A potential cut to the Department of Agriculture’s discretionary spending would be ill-timed for farmers and their lenders.

The Trump administration’s budget proposal, while thin on details, would reduce the agency’s discretionary funding by more than a fifth. That could threaten the agency’s federal loan guarantee program, which last year provided nearly $4.3 billion in assistance to help farmers buy agricultural necessities such as real estate, equipment and fertilizer.

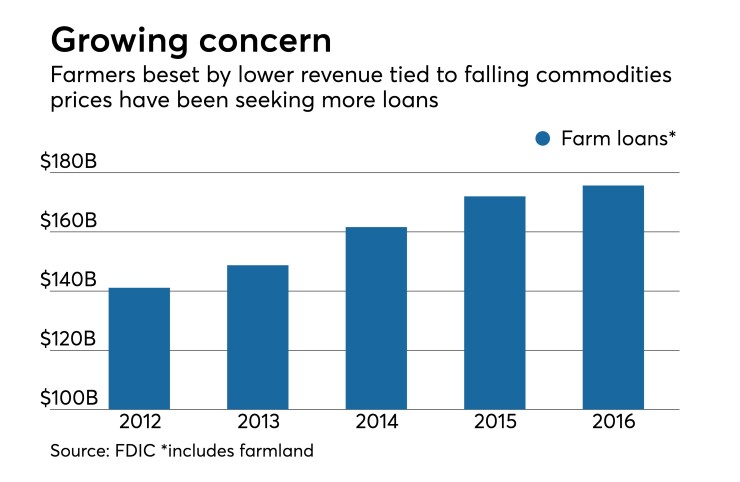

Farmers are facing increased challenges after several years of prosperity. Revenue is under pressure, largely due to declines in many commodity prices, which could force more farmers to seek ag loans. Guarantees help lenders offset the risks associated with those loans.

The banking industry is gearing up to persuade lawmakers to break with the proposal and boost discretionary funding to avoid creating a backlog of loan applications. Members of the American Bankers Association and the Independent Community Bankers of America plan to take the matter up with members of the House and Senate appropriations committees.

The ICBA also plans to include the issue in its talking points to help bankers when they speak to legislators.

A normal harvest this year would hurt farmers’ income and “could really fuel” demand for guaranteed loans, said Mark Scanlan, the ICBA’s senior vice president of agricultural and rural policy.

“Without an increase … we could run out of money faster and sooner,” said Ed Elfmann, the ABA’s vice president of congressional relations and political affairs.

The ABA is evaluating how much of an increase it would pursue, though it remains unclear how much the proposed cuts would harm loan guarantees. The Trump administration is expected to release a more detailed budget next month.

“We don’t have any specifics on what’s going to happen,” Elfmann said. “We just don’t know which [broad government] programs specifically will be targeted all the way down to the penny.

Ag lenders, meanwhile, are already starting to see some challenges.

The corn and soybean industries are set “to break even at best” this year, said Kevin Boyle, a senior vice president at Templeton Savings Bank in Iowa. If that happens, farmers will need to borrow to cover living expenses.

A reduction in loan guarantees “would affect us in a big way,” said Nate Franzen, agribusiness president at First Dakota National Bank in Yankton, S.D. “Basically, we wouldn’t be able to stick with some of our producers as long as we would like.”

Franzen was among the bankers who recently testified before the House’s agriculture committee about the important role banks play in the agricultural sector.

While the $1.5 billion-asset First Dakota has about $900 million of ag loans on its books, less than a tenth are guaranteed.

The $117 million-asset Templeton Savings feels “a lot better when we have the guarantee” on its ag loans, Boyle said, adding that he expects demand will rise as restricted cash flows reduce farmers’ liquidity.

“If we get one or one and a half, two years down the road, there’s going to be more demand for … guarantees just like it was in the 1980s during the last farm crisis,” Boyle said.

For now, ag lenders are holding out hope that lawmakers will match — or surpass — last year’s funding, though it could take more lobbying than usual to make sure it happens.

“I’m optimistic that they’ll do the right thing,” Franzen said.