-

Republican presidential candidates managed to get in several barbs over banking policy during the party's primary debate on Wednesday night, largely aimed at the Federal Reserve and government more broadly.

October 28 -

Democrats clashed over banking reform Tuesday night during the party's first primary debate, underscoring the sharp divide with GOP candidates on Wall Street issues.

October 14 -

For those wondering where the Republican presidential candidates stand on key banking issues, the answer remains somewhat of a mystery.

September 14

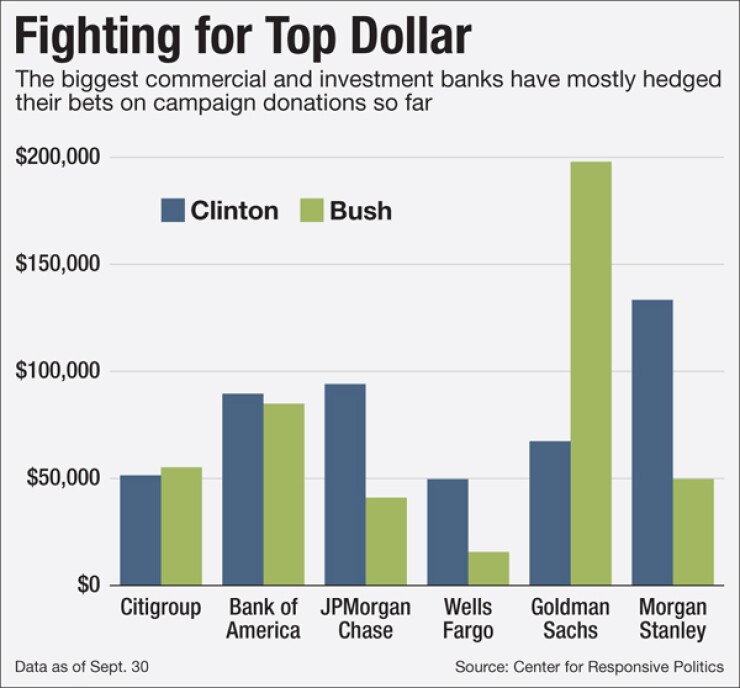

WASHINGTON — The presidential elections are still nearly a year away, but the financial services sector has already pledged tens of millions of dollars to top White House contenders.

The banking industry has consistently proven to be a major financial backer for candidates on both sides of the aisle, providing important clues about how this election season is shaping up.

Below we answer some frequently asked questions about the race for the presidency, including how bankers are voting with their wallets.

Who's getting the most support from the banking industry so far?

Democrat Hillary Clinton is leading the pack, having raised $5.5 million

"The financial sector wants stability," said Geoffrey Skelley, a political analyst at the University of Virginia's Center for Politics. "Having a track record and being more predictable is what Clinton and Bush offer."

Though it's early in the race, the two candidates have already amassed a steep lead on their opponents — both in terms of funding from the banking industry as well as in their war chests overall. Bush has raised $128 million through his campaign committee and outside groups, while Clinton has amassed a total of $97.8 million, based on Federal Election Commission data released Sept. 30 and analyzed by CRP. The third strongest contender in terms of funding is Sen. Ted Cruz, R-Texas, who's raised $65.2 million overall.

The banking industry has also been active in giving to outside groups supportive of top candidates, contributing a total of $116.2 million for all races this election cycle, by far

Marco Rubio, who some suggest could overtake Bush if he continues to fumble, has raised just $32.8 million overall, including $1.7 million in direct contributions from bankers. His $16.1 million super PAC, Conservative Solutions, has reportedly received another $1.4 million from the financial sector.

Cruz, who is married to a managing director at Goldman Sachs, has raised more than $36 million from the financial industry through three major super PACs, Keep the Promise I, II and III, backed by a small handful of

Why is the industry backing both Republicans and Democrats?

To some extent, financial industry contributors are likely doing what they know best — they're hedging their bets.

"Wall Street support is going to who they think the winner will be," said Mark Calabria, a former Senate GOP aide who now heads financial policy at the Cato Institute. "To some extent, it's going to more important on Republican side, because the candidates haven't shaken out in the same way."

Yet curiously, the banking industry and financial reform have gotten relatively little attention from the GOP candidates so far, despite the vast field of contenders. While many of the Republican candidates are on record as saying they'd repeal or drastically gut the Dodd-Frank Act, few have offered concrete proposals. The issue has barely registered during the three primary debates so far, including one dedicated to discussing the economy. There's been very little said that's outwardly critical of Wall Street, with the focus instead on how government regulation is hampering the markets.

"To me there's an opening for a candidate who wants to say, I'm really for Main Street Republican values — to say that Main Street values are not the same as Wall Street values," said Arthur Wilmarth, a professor of law at George Washington University. "It's been a bit of a surprise that nobody's saying that, given there's such a large field where you'd think people would want to be setting themselves apart."

Analysts will be watching closely to see if the issues gain any further traction on Tuesday night during the fourth GOP debate.

What hurdles remain for the top candidates?

If Bush continues to falter in coming weeks and months, it's possible that one of his rivals could replace him as the darling of the financial industry.

Rubio is considered a strong competitor who could win over the business community, and even Cruz, a stark conservative, could be a beneficiary. Both Donald Trump and Ben Carson have put up strong polling numbers in recent months, though they've so far received considerably less support from the banking industry. On the other hand, it's also possible Clinton could see an uptick in fundraising should Bush lose support, particularly if it bolsters the odds of her winning the general election.

On the Democratic side of the aisle, there's little guessing over why bankers are backing Clinton. Her primary rivals, Sen. Bernie Sanders of Vermont and former Maryland Gov. Martin O'Malley, are vocal critics of Wall Street and have both come out with plans to break up the biggest banks. Sanders has collected just $298,000 in direct contributions from the financial sector so far this season, while O'Malley has raised nearly $313,000.

The two contenders were quick to challenge Clinton on her financial services record during the party's first primary debate last month. Clinton has struggled to strike a balance in going tough on the industry to appease progressives, while not pushing potential backers over the edge.

"It will be interesting to see if Clinton's shift left in terms of rhetoric on Wall Street and the financial industry actually results in less money," said Skelley. "Or are donors going to read between the lines and say, she's not going to be too aggressive."

So far, she's backed legislation to reduce the revolving door between private sector work and government employment and has called for bankers who commit crimes to be punished, but has offered what many view as a relatively modest plan for reform. She's raised $2.4 million from securities and investment firms and commercial banks alone, slightly edging out Bush, who's raised $2.1 million from those groups in direct contributions. Those groups have given Sanders just $71,000 and O'Malley $92,000.

"She's doing the minimum necessary to protect herself from the attacks being leveled by both Sanders and O'Malley," said Wilmarth.