MidFlorida Credit Union in Lakeland has agreed to buy Community Bank & Trust of Florida in Ocala.

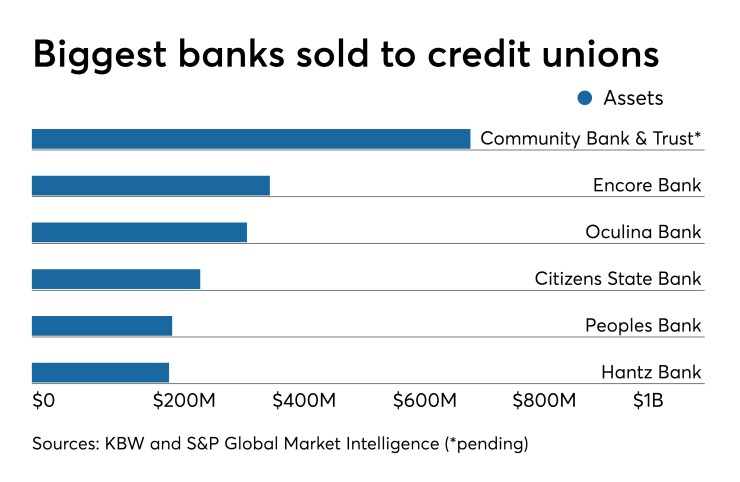

Community Bank, at $730 million in assets, would become the biggest community bank to be sold to a credit union.

The $3.5 billion-asset MidFlorida also announced in a press release Friday that it will buy certain assets and liabilities in Florida from First American Bank in Fort Dodge, Iowa. The portfolio includes about $250 million in loans and $125 million in deposits.

First American’s Florida focus has been on commercial lending and residential mortgages around Naples and Cape Coral.

When the two deals are completed, MidFlorida will have $4 billion in assets, $3 billion in loans, 1,100 employees and 63 branches. MidFlorida said it will keep all the branches and staff of both banks.

It's the sixth deal this year in which a credit union has agreed to acquire a bank. In five of those deals the seller was based in Florida.

Two of the nine credit union-bank deals announced last year were also in the Sunshine State.

Michael Bell, a lawyer at Howard & Howard who advised MidFlorida on the Community Bank transaction, said a deal of this size has been a long time coming.

"This proves these transactions are real and relevant at higher asset levels," Bell said.

Community Bank manages more than $300 million in trust assets. MidFlorida will establish a trust company to manage and expand the service.

Richard Garabedian, a lawyer at Hunton Andrews Kurth, said the most recent announcement could kick off more large credit union-bank deals, though it will require bigger credit union buyers. And larger bank sellers may have more complex profiles, with more commercial loans than perhaps some credit unions can hold and service, he said.

Larger institutions will also lead to longer regulatory processing times, Garabedian added.

While MidFlorida has completed 15 credit union mergers, Community Bank and First American's Florida operations are its first bank acquisitions.

Kevin Jones, the credit union's CEO, said in Friday's release that credit unions are becoming the primary source for consumer and small-business banking.

“We hope to strategically acquire additional financial institutions in Florida to expand our affordable consumer and business services," Jones said.

Hugh Dailey, president and CEO of Community Bank, said the deal allows the bank to maintain the most important parts of its business — a focus on customer needs, an emphasis on community and the ability to make quick, local decisions.

Dailey will join MidFlorida as its market president for north Florida.

The First American deal is expected to close in November, while the acquisition of Community Bank should close by the end of this year. MidFlorida did not disclose the financial terms of either deal.

Alex Sanchez, president and CEO of the Florida Bankers Association, said he was in a "state of shock" at news of the latest deal. Florida has been the site of many credit union-bank deals because it's a hot market, with 900 people moving into the state daily.

"This bank they bought in Ocala probably paid between $2 million and $3 million a year in taxes," Sanchez said.

"They will no longer pay those taxes," he added. "Who's going to pay for the defense of this country, the roads, the needs of our children?"

MidFlorida was advised in the First American transaction by Smith Mackinnon and DD&F Consulting Group. First American was advised by Barack Ferrazzano Kirschbaum & Nagelberg and Hovde Group.

Howard & Howard and DD&F advised MidFlorida on the Community Bank deal. Smith Mackinnon and Hovde advised Community Bank.