Wanted: a midcareer banker with an Ivy League education and a fulfilling — if hectic — personal life. A career break from financial services is required.

As big banks all but fall over themselves to attract

Barclays is the latest Wall Street bank to offer a paid internship program for midcareer bankers who have left the industry but want to come back. The idea is to give once-high-performing employees an opportunity to brush up on their skills and re-establish their networks.

-

In recent years Barclays' Barbara Byrne has found some atypical ways to support the careers of women. The latest is her investment in the film "Equity," which is about Wall Street and features women in the starring roles as well as behind the camera.

September 22 -

Despite years of diversity initiatives, senior management teams remain overwhelmingly male. Now a growing number of women are coming around to the idea that real change starts in the boardroom.

September 22 - WIB PH

Barclays' Barbara Byrne launches her Women in Leadership index, one bank bans all-male shortlists, the @GSElevator guy speaks out for women, Karen Peetz has some ideas to make social finance more attractive and the Manbassador movement grows.

August 13

The program — branded as

Did you take a few years off to raise your kids? Did you ditch your high-stress finance career to travel the world, but decide it's time to return?

Barclays wants to chat.

"We like to have porous borders," said

For years, big banks have relied on competitive summer internship programs to recruit young graduates. But they have lacked similar programs for recruiting older but equally talented employees, who have taken a career break, Byrne said.

"People used to say, 'Once you leave, it's hard to get back in,' " Byrne said. "Well, why? Why should we not want that talent?"

Over the past few years several big banks have invested in programs to bring seasoned employees back into the fold.

Goldman Sachs, for instance, has had a midcareer internship program in

In some ways this is not Barclays' first go-round. Lehman Brothers — which

Byrne, a former Lehman executive, said the Barclays internship is more intensive.

Under the Encore guidelines, applicants must have taken at least one year off and attained a vice president title before leaving the industry.

If accepted, applicants will go through 10 weeks of training, with the likelihood of receiving a full-time offer at the end.

Byrne added that the program helps address a persistent problem in the industry: It is simply hard to keep some of the best bankers — particularly women — on an executive career track.

"It's a competitive industry, and it can be demanding," she said.

There are a number of reasons women drop out of the workforce, but family obligations are a primary culprit.

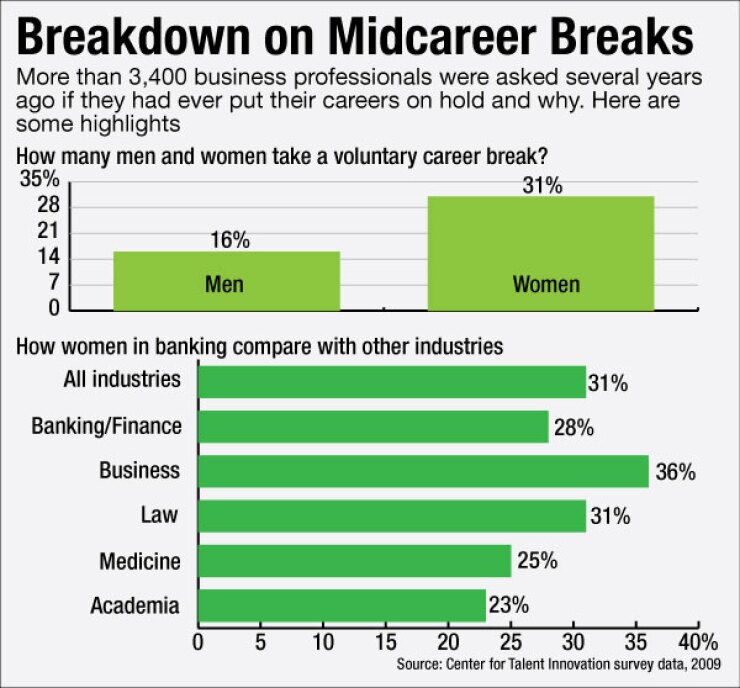

Just over 30% of women take a voluntary career break, usually to care for children or elderly parents, according to a survey of more than 3,000 professionals in business, banking, law, medicine and academia conducted by the Center for Talent Innovation.

However, workplace attitudes have changed in the seven years since the study was conducted, said Melinda Marshall, an executive vice president at the center.

For instance, it is now common for women to have sponsors at their companies who encourage them to come back after a maternity leave, Marshall said.

"Women are mentored to death," Marshall said.

Additionally,

In the 2009 survey, 16% of men reported taking time off from their careers, though many did so to change careers or seek out better pay.

The launch of the Barclays program also coincides with the rise of more family-friendly work policies across the industry.

A number of big names, including Bank of America, this year

One distinctive aspect of the Barclays internship is that, unlike its rivals, the bank marketed the program to men and women, Marshall said.

Still, more than half of the applications that Barclays has received — about 62% — are from women, many of whom are in full-time caregiving roles.

The application process closed at the end of June, and Barclays is reviewing resumes and preparing for interviews.

In total, Barclays received more than 220 applications for 10-12 spots. Many applicants have advanced degrees from Harvard and Wharton, and some were managing directors before they left the industry.

So the business case for the internship program is clear: It taps into a highly credentialed, eager-to-work talent pool, Byrne said.

Plus, having more older people around may be a boon to a company's culture, Byrne said.

"If you come here and you join with us after taking some time off, you're going to stay," she said. "We want people who you can invest in and stay with us, who form relationships."

Some of the applicants have stories that echo Elizabeth Schirick, a vice president and assistant general counsel at JPMorgan Chase.

Schirick joined JPMorgan in 2015 as part of its midcareer internship program, known as ReEntry.

After graduating from Fordham Law School in 2003, Schirick worked for years at several big firms, including the Wall Street powerhouse Skadden, Arps, Slate, Meagher & Flom.

She took a break from her legal career in 2008, after the birth of her first child. The market was crashing at the time, so it was an opportune time to step away.

Schirick briefly returned to work about a year later. But after the birth of her second child, she and her family moved to the suburbs, and she took another career break — this time for about five years.

When Schirick made the decision to rejoin the workforce, she knew it would not be easy.

"When you're out for any extended period of time, you become marginalized," she said.

But when she heard about the JPMorgan ReEntry program through her alumni network, she knew it would be a good fit.

After completing her four-month training, Schirick was offered a job in the JPMorgan legal department, on a team that works on derivatives.

"Just because you have a gap in your resume doesn't mean you don't have value," Schirick said.

With its new Encore program, Barclays hopes to provide similar opportunities.

Byrne said the company is excited to welcome its inaugural cohort in September. The goal is to hire them full time, although if they get hired elsewhere in the industry, Barclays will also consider it a success.

"They just need an opportunity to show what they can do," Byrne said.

She also said, jokingly, that new mothers may feel right at home when they step back into banking management.

"Come back to my industry," Byrne said, recalling conversations she's had with friends who are stay-at-home mothers. "We're managing lots of kids — some of them are in their 50s."