of more than six months, private student loans, overdraft lines of credit and more.

In October 2017 credit cards will get added to the list of covered loans. Even after the new rules are fully implemented, residential mortgages and loans for the purchase of automobiles will remain exempt.

How can banks and credit unions determine if a specific loan applicant is covered by the law?

Lenders have some choices here, but most financial institutions are expected to use one of two options that will provide them a safe harbor from lawsuits. The two methods are: querying a website maintained by the Department of Defense, or checking with a credit reporting agency that has a link to the Pentagon database.

There have been delays in connecting the three national credit reporting agencies — Equifax, Experian and TransUnion — to the Pentagon's database. But Nessa Feddis, a senior vice president at the American Bankers Association, said, "The bureaus indicate that they will be up and running by the due date."

What are the pros and cons of the two methods?

Larger institutions are expected to rely on reports from the credit reporting agencies, since that process is likely to be easier and more efficient than checking the Pentagon's website. The downside is that lenders will have to pay for the information; so far, the credit bureaus have been tight-lipped about how much they plan to charge.

The upside of checking the Pentagon's database directly is that financial institutions will not have to pay. Inquiries can be run in batches, though there will be a significant lag time before the lender gets an answer. Smaller institutions that need to check the database less frequently are seen as more likely to choose this option.

What other obligations do banks and credit unions have under the Military Lending Act?

The new rules require financial institutions to make certain disclosures, both orally and in writing, to active-duty service members and their dependents who take out covered loans. The lender must make a standard disclosure regarding military APRs, for example.

Until late August, banks and credit unions were uncertain about how specific the oral disclosures needed to be. The Defense Department clarified on Aug. 26 that generic oral descriptions are sufficient. That decision should lessen the industry's compliance costs.

"That's very big," said Joe Gormley, assistant vice president and regulatory counsel at the Independent Community Bankers of America.

What are the consequences for failing to comply with the Military Lending Act?

Banks and credit unions that violate the rules might be hit by their regulators with enforcement actions. They might also be sued by a class of borrowers; the Pentagon's rules bar lenders from requiring consumers to submit to arbitration.

But what really scares industry sources is a provision stating that credit agreements that fail to comply with the new rules are void. In other words, none of the terms of the contract would be legally binding.

Will banks and credit unions be ready on Oct. 3?

Overall, the financial industry appears to be fairly far along in its preparations. Still, since the Pentagon only recently provided answers to several important questions, industry representatives have asked their regulators for some early forbearance. In a letter Wednesday to federal banking and credit union regulators, seven industry trade groups requested that examiners wait until after March 3, 2017, to start testing transactions for compliance with the new rules.

"We believe that this approach is not only fair and practical, but will help to ensure that military personnel, their spouses and dependents continue to have access to depository institution credit products they need and value," the trade groups wrote.

Will some banks and credit unions stop offering certain loans to members of the military?

Last year, when financial trade groups were lobbying against stricter rules, they argued that overly stringent rules would

In recent interviews, trade group representatives said that outcome is still a possibility, though they did not provide specific examples of firms that plan to stop lending to service members. Some small credit unions are asking, "Do they truly have the capacity to do this in a compliant way?" said Brandy Bruyere, director of regulatory compliance at the National Association of Federal Credit Unions.

Will the rules present new opportunities for banks and credit unions?

The tougher regulations will apply not only to federally insured financial institutions, but also to installment lenders and auto title lenders that set up shop near military bases. For years, those nonbank firms

"Some traditional installment lenders do not offer a product that fits into the restrictions … and so may not be able to offer loans to service members and their families," the American Financial Services Association, a trade group that represents installment lenders, said in an email.

In theory, the Pentagon's new regulations could help drive some of the loan demand to banks and credit unions — especially to institutions with branches on military bases. But whether theory will match reality remains to be seen.