Needham Bank in Massachusetts is making preparations to join the latest wave of bank consolidation.

The $2.3 billion-asset Needham, based in a Boston suburb, plans to convert from a mutual cooperative bank to a mutual holding company. While it would remain depositor-owned, the new structure would give Needham more flexibility to acquire smaller mutuals across Massachusetts, CEO Joseph Campanelli said in an interview.

The move follows in the footsteps of other acquisition-minded mutuals, including First Mutual Holding, which converted to the mutual holding company format in 2015 and

“Issues around succession and diversifying product lines,” are driving many small mutuals to sell, said Thomas Fraser, First Mutual's CEO. "That's what we’re seeing.”

In Maine, the $502 million-asset Biddeford Savings Bank and the $426 million-asset Mechanics Savings Bank have agreed to merge, four years after

“We really needed to do a better job of alignment," Hulit said. After you create a common set of products, policies, procedures "and a common culture, you really have become one bank."

Other small mutuals are facing similar challenges, “and it only gets more difficult,” Hulit added.

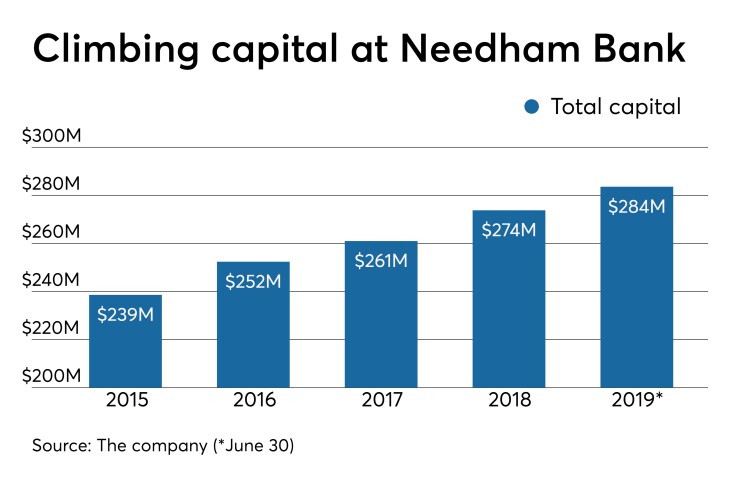

Since its footprint is in the fast-growing Boston area, Needham has been insulated from many of the issues other mutuals face, Campanelli said. The mutual's assets have increased by 15% since Campanelli arrived in late 2016. With a Tier 1 capital ratio north of 16%, Needham can make a compelling case to potential sellers, he said.

Needham's plan, “in the big picture, is good news,” Fraser said. “Mutuals need to have options, and if we can preserve the charters, that’s all the better.”

The following is an edited transcript of a recent conversation with Campanelli.

What is your plan for Needham after it forms the mutual holding company?

JOSEPH CAMPANELLI: I’m a big believer in maximizing flexibility. Those that can be nimble and move quickly can be very opportunistic, especially in a market that is shifting as quickly as this economy and the whole financial services sector.

We’re in a great region. We’re growing very nicely, as is the marketplace. We’ve really diversified to compete effectively with the much larger banks, and to be much more friendly from a millennial standpoint. We’ve lowered the average age of our clients significantly. We’re really looking toward the future.

I’m a big believer that if you’re going to merge or acquire somebody you need to earn the right. The fact we’re growing faster than the market proves we have a compelling proposition to position ourselves more competitively.

Most of our new clients come out of larger banks, where they want the products and services, they want online banking, they want mobile, they want robust payment methodologies and ease of use and convenience. But they also want high-quality customer contact and a high level of service. They want it from a branch or a call center or private bankers. They really want that flexibility.

It seems like Needham will be in a position to buy other mutuals.

We think we can be a responsible partner to other mutuals. We’re fortunate because we have almost $300 million of capital and growing. We can [approach] a partner and say, "You can maintain your identity and just bring more products and services immediately to your local marketplace."

If it works, fantastic. If it doesn’t, we still have a great organic strategy that we’ll continue to grow, add market share and expand our reach.

At least one other depositor-owned mutual holding company is looking to allow the mutuals it buys to keep their charters and identity. Is that what you plan to do at Needham?

Yes. That would be great. I think we have a very compelling argument to support [the strategy].

I think this whole bank local, buy local is a growing preference, especially among millennials and younger generations where they want to see companies that balance a commitment to the community along with what I always call compassionate capitalism. That’s where the mutual model fits in.

Interested banks can have the best of both worlds. They can have their local identity. They have boards that understand the local market. But then we can give them a whole host of products and technology.

People want options. I can’t think of any industry that’s not been impacted by technology. We all want more convenience, we all want to be able to do things on our smartphones, but then we want to be able to talk to a person when and where we want to see them.

This should help offset rising compliance and cybersecurity costs, right?

We see a lot of companies that have not invested in compliance.

Regulators are still concerned about [anti-money-laundering] and Bank Secrecy [Act compliance]. They really want to make sure that, as new technologies come in place, we still have a good compliance function. Every time you create a new channel like mobile banking, you create more cybersecurity challenges. You need to make sure you have the scale to address cybersecurity and compliance issues.

Then you add today’s yield curve to the challenges. A lot of the smaller mutuals do a lot of residential lending. All of the sudden, with the inverted yield curve, the mortgage market has reduced rates to [around 3.5%] in long-duration assets. People are still looking for CDs and funding [near 2%]. A 2% cost of marginal borrowing and lending at 3.75% doesn’t work, so you need to diversify.

How did you determine the need for a mutual holding company?

It kind of came out of my

We understand our markets. We can be versatile in each of our markets. We just thought what drove consolidation in public banks is going to drive consolidation, in all likelihood, in mutuals. There are going to be some very good mutuals long-term. We’re confident we’re going to be one of them.

But there are going to be ones that don’t have succession, that aren’t attracting a younger labor force that’s a little more creative and innovative, and have a customer base that’s getting older. They’re going to be forced to make some big decisions. To be part of that, we want to make sure we’re positioned well.

We don’t need to do an acquisition to grow, but I think we have a compelling proposition. All our products and services are very scalable. If we’re able to partner with banks that’s fantastic, and we’re in a part of Massachusetts where there’s a lot of growth in greater Boston and its suburbs. Whether it’s in our market or in central or western Massachusetts we have an attractive, compelling option for people to consider.

It can be argued that Boston is the strongest market for mutuals.

I’ve been in this market 30 years and it still amazes me, the transformation. I’ll never forget, my daughter was going to go to college on the West Coast. At the last minute, she decided she wanted to go to Boston College, which is seven miles away.

Besides that, she used to say, "I’m never going to work in Boston. No young people work here. We want to go to Palo Alto or Chicago or New York, where things are happening." Now, she’s working in Boston in the Seaport [District] for a life science company.

Boston has had such an influx of young people working for all these technology innovation companies. It’s transformed the market. It’s international in scope. It’s got a combination of great colleges and universities breeding some strong, brilliant brainpower, and it has an airport that can fly you around the world to most destinations nonstop.

One of the numbers that jumps out at me is that 35% of [greater Boston’s] population is between 20 and 35. I think that’s what’s really driving innovation, whether it’s in health care, manufacturing or technology.

It sounds like a major goal is for Needham to be ready to bank a younger customer base.

Absolutely. We’re really good at banking the cable generation. The problem is millennials don’t watch cable. They don’t read the newspapers we advertise in. They don’t listen to the radio at drive time. We need to find new ways to reach that generation.

Everything we consume is changing radically due to the Amazon effect, how it’s affecting retail in general. You look at technology. How we consume health care. It's evolving at an ever-increasing rate. We need to evolve with it. Otherwise we’ll be left behind. There are great brands out there like Sears & Roebuck. You wonder where they are now.

In New England we talk about Digital Equipment and Wang Labs, all these great brands that have gone by the wayside. There's no such thing as the status quo. You’re either going forward or you’re going backwards.

How do M&A discussions develop among mutuals?

I think the motivation is very different. A stock bank is motivated through a publicly traded valuation and a board, where historically the top priority has been shareholder value.

The mutual concept from day one has always been a balanced approach to value creation, financial stability, community involvement, community development — not just a pure economic valuation. That’s really been the core DNA of mutuals.

We’re proud of that legacy, but things have evolved, our communities evolved. Our focus should be to evolve with them. Some enterprises haven’t made that investment, so you’ve got a different motivator now. [At many mutuals], the customer base is getting older because they don’t have the products and services younger generations are requiring.

I believe that if you can’t do it on your smart phone, whether it's depositing a check, transferring money or opening an account, you’re not going to be relevant down the road. But you also want that personal touch, and you want to make sure you’re affiliated with a brand that shares your value system.

Your just waiting on regulatory approvalf for the conversion, right?

Correct. Here’s what it is. We’ve got a very well-thought-out, detailed strategic plan that we’ve shared with all our team members, our board and our regulators. It’s a road map of our journey for the next five to 10 years. Most importantly, our message to the average person is, I want your grandkids to bank at Needham. What are they going to require out of their bank? If you think about what’s changed in our lifetimes, versus somebody just entering the workforce today, there’s going to be a lot of evolution. We want to make sure that we’re a very good alternative.

What's the possibility of a capital raise at Needham?

If you use an MHC structure you can borrow money at the holding company level and downstream it to the bank to buy a stock bank. It’s been done a couple other times, so it gives you lots of flexibility.

At the end of the day, capital is king. We’re very fortunate that we’ve been able to grow significantly the last couple of years while maintaining very high capital levels. We didn’t have to leverage our balance sheet because we were able to support growth through earnings.

I think you really want to make sure that in good times and bad you have plenty of capital. Needham Bank experienced very strong growth in 2009, 2010 and 2011 because so many other banks were capital-constrained and pulled out of the market.

It all comes back to flexibility.

In life, when you need something, it’s too late to go and get it. You really want to be opportunistic so you can do something quickly. In the past, we’ve been approached about potential opportunities, and we had to pass because we didn’t have the right structure.