You know times are tough when a bank has to defend its 54.5% efficiency ratio.

That happened to U.S. Bancorp Chief Executive Richard Davis, who received a lot of questions again this quarter about the Minneapolis bank's investments aimed at future growth. He pointed out to analysts that the company had managed to keep its efficiency ratio relatively stable (it was 53.1% a year earlier) despite that targeted spending and the low-rate environment.

"I always find a need to pause and remind you guys: to be in the 54%s isn't, like, easy," Davis said on a conference call Wednesday. "We watch every nickel and dime, and we have efficiency programs all over the company."

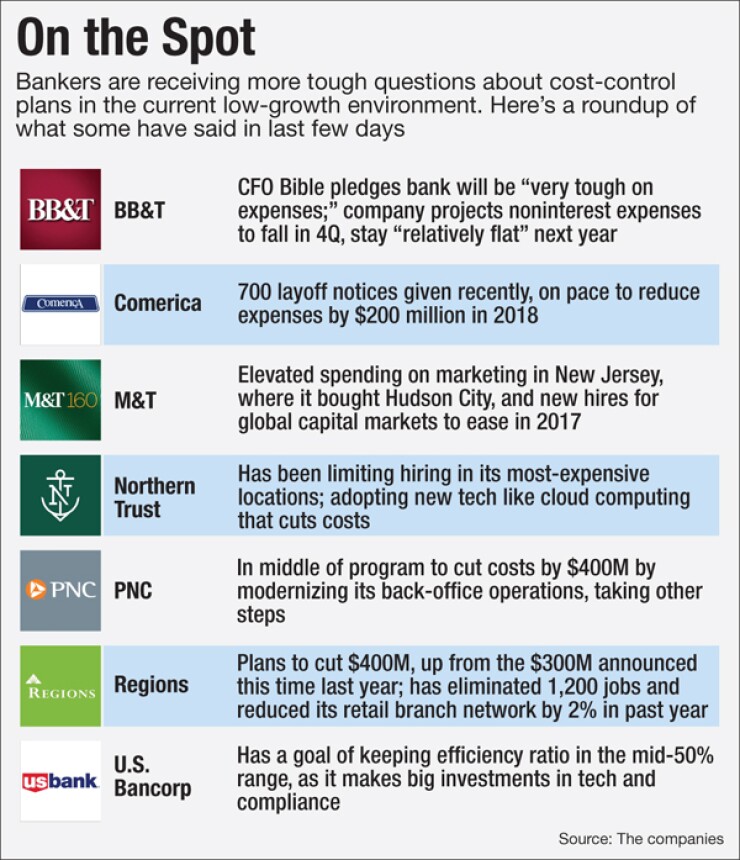

He's not the only one. Executives at companies such as BB&T, M&T Bank, PNC Financial Services Group, Regions Financial and Comerica have spent time on earnings calls in the last few days updating cost-cutting plans in great detail or defending selective spending increases — even when the extra dollars are supposed to save money (mergers, branch closures) or make more money (mobile technologies, marketing) in the long run.

Here is an overview of how some of the heads of the big regionals responded to the calls for more, more, more.

U.S. Bancorp

When it comes to cost-cutting, U.S. Bancorp is getting awfully close to the bone.

That was the message from Davis during the company's quarterly call with analysts Wednesday.

U.S. Bancorp — a company known for its expense discipline — has reported notably higher expenses in recent quarters as it makes major investments in technology and compliance. To fund those investments, it trimmed expenses broadly across the company.

But cost-control is simply getting harder, as low rates weigh heavily on revenue. And if the Federal Reserve declines to raise rates in the coming year, the company could be forced to slash expenses in a way that sacrifices future growth, Davis said.

It would "probably cut into some of the muscle of the company's long-term objectives for growth and innovation," Davis said, noting that the company would have to cut "hundreds of millions of dollars" without a couple of rate hikes. "So we're not going to make that commitment at this stage, but we'll watch" spending closely.

During an interview Wednesday morning, Chief Financial Officer Terry Dolan said the company could look at options such as deferring new hires, or holding off on marketing expenses in the future. Still, he emphasized that the company will continue to make "appropriate" investments in the months ahead.

During the third quarter, noninterest expenses jumped 6%, to $2.9 billion, from a mix of compensation, compliance and technology costs. The pace of growth is expected to slow down in the current period, with costs projected to rise by 2.5%.

If the Fed raises rates in the coming year, revenue is expected to grow at a faster pace than expenses, according to Davis.

Unlike many of its peers, U.S. Bancorp has not announced a splashy plan to cut costs and boost profitability. Instead, Davis said the company looks at ways to trim expenses "'all the time, every day, forever."

BB&T

BB&T in Winston-Salem, N.C., continues to place heavy emphasis on cost-cutting in the months following its acquisition of two financial institutions in Pennsylvania, Susquehanna Bancshares and National Penn Bancshares, and wholesale insurer Swett & Crawford.

While the bank's noninterest expense increased $117 million over the third quarter of 2015, its revenue of $2.8 billion reflected a gain of $325 million over the same period. Compared with the prior quarter, noninterest expense was down $86 million, partly as a result of reduced employee benefits and incentives.

And BB&T's leadership team has no intention of loosening its belt any time soon.

"We are being very, very intense about our expectations for next year," said Kelly King, the $222.6 billion-asset company's chairman and chief executive, during a conference call to discuss quarterly results. [Going forward], he said, "our expenses will be kind of flattish. We'll not see a material increase and [will see] some opportunities for a slight decrease."

As usual, King was reluctant to give detailed guidance for future quarters. In the past he has

One forward-looking metric BB&T has been especially leery of is its efficiency ratio. Asked during the conference call whether the Winston-Salem, N.C.-based bank could achieve a ratio in the high 50s next year without a move from the Fed, Daryl Bible, the bank's chief financial officer, declined to tie himself to a specific number. It will depend on how much the market allows BB&T to grow its revenue and whether the bank can control expenses as planned, he said.

"We will be very tough on expenses and do what we think is right for the long-term benefit of our company and our shareholders," he added.

The bank's adjusted efficiency ratio was 58.7% as of Sept. 30, a slight improvement over the ratio of 59.6% from the prior quarter.

With its recent acquisitions now well in hand, BB&T's merger-related and restructuring charges fell further this quarter.

Merger-related and restructuring charges of $43 million were down $34 million from the third quarter of 2015 and fully $49 million lower than in the prior quarter, when the acquisitions took place.

Bible estimated the bank will absorb $20 million to $30 million in such costs for the fourth quarter of 2016. "It's pretty much phasing down," he said. "This might be the last quarter of any substance."

All that will remain by the first quarter of 2017, he said, are a few "little dribbles and drops."

M&T

M&T Bank's newly installed chief financial officer, Darren King, readily acknowledged on Wednesday that the Buffalo, N.Y., company had some higher expenses in the third quarter. At least one of the items was directly tied to its October 2015 acquisition of Hudson City Bancorp in Paramus, N.J.

The Hudson City deal put M&T in New Jersey for the first time, and M&T wanted to "[make] a splash … as we went in there," King said. M&T's advertising and promotion costs were higher in the quarter, although the bank did not provide specific figures.

M&T's expenses also increased as it hired new personnel for its global capital markets division.

Another cause of M&T's higher expenses was out of its control—its deposit insurance assessment rose 27% to $28.5 million from the previous quarter, as a new surcharge took effect for banks over $10 billion of assets.

Except for the FDIC surcharge, many of M&T's higher expenses in the third quarter likely won't persist into future quarters, King said.

"We think that we'll continue to make investments as appropriate, but probably the pace will slow down a little bit," he said.

PNC

PNC Financial Services Group in Pittsburgh plans to cut $400 million in 2016 by modernizing its back-office operations and through other moves. Some of the savings will go back into new spending, such as technology upgrades and branch renovations.

Even with the expense savings program in place, PNC's noninterest expense rose 1% to $2.4 billion compared to the previous quarter. And PNC projected noninterest expense will rise in the low single digits, on a percentage basis, from the third to the fourth quarter.

Regions

The third quarter was a case of good news, bad news for Regions Financial on the subject of expenses.

On the one hand, the $125 billion-asset company pleased investors by announcing it will expand its cost-cutting program to $400 million, up from $300 million.

On the other hand, noninterest expense increased at the Birmingham, Ala., company on both a yearly basis and quarterly basis. Its $934 million in noninterest expense was 4.4% higher than a year ago and 2.1% above the second quarter. Regions blamed the higher costs on a $14 million charge for an early debt extinguishment and a $5 million charge to close branches.

Further testing the patience of investors on Tuesday was Regions' disclosure that the expanded cost-cutting program won't be completed until 2019. Steve Moss, an analyst at FBR Markets, asked Regions if the plan could be completed next year. But CFO David Turner said, "Getting all of that in 2017 will be very difficult."

Another analyst, Michael Rose at Raymond James, expressed hope that Regions could push itself to slice expenses faster and asked if the cost-cutting that Regions had already implemented was the harder tasks and that future cutting would be easier. Grayson Hall responded that the opposite was true.

"The easy expense saves are long behind us," Chairman and CEO Grayson Hall said. "The things we are doing now are all much more transformative and take a little longer to execute" including shifting some business to digital channels and retooling branches to use less staff.

Several analysts, including Betsy Graseck at Morgan Stanley and Erika Najarian at Bank of America, questioned how Regions would be able to cut $400 million from its expenses when it has also stated plans to make more acquisitions and investments in technology, in addition to its own projections for higher salaries and general inflation. Turner's response seemed to satisfy them.

"We do continue to make investments to grow our revenue," Turner said. "We are trying to figure out how to pay for that by having other savings."

Comerica

Dallas-based Comerica has been under intense pressure to cut costs following a string of disappointing quarters. While some analysts had been pressing the $72 billion-asset company to sell off some business lines or even exit some markets, the bank has so far avoided such measures and has focused instead on reducing its headcount, consolidating branches and streamlining its technology functions.

On Tuesday's conference call, Chairman and Chief Executive Ralph Babb said that the company has notified roughly 700 employees — many of them managers — that their positions have been eliminated and is planning to shutter 38 branches, or 8% of its network. The bank is also shedding about 500,000 square feet of office space, making significant changes to its retirement plan and outsourcing certain technology functions, all in an effort to eliminate $180 million of expenses by the end of next year and $200 million by the end of 2018.

While other banks are looking to reinvest savings into new business lines or tech initiatives, Comerica is mostly focused on improving its returns for investors. Chief among its goals is achieving a double-digit return on equity sometime in 2018. The bank hasn't posted an ROE of 10% or higher since 2008.

Comerica is also determined to reduce an efficiency ratio that has been stuck in the mid- to high-60's for years. "Without any increase in rates we believe the actions we are taking will improve our efficiency ratio to the low 60%s by the end of 2017 and at or below 60% by year-end 2018," Babb said Tuesday.

Alan Kline contributed to this article.