In an ideal world a board member should devote ample time and attention to his or her company's operations, with few outside distractions.

That's not always the case. Though institutional investors and proxy-advisory firms strongly advise public companies to discourage directors from sitting on too many boards simultaneously, companies often court the same business veterans and VIPs who find the fees and prestige attractive.

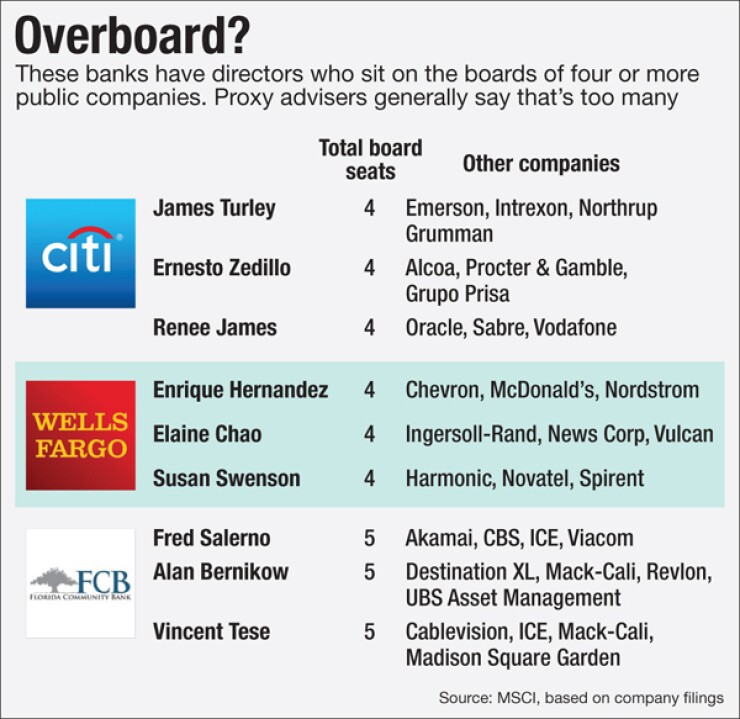

The issue, which some corporate-governance experts call "overboarding," permeates corporate America, including the banking sector. Citigroup, Wells Fargo and the $7.8 billion-asset FCB Financial Holdings in Weston, Fla., each have a sizable number of overboarders.

-

Kearny Financial completed its IPO less than a year ago and already it has found itself in the crosshairs of Lawrence Seidman. The well-known activist is pushing for the resignation of several board members he says are overcompensated and is urging shareholders to vote against a proposal on director pay this fall.

April 8 -

Banking regulators made several critically important changes in their new plan to restrict executive pay at financial institutions after their first attempt flopped in 2011. Here's what they did.

April 21

Many directors "are, by and large, very smart and capable people," said Ric Marshall, executive director of environmental, social and governance research at MSCI in Portland, Maine. "But how much can you do? Some are spreading themselves too thin."

MSCI, a publisher of indexes for equities, fixed-income securities and hedge funds, provided to American Banker its analysis of biographical information for directors at all publicly traded banking companies. MSCI's report, based on regulatory filings, found that Citi, Wells and FCB had more directors with multiple board assignments than any other banks.

Citi and Wells each have three directors who sit on the boards of four public companies including the banks themselves. Guidelines vary slightly by advisory firm or investment group, but the consensus is that a director should be on no more than three or four boards.

"We consider four to be the maximum, and that's probably pushing it," Marshall said.

Several banking companies have one or two directors who sit on four boards. Among the largest banks, however, Citi and Wells Fargo are the only ones with three such directors.

Then there is FCB. The holding company for Florida Community Bank employs three directors who serve on five public company boards. No other publicly traded bank has that many directors who have five total board assignments, according to MSCI.

Wells Fargo Responds

Citi and Wells Fargo each recently completed its annual meeting without running into opposition for its directors with four public board seats.

Citi's three directors who sit on four public company boards were all re-elected last week. Those directors are Renee James, James Turley and Ernesto Zedillo. James and a Citi spokesman declined to comment. Turley and Zedillo did not return calls seeking comment.

Wells Fargo's three directors with four board seats each were also re-elected last week. They are Enrique Hernandez, Susan Swenson and Elaine Chao, a former U.S. labor secretary who is married to Senate Majority Leader Mitch McConnell of Kentucky. Hernandez, Swenson and Chao did not return calls seeking comment.

Wells Fargo has policies in place to "consider the number of boards" of each member, "to ensure that any board service does not impair the director's service to the company," company spokesman Peter Gilchrist said.

"We have a robust process for evaluating the performance of the board, including the individual contributions of each board member," Gilchrist said. "We believe all our directors are doing an effective job."

At FCB, two of its directors who each have five board seats are up for re-election this year at the company's May 16 annual meeting. Those directors are Alan Bernikow and Fred Salerno. The third director who has five board seats, Vincent Tese, is also FCB's chairman.

FCB and Tese declined to comment. Bernikow and Salerno could not be reached.

'Not the Job It Used to Be'

Many argue that being a bank director is harder than other board gigs.

Financial services directors must be knowledgeable about a wide range of complex issues, far more than other industries, Marshall said.

"They face some of the most complicated questions in the current environment," Marshall said. "With most industries, there is a clear separation between the operation of the company and the capital management of the company. In financial companies, those are kind of merged together."

Bank directors during the financial crisis found out how much personal risk is involved. After the crisis, the Federal Deposit Insurance Corp.

With the financial crisis over, the job of bank director may have changed slightly, but it is as stressful and time-consuming as it has ever been, said Robin Maxwell, an attorney at Linklaters who heads the firm's financial regulation group.

"Serving as an outside director of a large financial institution is no longer considered as much of a part-time a job as it once might have been," Maxwell said.

Directors for financial services companies must deal with issues such as Dodd-Frank regulations, cybersecurity, executive compensation and sensitive personnel decisions. For those reasons, financial services company directors probably have the most difficult job of any industry sector, said Steven Stokdyk, an attorney at Latham & Watkins in Los Angeles who advises public companies on corporate governance.

"Directors of banks and bank holding companies spend a lot more time with their companies than directors in other industries," Stokdyk said.

It is a wonder a director would want to subject himself or herself to the extra work, or the additional liabilities. But many directors are very generously compensated for their time. Many companies now give their directors a combination of cash and equity awards, Marshall said.

"You can get rich, if you pick the right board," Marshall said. "It's not uncommon for an individual who's on four or five boards to take home $1 million a year for their board service alone."

As a result some proxy advisory firms are taking a tougher stand on the issue. Glass Lewis, starting next year, will recommend shareholders vote against director nominees for any company if the nominee is an executive of a public company and serves on more than two public company boards. Glass Lewis' current recommendation is for no more than three boards.

Banks with Tough Policies

A number of banks have approved corporate governance bylaws to prevent directors from overboarding. The $7.8 billion-asset Berkshire Hills Bancorp in Pittsfield, Mass., has one of the strictest policies, limiting its directors to a total of three public company boards, including its own board.

The $18 billion-asset PrivateBancorp in Chicago bans its directors from being on more than two outside public companies if they are a full-time executive. Directors who are not full-time executives are limited to three outside public companies.

Other banks with stated "overboarding" policies include the $69 billion-asset Comerica in Dallas, the $2.8 billion-asset Capital City Bank Group in Tallahassee, Fla., and the $2.7 billion-asset First Connecticut Bancorp in Farmington.

It makes sense for banks to take this step, said Bob Mahoney, chief executive at the $1.9 billion-asset BSB Bancorp in Belmont, Mass. It is a matter of looking out for your bank's own interests, especially if you are a community bank.

"If I had somebody who was on two Fortune 500 company boards, then I'm going to lose out," Mahoney said. "If GE calls you to an emergency meeting in California, you're going to be gone for the whole week."

"When it starts to get bad is when he can't come to my board meeting," Mahoney said.