-

A likely sale of CIT Group's aircraft unit (and a whole lot of other stuff) is keeping Ellen Alemany busy, a former Wall Street banker talks about big data as a financial weapon of mass discrimination targeting women and the poor, and First Busey shows how investing in employees pays off. Also, TIAA's Kathie Andrade, Deloitte's Cathy Engelbert and (to spice things up) Victoria Beckham.

September 8

-

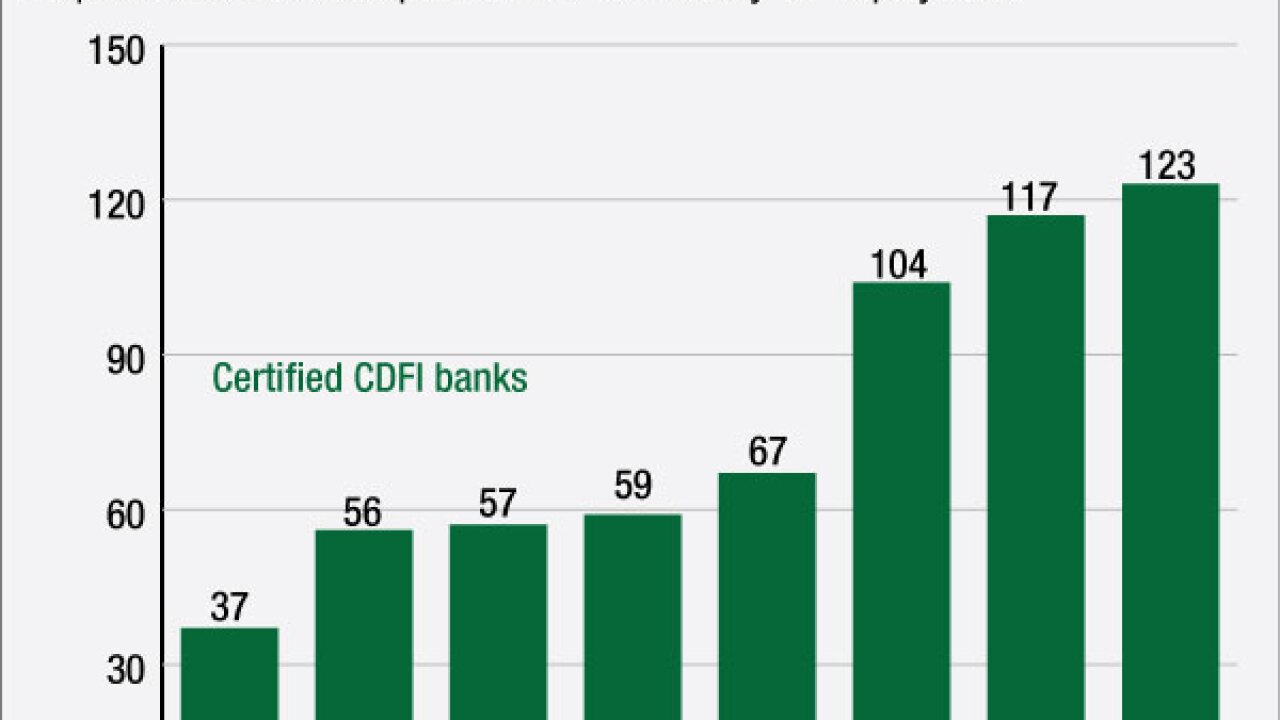

A rising number of banks are looking to become community development financial institutions, emboldened by low-cost capital and an exemption from the ability-to-repay rule.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Wells Fargo has agreed to pay $187.5 million to settle claims by federal regulators that the megabank wrongfully opened unauthorized bank and credit card accounts for more than 2 million customers.

September 8 -

Banks are making it easier to get approved for a checking account. But once-banished customers may not be able to use some of the features that made having an account attractive in the first place.

September 8 -

It's the hot new address for an old Wall Street machine: 1209 North Orange Street. There, in Wilmington, Delaware, several giants of American finance have established powerful outposts.

September 8 -

Without incentives to shoot higher, banks usually settle for "Satisfactory" on their Community Reinvestment Act exams, but many find that not getting a better grade has consequences.

September 8 K.H. Thomas Associates

K.H. Thomas Associates -

Though the Federal Housing Finance Agency has yet to provide full details about its new refinancing program to be launched next year, some analysts and industry observers are already convinced it will have only a limited impact.

September 7 -

Demand for lending services grew overall in the last six weeks but was more keenly felt in some regions while others remained stagnant, according to a report issued Wednesday by the Federal Reserve Board.

September 7 -

The trade group challenged the NCUA's member business lending rules enacted in February, but also hinted that it is prepared to file another lawsuit should the agency move forward with a separate regulation that would expand credit unions' field of membership.

September 7 -

The Federal Reserves structure and makeup and even geographical locations drew criticism from members of Congress and the public as favoring the wealthy and ignoring the conditions of ordinary Americans

September 7 -

Making good on threats it had made previously, the Independent Community Bankers of America filed suit Wednesday against the National Credit Union Administration, claiming the agency's recent overhaul of its member business lending rules violate two different laws.

September 7 -

Fintech is transforming consumer financial services, but automation and data innovation can also help banks meet their growing regulatory demands.

September 7

-

U.S. prosecutors are considering a criminal charge against a unit of HSBC Holdings Plc related to conduct on its foreign-exchange desk, according to two people familiar with the matter, imperiling an earlier deal that let the bank avoid prosecution.

September 7 -

The Office of the Comptroller of the Currency has named a new deputy comptroller in charge of leadership, executive and organizational development.

September 6 -

Banks, Wall Street critics and regulators are angling to define whether the leverage ratio should be a backstop or a binding constraint for the biggest banks a debate that could be among the most urgent in the post-Obama regulatory landscape.

September 6 -

State regulators' resistance to the idea of a national fintech charter is not surprising, but state-by-state regulation imposes heavy burdens that reverse the cost savings and expanded reach available through fintech.

September 6 Mercatus Center at George Mason University

Mercatus Center at George Mason University -

The Federal Deposit Insurance Corp.s recent statements encouraging new bank applications are promising, but some barriers to new charters may remain inside the FDIC and we are still waiting for the first de novo of 2016.

September 6 American Bankers Association

American Bankers Association -

Though no legislation is likely to pass prior to the election, lawmakers will be busy throughout September with hearings featuring top Federal Reserve Board officials and voting on a much anticipated financial reform bill. Here are five things to keep an eye on.

September 2 -

Regulatory infighting over bond loans offered by down payment assistance programs has the potential to curtail lending to first-time buyers and do real damage to homeownership.

September 2 Offit | Kurman

Offit | Kurman