-

New, stricter regulations on loans to active-duty service members take effect on Oct. 3. Heres a guide for getting ready.

September 2 -

Fannie Mae and Freddie Mac can still manage their risk exposure even after reducing or eliminating "loan level price adjustment" fees.

September 2 National Association of Realtors

National Association of Realtors -

Emboldened by supportive comments from presidential hopeful Hillary Clinton, community development banks are asking regulators for more leniency in areas such as disclosure fees and Bank Secrecy Act enforcement.

September 2 -

American Banker readers share their views on the most pressing banking topics of the week. Comments are excerpted from reader response sections of AmericanBanker.com articles and our social media platforms.

September 2 -

A federal district court handed the Consumer Financial Protection Bureau a major victory this week by ruling that the online loan servicer CashCall engaged in unfair, deceptive and abusive practices by using a "tribal model" to collect on loans in states with usury caps.

September 1 -

Big banks have less than a month to fix their resolution plans or potentially face severe regulatory consequences.

September 1 -

WASHINGTON Kansas City Federal Reserve Board President Esther George and Richmond Fed President Jeffrey Lacker will testify before a House panel on Wednesday.

September 1 -

The Mortgage Bankers Association has long been a staunch defender of the mortgage interest deduction. But the group's president and CEO now says he's open to Congress reducing, or even eliminating, the tax break.

September 1 -

With even community banks getting hit by ransomware attacks, there's a long list of cybersecurity practices that bankers can expect their supervisors to scrutinize during upcoming exams.

September 1 -

The suggestion that any area has too many local institutions dismisses the importance of community banks and overlooks the dangerous effects of consolidation.

September 1 Calvert Advisors LLC

Calvert Advisors LLC -

Approximately 37 million adults in the United States a number roughly equivalent to the population of California do not have a checking account. Some of those individuals have never relied on traditional banking.

August 31 The Pew Charitable Trusts

The Pew Charitable Trusts -

The largest U.S. banks are starting to question whether the advanced approaches modeling program embedded in the Basel accords is still valuable in a world where their capital levels are increasingly dictated by the annual stress tests and a supplementary leverage ratio.

August 31 -

The National Association of Realtors is urging policymakers to implement reforms meant to qualify more condominium buyers for Federal Housing Administration loans.

August 31 -

Plenty of banks have ended their federal loss-share deals early, but despite the incentives to wind them down, plenty more still have these crisis-era arrangements in place. It may be due to varying deadlines, mistakes calculating loan values or worries that they still might need the coverage for home equity lines.

August 31 -

Industry fears about the Consumer Financial Protection Bureau's "UDAAP" authority recall steps Congress took in the '70s to rein in the Federal Trade Commission.

August 31

-

The Financial Stability Board said Wednesday in its annual report to the G-20 that progress is being made in implementing post-crisis financial reforms, but that implementation of specific initiatives remains uneven across industrialized nations.

August 31 -

The growth in loan demand and the industry's interest-related income has come in spite of continued pressures on bank profitability.

August 30 -

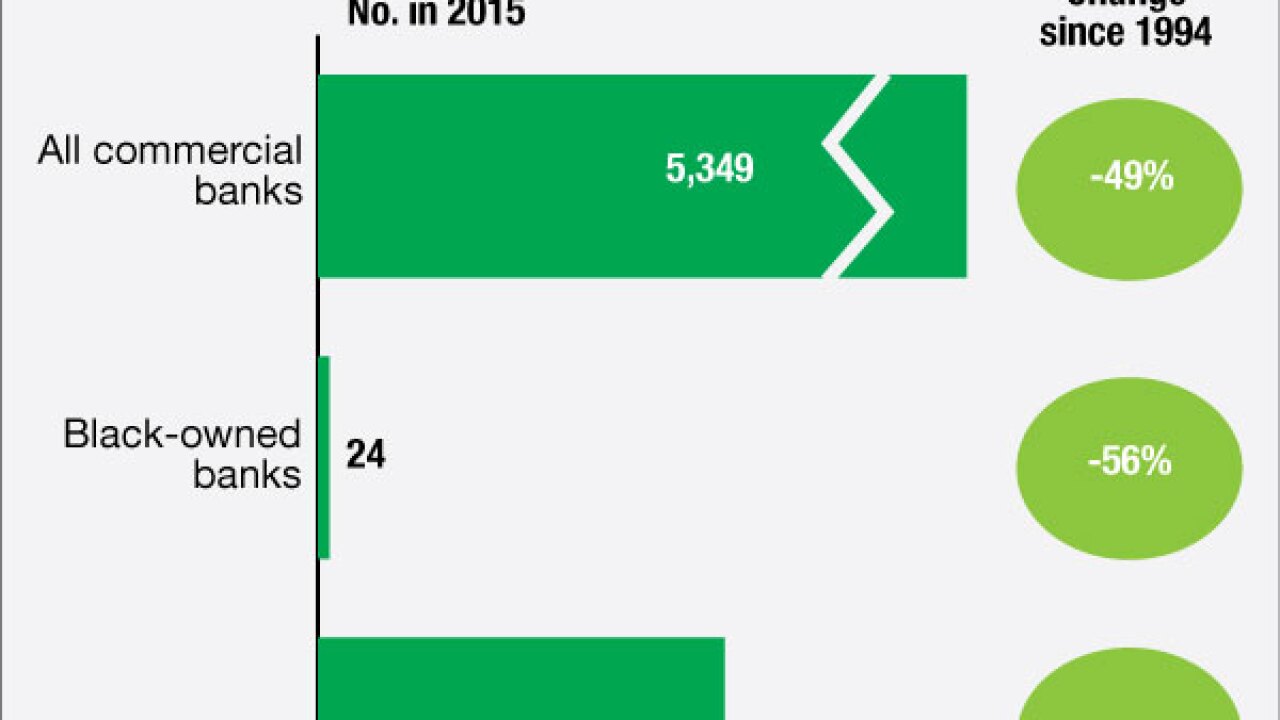

A longtime advocate for African-American-owned financial institutions argues that regulators should be taking more forceful action to keep them alive.

August 30 -

Banks and regulators both deserve credit for how they have navigated the post-crisis period, but how regulators continue to implement rules and how banks continue to deal with this environment will determine if this is a turning point for finance or the prelude to another round of pain.

August 30 Ludwig Advisors

Ludwig Advisors -

U.S. banking earnings rose 1.4% in the second quarter from a year earlier to $43.6 billion driven largely by interest-related income while the Deposit Insurance Fund hit a key trigger that will affect industry premiums.

August 30