A new lawsuit brought against Apple aims to erode the tech giant’s grasp on the mobile payments market currently held by Apple Pay.

On Monday, the $137 million-asset Affinity Credit Union in Des Moines, Iowa, filed an

It may seem like a monumental fight for such a small card issuer, but it echoes sentiments that banks and credit unions have expressed since Apple introduced its mobile wallet in 2014 (with one banker at the time calling Apple's terms "

“Affinity is proud to represent other credit unions and banks challenging Apple’s behavior … Apple takes no risk but taxes every credit card transaction that uses Apple Pay, [whereas] Google and Samsung do not do that,” the credit union said in a prepared statement. “It is not fair.”

Apple did not respond to requests for comment before the deadline.

The credit union’s case against Apple is the most recent in a

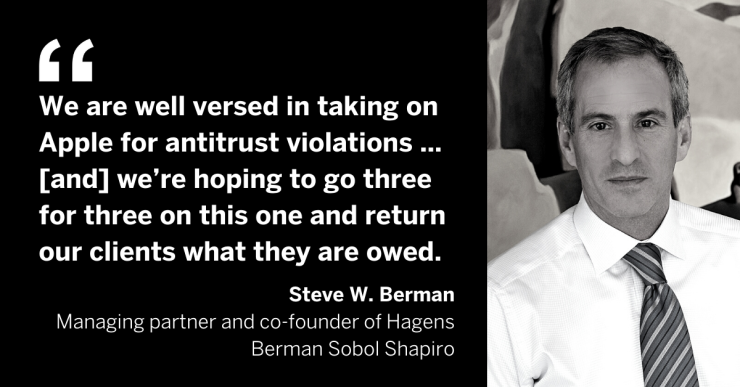

Affinity is represented by Hagens Berman Sobol Shapiro, a Seattle-based legal firm experienced in antitrust, consumer fraud, securities and investment fraud, whistleblowing and other subject matters.

Steve W. Berman, managing partner and co-founder of Hagens Berman, explained that its case with the credit union is not the firm’s first encounter with Apple.

“While we have not represented this class [of plaintiff] before, we are well versed in taking on Apple for antitrust violations. …

In addition to recouping the fees Apple charged to Affinity and other financial institutions, the law firm is also hoping to put a stop to Apple’s current pricing policy, Berman said.

Experts say that with the shift in consumer behavior to digital transactions that originated in response to the COVID-19 pandemic, being able to offer members the choice of adding credit union-branded cards to their digital wallets is critical for enticing younger consumers to open an account.

Tony DeSanctis, a senior director at Cornerstone Advisors in Scottsdale, Arizona, stressed that in addition to the NFC component of Affinity’s complaint, the impact on digital card-not-present transaction revenue is an equally important concern.

“If you just think about the way we function [as consumers] when we buy stuff online, we're looking for that Apple Pay logo and we're looking for that PayPal logo, we're not looking to type in our card numbers or even the stored number on our phones … so [Apple Pay] is definitely a convenience, and there's definitely consumer adoption there,” DeSanctis said.

The

Institutions with smaller economies of scale that are unable to accommodate the costs ingrained within the digital wallet are faced with the challenge of generating additional revenue to offset the charges, or otherwise diminishing the suite of services offered to members, according to the National Association of Federally-Insured Credit Unions.

“To be able to offer the latest in financial services, technologies and products to members and maintain a level playing field among other institutions is really important for credit unions, because the financial services marketplace is incredibly competitive. … If they don't have the latest in financial products and technology, the members are going to go to those who do,” said Greg Mesack, senior vice president of government affairs for NAFCU.