In rewriting Huntington Bancshares Inc.'s mobile and online banking strategy, Jeff Dennes faces a challenge he didn't have at USAA Federal Savings Bank: a large branch network.

At USAA, where he spent 10 years, Dennes proved he knew what consumers wanted from mobile banking applications by spearheading successful rollouts of smartphone programs and a mobile remote deposit capture service. But USAA has one brick-and-mortar branch. Huntington, which announced Monday that it had hired Dennes as a senior vice president and director of online and mobile services, has 608 branches.

"What Jeff now has to do is not just bring in his mobile technology smarts, but convince the board of Huntington Bank to drop a lot of money into identifying the next mobile remote deposit capture — what is it that could set Huntington apart in a way that USAA has," said James Van Dyke, the president of Javelin Strategy and Research.

The potential return on investment is easier to predict for a bank like USAA because of its branchless structure, Van Dyke said. Mobile phone apps, remote deposit capture and other technology are sure to help Huntington, but it is difficult to predict how helpful they will be because Huntington's customers are comfortable doing business in the branch.

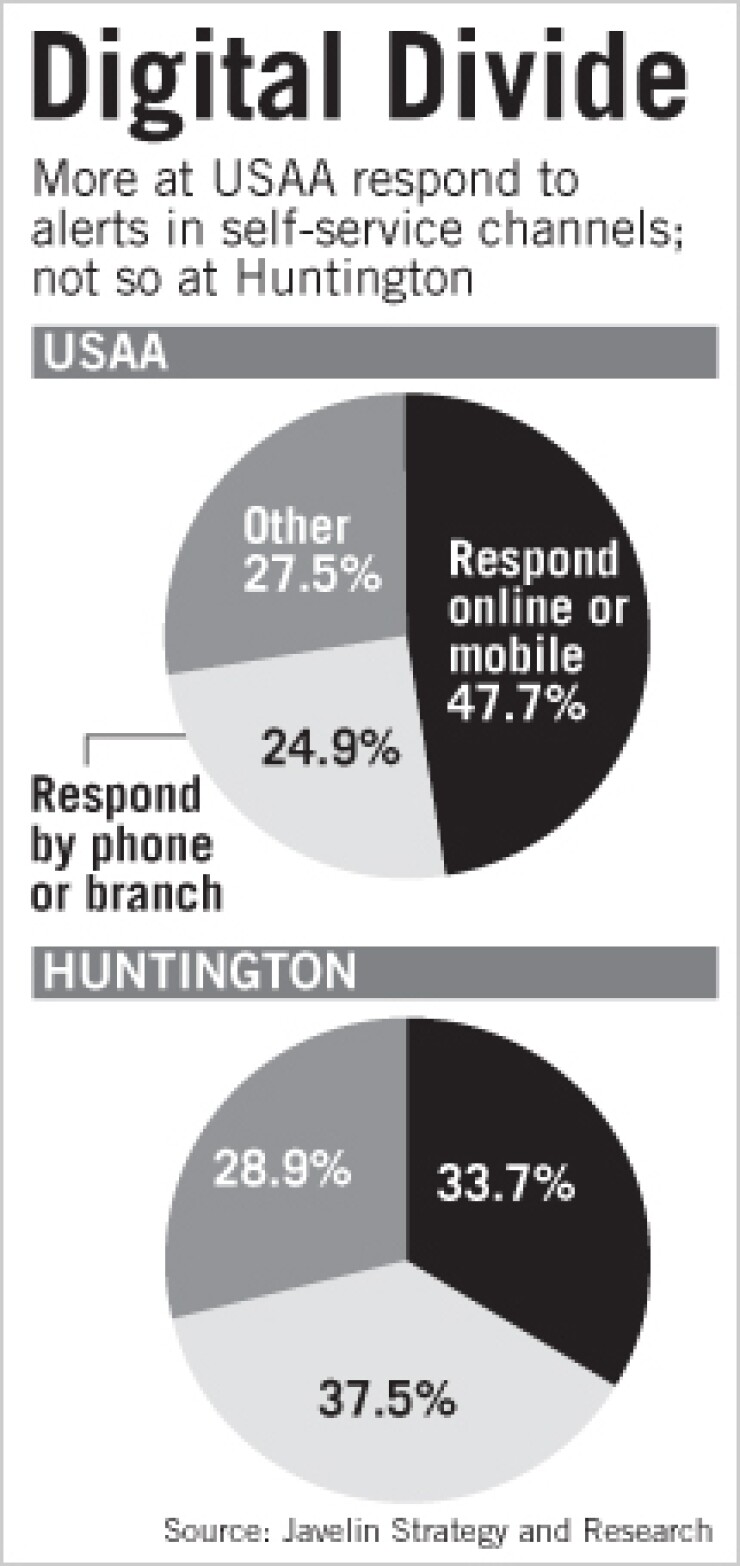

Javelin research shows that upon receiving an alert on their financial status, Huntington's customers are almost as likely to call the bank as they are to log in to its online banking site.

Huntington, the $52 billion-asset parent of Huntington National Bank of Columbus, Ohio, was considered by many experts a top player in mobile and online banking until recent years.

"When times have been kind of tough here in the last few years, we haven't invested in online types of technology or digital technology as much as we have in the past, so we're reinvesting in it," Mary Navarro, a senior executive vice president and retail and business banking director for the bank, said in an interview Monday.

"When we were looking at what we needed to do to … have a competitive advantage in online, mobile and text, we tried to look around and see who's done it before, who really is progressive and ahead of the curve in this, and Jeff really stood out," she said.

Dennes, who officially joined Huntington in late August, said Friday that his immediate plans include rolling out Huntington apps for Apple Inc.'s iPhone and smartphones using Google Inc.'s Android operating system.

Beyond that, new devices, including Apple's iPad, will be a focus, he said, adding that he views such technology as a separate channel from mobile and online banking services. "It's going to be used a little bit different" from the iPhone, he said.

George Tubin, a senior research director who follows mobile banking for TowerGroup, agreed that Huntington's branch network could make it hard for Dennes to match the success he had at USAA. However, "Huntington is one of the banks that does understand the value of an integrated value experience," Tubin said.

"Trying to service those customers the best way possible through all the channels that you have while at the same time gently trying to migrate customers to … lower-cost channels is something … I expect a bank like Huntington will be looking to do," Tubin added.

Dennes' departure from USAA is a loss for the San Antonio company but should not disrupt its strategy, Tubin and Van Dyke said. USAA recently named Neff Hudson as its head of emerging channels, including mobile technology, a spokeswoman said. Hudson previously was in charge of member experience at USAA.