Discover Financial Services is the latest financial services company to get hit in an onslaught of litigation over unwanted robocalls to consumers.

The credit card issuer disclosed this week that it faces a new lawsuit filed by a Texas woman who alleges that Discover called her cellphone number in a mistaken effort to contact someone else. She is seeking class-action status for the suit.

The case, filed Sept. 20 in federal court in Chicago, is an example of the legal peril that banks continue to face over the use of automated phone calls for debt collection, sales and other purposes. Banks and other companies

Within the last six years, Discover has paid $13.7 million to settle two similar cases, according to news reports. Capital One Financial

Discover, based in Riverwoods, Ill., said in a securities filing Wednesday that it will seek to vigorously defend itself in the most recent suit. The company also said that it is not currently in a position to assess its likely exposure.

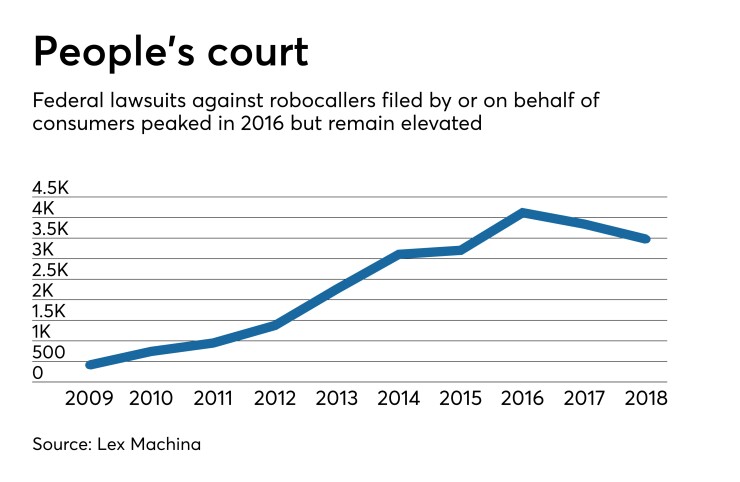

In 2018, plaintiffs filed more than 3,400 federal lawsuits over robocalls, according to a recent report by Lex Machina, which is part of LexisNexis. While that number was down 16% from the peak two years earlier, it was still eight times larger than in 2009.

Under the Telephone Consumer Protection Act, companies are generally barred from using auto-dialing technology to call cellphones without the consumer’s prior authorization. The 1991 law establishes strict liability for callers — $500 for each unsolicited call to a mobile phone, or $1,500 for intentional violations.

Those plaintiff-friendly standards have likely contributed to the decadelong surge in litigation. “I think people are capitalizing on statutory damages,” said Laura Hopkins, who authored the Lex Machina report.

The report’s findings suggest that banks and other corporations are spending a lot of money to defend themselves in robocall suits. On average, the amount of time that it took for a class to be certified in the cases was 648 days.

Many of the robocall lawsuits have been filed by the same people, including one man who filed 75 such suits, according to the report. That trend has fueled the perception among defendants that the cases are the driven by plaintiffs’ lawyers who are seizing on legal technicalities.

The plaintiff in the case filed last month against Discover, Viann Bonoan, has also filed similar lawsuits against American Express and Adobe Inc. within the last year.

Bonoan, who lives in Humble, Texas, said in her complaint that she has never been a Discover customer. She added that she did not provide her cellphone number to the company and does not owe a debt that Discover was trying to collect. The lawsuit identified one specific call from Discover in 2018 but did not make clear whether she received other calls from the company.

The lawsuit states that Bonoan got her cellphone number in 2017, and it identifies another man that Discover was allegedly trying to reach, indicating that the man’s prior phone number may have been reassigned to the plaintiff.

A Discover spokesman said the company had no comment on the lawsuit beyond what was in the securities filing.

Banks have long argued that federal regulators should find a way to limit their liability in cases where they inadvertently call a phone number that has been reassigned.

Last December, the Federal Communications Commission announced the adoption of new rules to establish a reassigned numbers database. The goal was to provide companies a single, comprehensive way of determining whether they were calling the correct phone number, and to provide a safe harbor from legal liability for any calls to reassigned numbers that were the result of errors in the database.

An FCC spokesman said Wednesday that the commission is currently going through the process of choosing an administrator to build the database. The FCC will issue a public notice announcing when it will be available for use by callers, the spokesman added.