Commercial real estate exposure is the bogeyman George Gleason can’t seem to put to rest.

Gleason, chairman and CEO of Bank of the Ozarks, has spent two years trying to convince analysts and shareholders that the Little Rock, Ark., company has found a way to aggressively — and conservatively — make CRE loans through a national platform.

On a July 2016 conference call, Gleason provided an

While the $21 billion-asset company has been able to reduce CRE to less than three-fourths of total loans, Gleason still fields plenty of questions about the business. Half of the 10 analysts on Tuesday’s quarterly conference call queried management on topics ranging from CRE trends and pricing to loan mix and management structure.

Those queries spurred Gleason to again defend his company’s CRE dealings.

“We've been doing this business for a long time,” Gleason said during the call. “Our excellent loan-loss ratios, both in recent years and for decades before, along with our consistently excellent asset quality ratio … support our view that we’re very conservative.”

CRE has been very good for Bank of the Ozarks, which reported record earnings of $422 million last year.

The company’s real estate specialties group originated a record $9.1 billion in loans in 2017, and management expects higher numbers in coming years. The company ended last year with a $13 billion of loans that are waiting to be funded.

“We expect [the group] will continue to be our largest growth engine and that it will continue to increase its volume of originations,” Gleason said.

Related:

Much of the criticism has come from commentators outside of mainstream equity research.

John Maxfield at Motley Fool has called Bank of the Ozarks “one of the riskiest banks in the country,” while Carson Block, director of research at Muddy Waters, once suggested that investors short the company’s stock because of the CRE exposure.

While Ely Razin, chief executive of the CRE analysis firm CreditFi, struck a less ominous tone, he noted that the company has devoted an increasingly large proportion of CRE lending to construction loans, which he characterized as “one of the riskiest types" of CRE lending.

“The most stable business is to lend on existing buildings that are well run by owner-operators and have a long list of existing tenants,” Razin said. “That doesn’t mean [increased construction lending] is toxically risky. I’m simply saying Bank of the Ozarks is taking on more risk.”

Gleason’s point about the bank’s stellar asset quality in recent years is 100% correct, Razin said, though “it’s difficult to assess how good their underwriting is until we get into a down cycle.”

Bank of the Ozarks’ ratio of CRE to risk-based capital was 340% on Sept. 30, a level high enough to merit added scrutiny from regulators. (The company, which originated another $2.6 billion in CRE loans in the fourth quarter, did not provide a Dec. 31 figure.)

The company’s dealings have led some Wall Street analysts to ask for more detailed information and metrics about its CRE business. The company, for instance, doesn’t provide segmented information about its loan portfolio when it reports earnings.

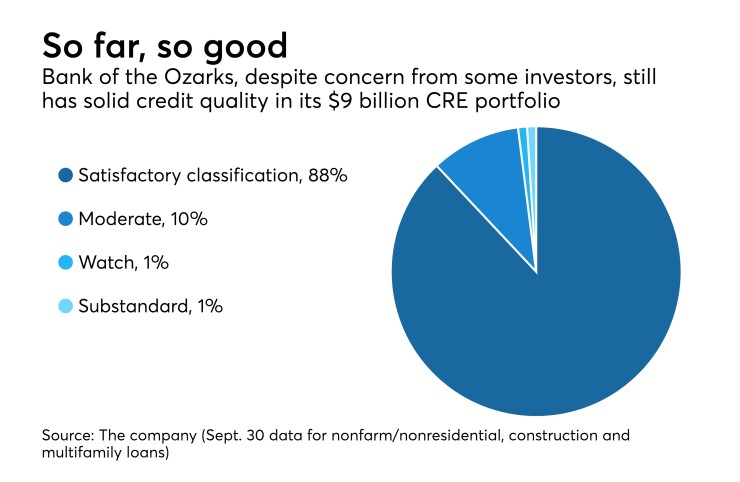

Management used their latest quarterly call to emphasize the portfolio’s stellar credit quality.

Bank of the Ozarks’ ratio of net chargeoffs to total loans was just 0.07% at Dec. 31. The average loan to appraised value for originations in the real estate specialties group was 41.9% last year, Tom Hicks, the company’s chief administrative officer, said during the call.

“I’ve been doing this job for over 38 years,” Gleason said Tuesday. “We’ve made money every year and for the past decade we’ve posted industry-leading results almost every year. That’s a pretty good track record.”

Several analysts have expressed comfort with the business model, though they are quick to acknowledge that investor trepidation could temper enthusiasm for the company’s stock.

Investors have also started to return to the company. It shares, which fell to as low as $34.82 a share in late June 2016, have since appreciated by more than 47%.

The company is on pace “to post among the strongest core EPS growth rates and strongest profitability metrics in our coverage over the next two years,” Matthew King, an analyst at Barclays, wrote in a Wednesday note to clients.

“Concerns over the bank’s [real estate specialties group] lending segment will continue to keep the shares below the range we think to be more appropriate,” Stephen Scouten, an analyst at Sandler O’Neill, wrote in his Tuesday research note.