WASHINGTON — With the recent appointment of a new Federal Deposit Insurance Corp. chief and policy changes easing the regulatory burden has come growing optimism that ownership groups are finally interested again in forming new banks.

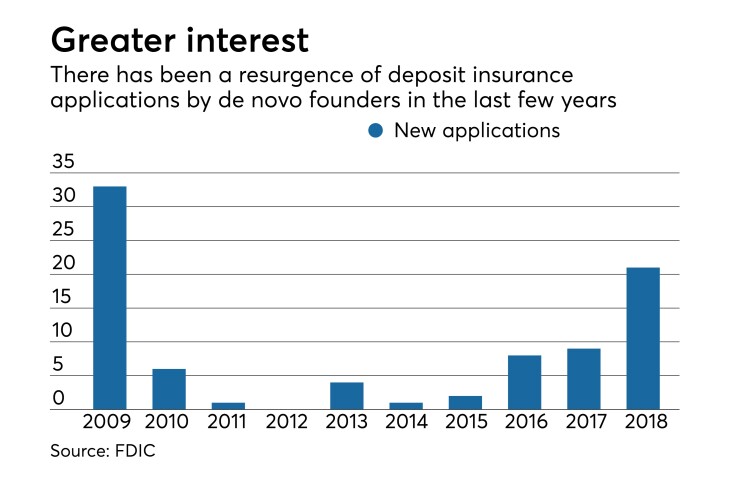

The 21 applications filed with the FDIC this year to insure de novo banks, as of Sept. 30, are already more than double last year's total.

Observers say the climate for startup banks is more encouraging after Jelena McWilliams took the helm of the agency in June, and all the regulators began implementing the regulatory relief bill that became law in May. But applicants are likely also eyeing FDIC approvals of new banks as a sign of a welcoming approach.

“Part of that flurry in applicants is probably from seeing more success stories in the last year,” said Aaron Dorn, chairman, president and CEO of Studio Bank in Nashville, Tenn., which opened in June after receiving approval from the FDIC. “At least four other groups have reached out to me because they are interested in filing to open a bank as well.”

But there are also signs that regulators are not about to just start giving out a rubber stamp. Of the 21 applications this year, only four have been approved. Two have already been "returned" and three were withdrawn. Among those tabling their applications have been a number of fintech firms yet to meet the FDIC's criteria.

“The FDIC is being cautious and appropriately so,” said Kevin Petrasic, a banking partner at White & Case’s Washington office. “Clearly, there’s a pattern that warrants further scrutiny from any future fintechs considering this strategy.”

Two fintech firms that pulled the plug on their bids — the payments processor Square and Nelnet, an online student lender — had applied with the FDIC to form an industrial loan company. More recently, Varo Money pulled its FDIC application for a national bank; the company had received preliminary approval from the Office of the Comptroller of the Currency. (All three say they intend to refile their applications.)

The ILC charter has been the focus of its own controversy for over a decade, with critics arguing the specialized bank structure is a loophole for those trying to avoid traditional limits on financial institutions. But others say the withdrawals are a sign of the FDIC's reluctance to approve fintech firms, which could drive other tech-focused providers to apply for the OCC's new special-purpose fintech charter, which does not require deposit insurance.

“If a fintech company decided they don’t want to pursue a charter through the FDIC and they don’t need deposit insurance, then the OCC’s fintech charter becomes all the more attractive, relatively speaking,” Petrasic said.

Still, industry watchers are hopeful that the uptick in new-bank applications will be a long-term trend. Some note that the trend was already looking upward under former FDIC Chairman Martin Gruenberg. Following a multiyear lull in new-bank openings, the FDIC approved seven new charters in 2016 and five in 2017.

But potential applicants welcomed comments by McWilliams that stressed the importance of encouraging new banks even before she took office. And of the seven total approvals by the FDIC this year, six de novo applications were approved in the past four months.

“In order for us to replenish the ranks of the specialty community banks, we need to encourage de novo application,” McWilliams said before the Senate Banking Committee Tuesday.

Studio Bank was approved to open June 6, the day after McWilliams came to the FDIC.

“I do appreciate her comments about streamlining the de novo process and I think that’s certainly encouraging and the chairman continues to encourage groups to apply,” Dorn said. But he said it is hard to gauge if that is a direct result of McWilliams coming aboard. “In terms of the uptick in volume and how much it can be attributed to a change of leadership, that remains to be seen.”

The recent withdrawals by fintech applicants do not appear to have thwarted others from trying to form a bank through the FDIC. The loan servicer AmeriNational Community Services in Las Vegas just announced Monday that it applied with the FDIC and Nevada’s financial regulator to form an ILC, for example.

And observers said it appears that McWilliams is open to ILCs based on recent statements.

“Congress authorized the FDIC to act on applications for deposit insurance for ILCs and the FDIC stands ready to fulfill its mandates, to review any application and approve them when they meet statutory requirements,” McWilliams said during the Tuesday hearing.

Some observers said the few withdrawals do not necessarily mean that the FDIC is generally opposed to fintechs' becoming banks.

“It’s hard to generalize with such a small sample. And every bank charter has an idiosyncratic process to getting approved by the FDIC,” said Wayne Abernathy, executive vice president for financial institutions policy and regulatory affairs at the American Bankers Association. “But our bankers want to see more banks because it brings new blood into the system.”