The Trump administration's stance on immigration is causing headaches for some banks, how a tiny black-owned bank is turning to fintech to turn itself around; why banks are rejecting Facebook's offer to share data and more from this week's most-read stories.

BofA faces backlash over questions about customers' citizenship

(Full story

The painstaking process to sell a family's century-old bank

(Full story

Banks won't 'like' this offer from Facebook

(Full story

A blue wave is coming. Banks need to get ready

(Full story

How this tiny black-owned bank is turning itself around with fintech

(Full story

Fannie, Freddie could need $78B in crisis: FHFA

(Full story

Senate Dem demands Wells Fargo explain error that led to 400 foreclosures

(Full story

'Still a real need for … human interaction' in retail banking's future

(Full story

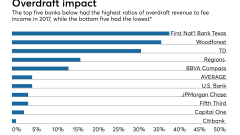

Banks earning less from overdrafts, but critics still find fault

(Full story

What's missing from the OCC's fintech charter

(Full story