Low interest rates are crimping net interest margins, but bankers can take some comfort in the fact that falling rates are stimulating consumer demand for mortgages and car loans.

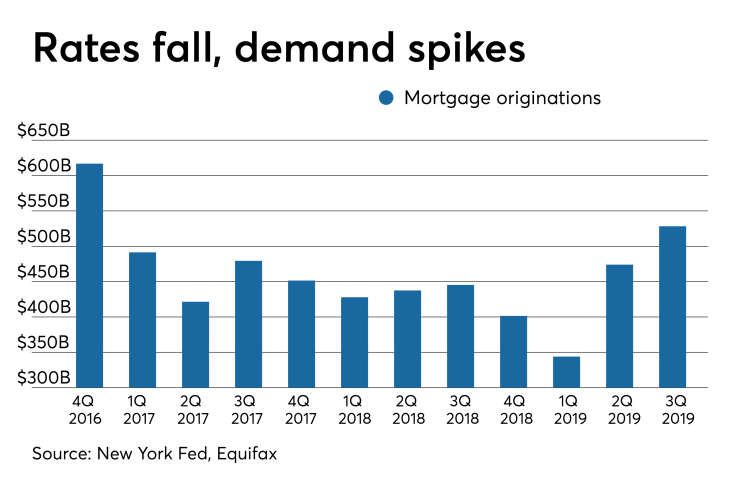

A report on household debt and credit released Wednesday by the Federal Reserve Bank of New York and Equifax showed that mortgage originations in the third quarter climbed to a nearly three-year high while auto originations climbed to the highest level in 14 years. In a news release, the New York Fed said that the data indicates consumers took advantage of two cuts to benchmark interest rates in the third quarter to buy cars, purchase homes or refinance existing mortgages.

“New credit extensions were strong in the third quarter of 2019, with auto loan originations reaching near-record highs and mortgage originations increasing significantly year-over-year,” Donghoon Lee, a research officer at the New York Fed, said in the press release.

New mortgage loan originations totaled $528 billion in the third quarter, an 18% increase from last year’s third quarter.

That was also consistent with what many regional banks reported in their latest round of quarterly earnings. While business borrowing was generally sluggish, many banks reported strong demand for mortgages, particularly refinance loans.

New auto loan originations totaled $159 billion in the third quarter. While that represented a yearly increase of less than 1%, the New York Fed said it marked the second-highest level of quarterly originations ever recorded. The highest was in the third quarter of 2005, when car loan originations reached $159.7 billion.

Nationwide, total auto loan debt rose 4% year over year to $1.32 trillion, while total mortgage debt increased 3% to $9.44 trillion.

Total household debt grew 3% year over year to $13.95 trillion and has now increased in 21 straight quarters.

The low interest rate environment did little to boost home equity lending, however. Home equity line of credit balances declined almost 5% from last year’s third quarter to $396 billion. Industry experts have attributed

Student loan debt also continued to rise, increasing 4% to $1.5 trillion year over year. Student loans represent the largest share of total household debt after mortgages.

In this quarter’s report, researchers with the New York Fed also examined racial disparities in student loan borrowing and repayment. While consumers in majority-black ZIP codes did not borrow much more than those in majority-white ZIP codes, their rate of default was nearly double that of borrowers in majority-white areas, at 17% compared with 9%.