Several up-and-comers in New York could get a big lift from First Niagara Financial Group Inc.’s decision to sell some of the branches it is planning to buy from HSBC Holdings PLC.

First Niagara is expected to divest roughly a quarter of the 195 branches, which are in New York and Connecticut. Industry observers have identified at least five community banks that would have an interest in bidding on the branches.

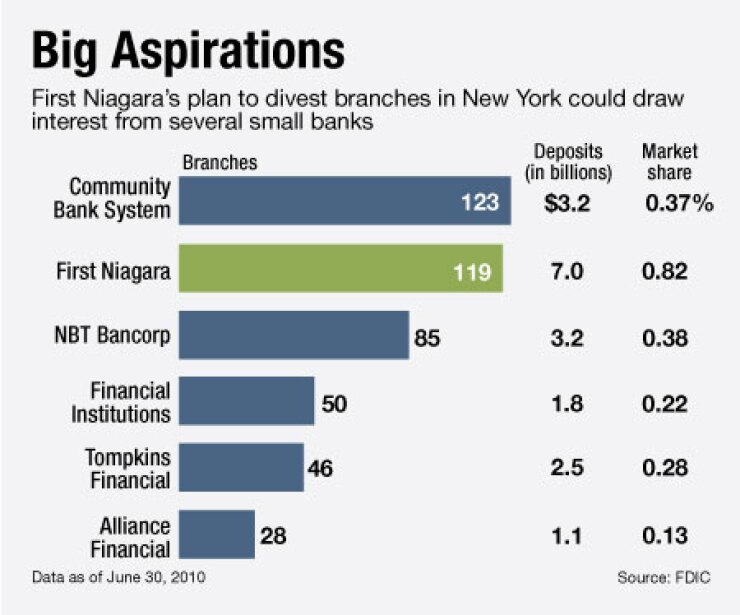

Contenders include Alliance Financial Corp., Community Bank System Inc., Financial Institutions Inc., NBT Bancorp Inc. and Tompkins Financial Corp. Observers said those banks — each based in New York — have the financial strength to make a deal happen.

“They’re all very well positioned,” said Damon DelMonte, an analyst at KBW Inc.’s Keefe, Bruyette & Woods. “They’re all at healthy capital levels,” he said, though some may need supplemental capital depending on how many branches are involved.

First Niagara has yet to officially detail the number of branches it plans to sell. After the planned divestitures, First Niagara will end up getting about $11 billion of deposits from HSBC, and about $2 billion of loans.

There are two crucial reasons for the proposed divestitures, according to the Buffalo, N.Y., company. Some branches are likely to be sold to secure approval from the Justice Department, which reviews antitrust implications. First Niagara is likely to shed other locations that it determines do not fit its core strategy. HSBC bought all of the branches in the 1980s.

Roughly 15% to 18% of the HSBC branches, or about 30 locations, will be closed or sold because they are near First Niagara branches, spokesman Jeff Schoenborn said. He said that most of those branches are in upstate New York, between Albany and Rochester.

It is possible that First Niagara could sell the branches to a “menu of buyers,” said Jeffrey Marsico, a bank consultant with Kafafian Group Inc. in Parsippany, N.J.

“I think very few of these companies can digest them whole,” he said. If First Niagara sells all $4 billion of divested deposits to one buyer, DelMonte said a Buffalo rival, M&T Bank Corp., would “hands down be the most logical acquirer,” given its size.

Though it remains unclear exactly which branches First Niagara will divest, Tompkins covets some of them. Frank Fetsko, the Ithaca, N.Y., company’s chief financial officer, said Tompkins has looked at the HSBC branches in central New York and, to a lesser extent, branches in metropolitan Buffalo. (The $3.29 billion-asset company operates three banks in New York.)

“We have said we’re interested in exploring growth opportunities through acquisitions in markets that make sense for us,” Fetsko said. “Certainly some of these markets would be consistent with that.”

If history is a guide, some of the named contenders could be on an acquisition streak.

In July, NBT in Norwich, N.Y., bought four branches of Legacy Banks in western Massachusetts, including $158 million of deposits and $45 million of loans. The branches were sold as part of Berkshire Hills Bancorp Inc.’s $108 million acquisition of Legacy Bancorp Inc.

Florence Doller, NBT’s director of marketing, would not discuss the HSBC branches, though the $5.34 billion-asset company “actively seeks strategic opportunities to expand our delivery of community banking services.”

In April, Community Bank System in DeWitt, N.Y., bought Wilber Corp., the parent of Wilber National Bank, for $102 million. Scott Kingsley, the $6.31 billion-asset company’s chief financial officer, declined to comment on specific opportunities, though he said deterrents to acquisitions include the issue of having excessive liquidity afterward.

Financial Institutions also could be poised to buy branches thanks to recent moves. Alexander Twerdahl, an analyst at Sandler O’Neill & Partners LP, wrote in an Aug. 30 note to clients that, since the beginning of the year, the Warsaw, N.Y., company has raised $46 million, repaid $37.5 million to the Troubled Asset Relief Program and redeemed other trust-preferred shares.

Twerdahl wrote that Financial Institutions’ 8% tangible common equity ratio is “plenty to take advantage of any opportunities that may arise.” Its executives declined to comment on the HSBC branches during a recent meeting, though they said they are able to buy up to $500 million of assets or deposits without raising more capital, Twerdahl wrote.

Matthew Murtha, a spokesman for the $2.29 billion-asset Financial Institutions, also declined to comment. Daniel Mohr, the chief financial officer of the $1.48 billion-asset Alliance in Syracuse, N.Y., did not return a call seeking comment.