-

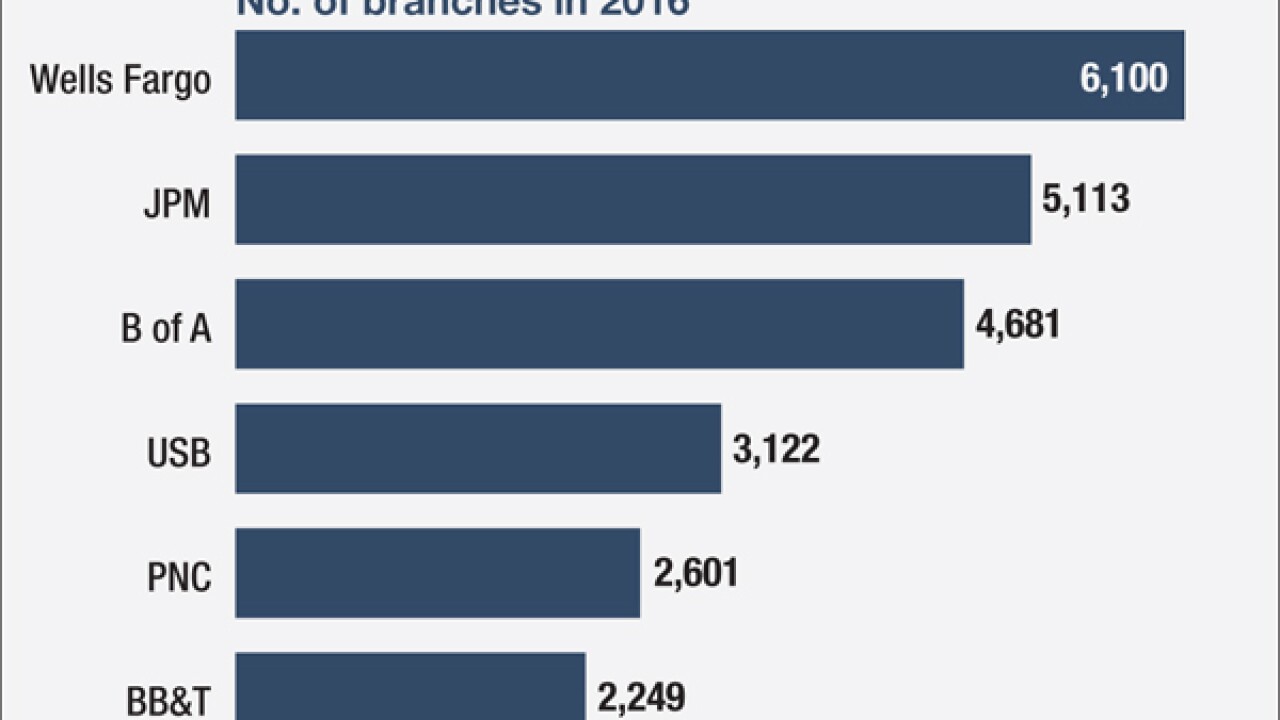

Some analysts are suggesting Wells Fargo should start closing branches, in order to move beyond the phony-accounts scandal, make up for an expected drop in fee income from reduced cross-selling and position itself for a digital future.

October 13 -

As Fannie Mae and Freddie Mac continue to experiment with upfront risk-sharing deals, some small mortgage lenders fear they will be left out of the action.

October 13 -

Without investigations by the Los Angeles Times and city prosecutors, the Wells Fargo account scandal would never have come to light. Where were federal regulators?

October 13

-

The new CEO has vowed to clean up the sales practices that tarnished the bank's reputation and cost John Stumpf his job. But skeptics from Wall Street to Capitol Hill say Sloan, too, was "culpable" in the phony account-opening scandal and that only an outsider can fix what ails the nation's third-largest bank.

October 12 -

A federal appeals court ruling against the Consumer Financial Protection Bureau has raised questions about whether banks and other firms cited by the agency can protest previous enforcement actions. But doing so may create new risks for firms.

October 12 -

In states with strict rules on small-dollar loans, lenders could see an opening in the language of the CFPB rule to actually hike rates, observers say.

October 12 -

The change at the top of the No. 3 U.S. bank by assets after a snowballing phony-accounts scandal marks the rare case of a major U.S. bank CEO resigning amid accusations of company misconduct. His successor, Tim Sloan, faces a hard road to recovery.

October 12 -

WASHINGTON Rep. Scott Garrett, R-N.J., is demanding answers from the Federal Reserve Board on whether one of its board member's political ties to the presidential campaign of Hillary Clinton compromises the central bank's independence.

October 12 -

The head of the international Basel Committee on Banking Supervision underscored the importance of international consistency in banking standards in comments Wednesday before the European Parliament.

October 12 -

A top Wells Fargo executive and a former employee painted very different pictures of the culture and oversight at the San Francisco bank during a hearing by a California Assembly committee on Tuesday that probed the opening of 2 million phony accounts.

October 11 -

WASHINGTON Eighteen Republican State Attorneys Generals sent a letter to the Consumer Financial Protection Bureau last week pushing back against the agency's proposal to rein in high-cost small-dollar loans.

October 11 -

The Wells Fargo scandal has given cross-selling a bad name, but experts say that, done right, it is a crucial revenue driver in this era of razor-thin net interest margins. Their advice: Only sell products that customers need and compensate employees for retaining customers, not simply opening accounts.

October 11 -

The ramifications for a U.S. Court of Appeals decision against the CFPBs constitutionality go far beyond just the agencys independence, and may have consequences for other federal agencies with similar structures. The ruling may also hamper the CFPBs powers, including its ability to retroactively apply new rules.

October 11 -

Large banks are outpacing community banks in deposit gathering because new liquidity rules make deposits more valuable to the biggest banks, mobile banking has been a deposit magnet for the heavyweights, and regional and midsize players hold certain advantages over smaller rivals, too.

October 11 -

WASHINGTON Financial authorities from the Group of Seven countries on Tuesday released cybersecurity recommendations for private and public entities operating in the financial sector.

October 11 -

Navy Federal Credit Union, the largest credit union in the country, agreed Tuesday to pay $28.5 million to settle regulatory allegations it engaged in illegal debt collection practices.

October 11 -

Fintech circles are abuzz about the possibilities for streamlining compliance work following IBM's deal to buy Promontory. Artificial intelligence software could help separate false positives from true violations, for example, or read and parse through lengthy regulations.

October 11 -

The new prepaid rules make it harder for bad actors to enter the industry while also being broad enough to apply to future digital products.

October 11

-

The single-director structure of the Consumer Financial Protection Bureau represents an unconstitutional concentration of executive power, a federal appeals court said Tuesday. But the court stopped short of disbanding the agency, instead giving the president more power to remove its leader.

October 11 -

WASHINGTON Federal Reserve Board Vice Chairman Stanley Fischer said Friday that the Dodd-Frank Act has addressed the biggest issues with bank instability but the "shadow banking" sector industry still needs to be addressed.

October 7