American consumers continue to pay their bills on time even as they take on more and more debt.

In its quarterly consumer delinquency bulletin, released Thursday, the American Bankers Association said that the delinquency rate on consumer loans held steady at 1.56% in the second quarter, unchanged from the prior quarter and still well below the 15-year average of 2.16%.

While delinquencies on auto loans ticked up slightly in the quarter, they fell across most other loan categories the ABA tracks. The results are yet another sign that the U.S. economy is strengthening, said James Chessen, the ABA’s chief economist.

“I had expected, now with an economic cycle in its ninth year, that there would be some movement back to more normal levels of delinquencies,” he said. “But we seem to be in a period where we’re not moving very quickly back to normal levels.”

It’s not that Americans aren’t borrowing. The Federal Reserve Bank of New York said in August that household debt hit a record $12.84 trillion in the second quarter, driven by gains in automobile, mortgage and credit card debt.

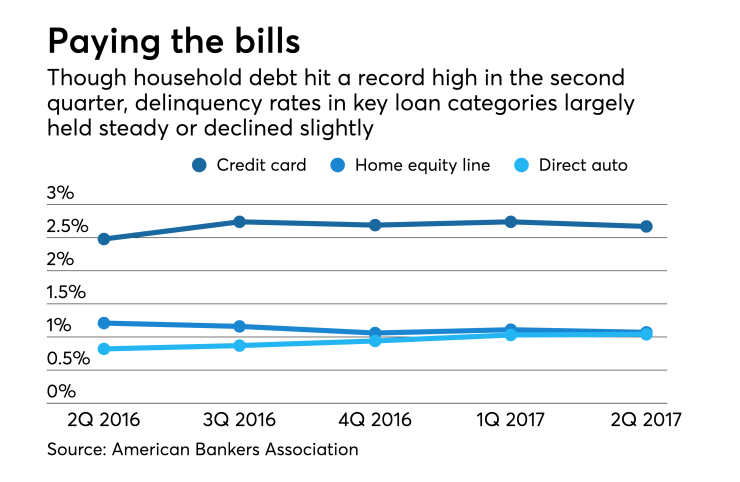

Auto loan delinquencies of 30 days or more continued to rise in the second quarter, but at a considerably slower pace — likely because some lenders have pulled back from amid growing concerns about risk in the sector. Delinquencies for both direct and indirect auto loans increased 1 basis point from the previous quarter to 1.04% and 1.84%, respectively.

“My sense is that bankers are increasingly skeptical about the trends in auto lending,” Chessen said. “The gloss came off of auto lending a little over the last few quarters, and I think that’s because banks began to see a little more risk than they were comfortable with.”

Delinquencies on mobile home loans showed the greatest quarterly increase, jumping 22 basis points to 5.08%, but Chessen cautioned against drawing broad conclusions from that. Mobile home lending makes up a thin slice of consumer lending and few banks specialize in it, he said, so that category is subject to more volatility.

“It’s an important signal and shouldn’t be ignored, but it’s a small portion of overall delinquencies so we can’t read too much into that in terms of trends, so much as an indication of stress in certain income levels,” he said.

According to the report, the percentage of consumers who were late by 30 days or more on their bank-issued credit cards fell 7 basis points to 2.67%, reversing a climb that began late last year. Chessen said that consumers are using credit wisely and that as a percentage of disposable income, credit card spending remains low.

Delinquencies on home equity loans and lines of credit and property improvement loans also fell during the second quarter, likely due to rising home values and equity in most major metro areas.

Areas hard hit by hurricanes could see a spike in delinquencies later this year, but when combined with relatively low delinquencies elsewhere the impact on the overall results will likely be minimal, Chessen said.

Still, Chessen said, lenders should remain vigilant in ensuring that households are not taking on more debt than they can handle.

“The danger late in the cycle is that individuals start to feel more comfortable about their income and their wealth and may tend to stretch themselves more thinly than they should.”