Although less than 10% of student loans come from the private sector, fintechs are making a new bet on education lending — with a twist.

Companies like

Meanwhile, fintechs like MPower Financing,

MPower Financing, which has $110 million in new financing and is set to announce plans to enter Canada, argues it’s a lucrative arena.

“We lend at 11.99% interest rate and we have less than 1% annualized defaults,” said Emmanuel Smadja, CEO and co-founder of the company. “This is a different asset class than other student loans. It’s not as dependent on the U.S. economy. … I’d also argue that the volatility of this asset class is not in line with the volatility of other traditional assets. It can be a good differentiation for any financial group that wants to decrease overall volatility.”

International student loans are a hard sell for most banks, however. In a survey of banks and credit unions, Cornerstone Advisors found that only 3% of financial institutions see student loans as a priority this year or next. Just 40% of financial institutions surveyed actually extended student loans.

“This is not a high-priority area of lending for them,” said Ron Shevlin, director of research at Cornerstone. “They won’t see the international market as lucrative or appealing.”

Smadja said business has been booming, with MPower Financing tripling its user base every year since its launch in 2014.

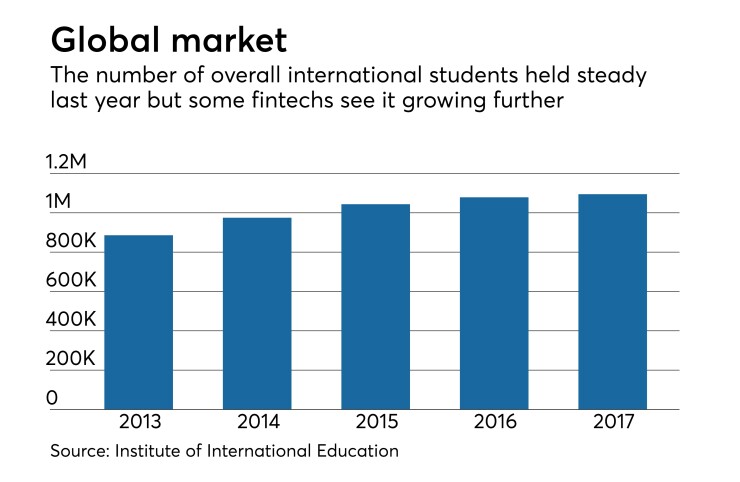

Still, there are challenges in turning to international students as a market. Although the overall number of international students has held steady in the past year, the number of new applicants dropped by 7% in fall 2017 from a year earlier, according to a survey of 522 campuses across the country by the

Some observers attribute the decline to President Trump, who has been critical of legal and illegal immigration. But Smadja said the decline in students is more the result of the Saudi government

There are also other concerns about student lending overall.

“You have left-wing politicians changing laws to forgive students loan defaults,” Shevlin said. “If you’re a bank looking to get into the student lending business, you’re looking at long-term prospects of getting into a business where we eat the defaults.”

Still, there are some advantages as well. For one, student loans can engender more customer loyalty than auto or home loans. “It’s getting in early in a relationship with someone,” Shevlin said. “The cross-sell opportunities over the 10 years following the student loan can be very attractive for a lot of financial institutions.”

MPower is attempting to develop this relationship through free personal finance education, career strategy services and guidance navigating the U.S. immigration system.

“They aim to engage with the customer holistically along the entire credit life cycle, which helps them also mitigate the credit risk,” said Craig Focardi, senior analyst at Celent.

Currently, MPower is partnered with the $210 million-asset Bank of Lake Mills in Wisconsin. What may increase the profitability of MPower is if it turns into a marketplace for international student loans like LendKey is for domestic students.

“Most banks in the U.S. have a difficult time offering loans to students who reside overseas,” said Jacob Haar, co-founder and managing partner at Community Investment Management. “MPower could demonstrate this model at scale and share their learnings.”

Just as SoFi expanded into mortgages, investment products and checking accounts after developing a platform for student loan refinancing, Smadja envisions building out more financial products that are underwritten based on a combination of home-country credit data enhanced by proprietary data sets.

“A lot of these products resonate with our demographics,” Smadja said. “So the question becomes, how do we build the neobank for global citizens?"